LNG producers write off $20bn

Australia’s LNG sector has blown up more than $20bn in writedowns after French energy giant Total took a $US800m hit.

Australia’s LNG sector has blown up more than $20bn in writedowns after French energy giant Total took a $US800m ($1.1bn) hit, sparking concern high construction costs and a lower oil price outlook may derail spending needed for a next wave of investment.

Total, which owns stakes in Inpex’s $US45bn Ichthys gas plant in Darwin and Santos’s $US18.5bn GLNG export project in Queensland, blamed “giant projects with high construction costs” and lower oil price assumptions for the impairment.

Over $22bn has now been written off on projects run by Woodside Petroleum, Shell, Origin Energy and Oil Search so far in July as some of the nation’s biggest gas producers slash their assumptions for oil amid COVID-19 uncertainty.

Australia’s $200bn LNG spending spree in the past decade has catapulted the country to be the world’s largest gas exporter but most projects have suffered cost blowouts and delays, trimming returns for some of the world’s biggest energy producers and raising doubts over the appetite of majors to bankroll a next wave of projects.

Total’s impairment “does compound industry perceptions that Australia is an expensive and difficult place to develop LNG,” Wood Mackenzie’s research director Angus Rodger said.

The writedown by Total probably included a hit from GLNG given Santos had already taken an impairment on the asset and underlined the poor economics of the Queensland project, Credit Suisse said.

“GLNG has proven one of the worst LNG projects in Australia on an economic basis, in the wake of cost overruns and more challenging rocks than initially envisaged, which has also garnered plenty of unwanted attention from government as domestic (gas) prices rose, placing jobs at risk,” Credit Suisse analyst Saul Kavonic said.

“But this is well-worn territory and the industry debate has moved on from GLNG’s woes last decade.”

The budget for the Ichthys project skyrocketed from an initial $US34bn estimate to a final bill of $US45bn but Inpex has defended the cost hike, noting rival LNG projects in Queensland and WA had also experienced blowouts.

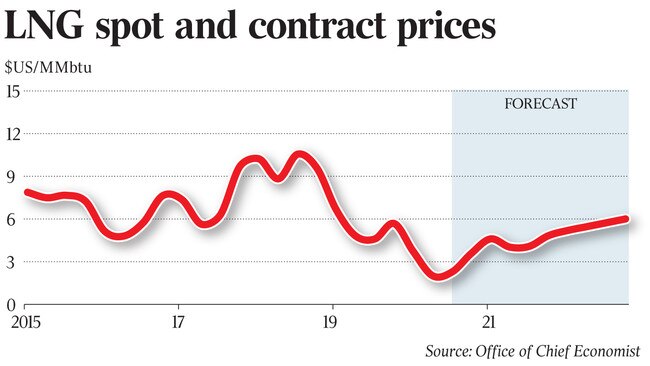

Credit Suisse said Australian producers were using higher oil price assumptions for impairment purposes than their European counterparts such as Total and Shell and investment decisions were likely to be based on even lower levels of less than $US50 a barrel.

“In the wake of COVID, Australian oil names are using long-term impairment pricing assumptions in the $US60-$US65 a barrel range versus Europeans, who have revised down long-term price assumptions into the mid-$US50s a barrel,” Mr Kavonic said.

“However, there is a big difference between price assumptions for investment versus impairment purposes, which muddies the waters, and we suspect most oil companies will stress-test investment decisions to sub-$US50 a barrel price assumptions, including in Australia.”

Total lowered its Brent oil price to just $US35 a barrel for 2020, rising to $US40 next year and recovering further to $US60 by 2023. Beyond 2030, it expected crude would only average $US50 a barrel, noting oil demand would have reached its peak due to technological advances, including in the transport sector.

Still, in the medium term, the French player expected prices to recover.

“Total maintains its analysis that the weakness of investments in the hydrocarbon sector since 2015 accentuated by the health and economic crisis of 2020 will result by 2025 in insufficient worldwide production capacities and a rebound in prices,” the company said.

Crude prices have more than doubled from record lows in April to trade at $US43 a barrel, but even at those improved levels many projects remain marginal.

The writedowns reflected both a lower oil price outlook and also a broader energy transition change, energy consultancy firm Wood Mackenzie said.

“These writedowns are not unexpected as we’ve revised the value of oil and gas assets in Asia Pacific by $US200bn as a result of a lower oil price outlook,” WoodMac senior analyst Daniel Toleman said.

“The writedowns reflect how the energy transition is impacting corporate strategy at the world’s largest oil and gas companies. The European super majors are setting out on a path towards more sustainable and resilient businesses, better equipped for a future of lower fossil fuel demand.”

Global major BP, which in June took a writedown of as much as $US17.5bn, slashed its long-term energy price assumptions and even warned it may leave oil and gas in the ground amid a fast-moving transition away from fossil fuels.

Total in May revealed plans to supply electricity for large industrial customers in a major Australian expansion pitting it against rival major Shell and the nation’s big three power retailers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout