Liontown Resources scaling back Kathleen Valley mine production

Just three months after opening the $950m mine, the Gina Rinehart-backed miner is in survival mode.

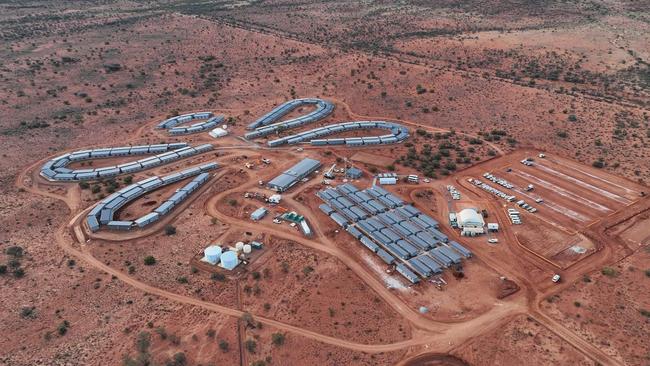

Lithium producer Liontown Resources is dialling down production and scrambling to cut costs just three months after opening its Kathleen Valley mine built at a cost of $951m.

Gina Rinehart-backed Liontown is in survival mode amid the prolonged downturn in lithium prices which has seen established producers like Pilbara Minerals and Chris Ellison’s Mineral Resources cut jobs and production.

Liontown, which has offtake agreements with Ford, Tesla and South Korean battery maker LG Energy Solutions said on Monday it was abandoning plans to ramp up production to 3 million tonnes per year and then to 4 million tonnes per year.

The company’s revised mine plan aims to deliver 2.8 million tonnes per year from the end of 2026-27 as it sweats on a recovery in lithium prices and tries to find cost savings of about $100m.

Liontown managing director Tony Ottaviano said Australia’s first underground lithium mine would focus on high margin tonnes ahead of volume to save costs.

Mr Ottaviano started calling for government assistance for the ailing lithium sector within days of the Kathleen Valley operations starting production on July 31.

“When market conditions change, companies need to quickly adapt to meet the market,” he said on Monday.

“Through the business optimisation work done by our team, the revised mine plan and guidance demonstrates our responsiveness to the low-price environment.”

Liontown said it expected unit costs of $775-$885m per tonne to produce 6 per cent lithium spodumene concentrate, and at an all-in sustaining cost (AISC) of $1170-$1290 per tonne.

Barrenjoey analyst Glyn Lawcock said the AISC cost was very close to the current lithium spot price.

Mr Ottaviano said the cost guidance provided by Liontown was competitive with industry peers and below current spot prices.

He said Liontown could satisfy all of its obligations to customers under the revised mine plan.

The cost estimate includes WA government royalties, with Liontown leading calls for those payments to be suspended until the market improves.

Wesfarmers, the only other company to open a new lithium mine in Australia in the past 12 months, has stopped short of supporting royalty relief as it ramps up production at its Mt Holland operations in WA, owned in partnership with Chilean-based SQM.

The Perth-based conglomerate’s chief executive, Rob Scott, said Wesfarmers was in a different boat to some other WA lithium miners in that its focus was on producing a battery-grade chemical material.

“Our main focus is developing our hydroxide plant,” he said after the company’s annual general meeting.

“So pleasingly, that’s 88 per cent complete, we’ve started the commissioning process, and we’re optimistic of having our first hydroxide product ready by the middle of next year.”

Mr Scott said Wesfarmers was pleased with the way the royalty structure in WA was structured to create an incentive for value-added producers.

He said Wesfarmers would “love” to see the Albanese government’s 10 per cent production tax credit for critical minerals processing flow through to industry.

“These are positive initiatives that should help value-added producers such as ourselves and other companies that are prepared to invest the billions of dollars required to get into value-added processing,” he said.

Mr Scott’s comments are a rebuff of Opposition leader Peter Dutton, who is opposed to production tax credits.

Liontown shares opened the day at 83c, a far cry from the takeover approaches the board rejected from New York-listed Albemarle in early 2023 amid a series of bidding wars for WA lithium projects.

The board eventually agreed to a $3-a-share offer which valued the company at $6.6bn, but Albemarle walked away after Mrs Rinehart’s Hancock Prospecting forked out about $1.3bn for its 19.9 per cent stake in Liontown.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout