Questions are mounting about how Lynas Corporation can fund a new plant to handle radioactive materials in Australia.

Lynas has been working to secure processing approval for its rare earths from the Malaysia Government.

It is understood that the Malaysian government’s plans to approve the plant rests on the condition that the parts of the plant that builds materials that create mildly radioactive waste be transferred to Australia.

However, it is understood that some of the terms with its lenders would make embarking on such a move a tough task for Lynas.

Its Japanese government-backed financier JARE is understood to have conditions on a $US150m loan that says Lynas cannot spend more than $25m in capital expenditure or incur any new liabilities.

It leaves the company (LYC) in a position where it may need to refinance $US150m of its JARE debt as well as the $350m to $400m needed for a new plant in Australia.

It comes after Wesfarmers launched a $1.5 billion takeover bid for Lynas following earlier talks with its target about jointly funding a plant for the rare earths processor in Australia.

Lynas processes rare earths used to make magnets for devices such as wind turbine generators and Wesfarmers sees the business as complementary because of its own mining and chemical processing expertise and track record of working with diverse stakeholders and government.

The bid was announced by Wesfarmers on March 26 and talks between the pair were believed to have unfolded over several months about solutions for the group.

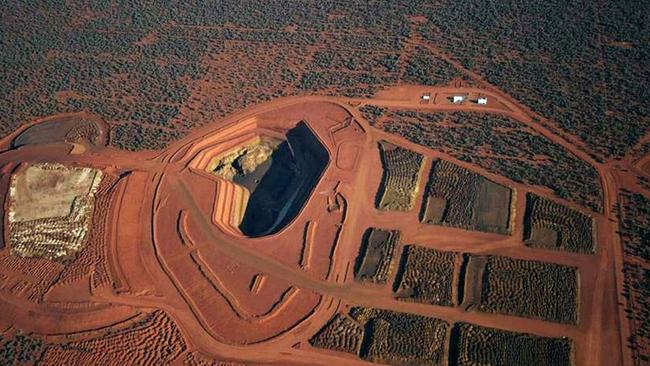

Lynas has been at odds with the Malaysian government over the waste stream at its Lynas Advanced Materials Plant.

Malaysian regulators were believed to have modified the licence conditions late last year governing the plant and Lynas’s auditors earlier this year warned that the company was at risk if it could not resolve the approvals impasse by September.

Wesfarmers is believed to be looking at whether it could relocate the processing facilities back to Australia, where it could be integrated into its existing chemicals business and potentially return the contentious waste material at Kuantan to Australia.

Wesfarmers is offering $2.25 per share for Lynas via a scheme of arrangement after shares on Friday closed at $2.11.

The offer at the time was a 44.7 per cent premium to its last closing share price of $1.55 and is conditional on due diligence and that relevant operating licences in Malaysia remain in force for a satisfactory period.

Lynas has rejected the bid and many market observers remain sceptical that it will proceed.

They say that the deal would likely require a sweetened offer by Wesfarmers, which was not thought to be a favoured move by the shareholders of the Perth-based conglomerate.

Highbury Partnership and UBS are advising Wesfarmers while Moelis is believed to be the Lynas adviser.