Gina Rinehart-backed Liontown Resources’ first lithium shipment from Kathleen Valley sets sail for China

Billionaire Gina Rinehart-backed lithium producer Liontown Resources’ first shipment of concentrate from its flagship Kathleen Valley operation has left Australia for China.

Billionaire Gina Rinehart-backed lithium producer Liontown Resources’ first shipment of concentrate from its flagship Kathleen Valley operation has left Australia for China.

The shipment departed from the Port of Geraldton on Friday as the company booked a higher full year loss of $64.9m for the year ended June 30, hit by costs linked to overseas giant Albemarle’s scuttled takeover as well as debt rearrangements.

Liontown chief executive Tony Ottaviano said the shipment was a “pivotal moment” for the company.

“Over the past six years, Liontown has focused on developing and constructing a world-class tier-1 lithium operation, and now we announce the beginning of generating revenue and cash flow, as we see our plans come to fruition,” he said.

“Within two months of first production at Kathleen Valley, we have not only successfully produced and now shipped concentrate, with a weighted average Li2O content of 5.2 per cent, but we have also achieved a sale on the spot market, realising a premium sales price in the current market conditions, and demonstrating the consistent demand for high-grade battery products.”

Ms Rinehart emerged as a stakeholder in Liontown with more than 18 per cent after her on-market raid forced Albemarle to withdraw from a $6.6bn takeover in October 2023.

Liontown’s loss for FY24 compares to its FY23 loss of $22.2m. The FY24 underlying net loss came in at $39.6m after adjusting for near-$4m in transaction costs related to the Albemarle deal and $21.3m towards borrowing costs in relation to debt facilities.

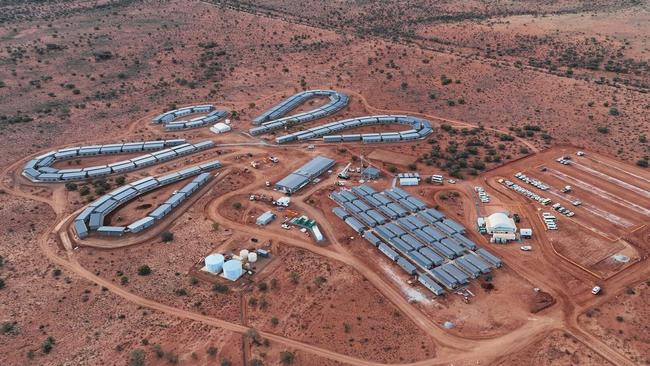

Liontown’s total assets increased from $655.1m as at June 30, 2023, to $1,384.9m as at June

30, 2024, with this increase primarily relating to the construction of the Kathleen Valley Lithium Project processing facility, which started production on July 31.

The lithium producer’s shipment on Friday on the MV Eckert Oldendorff comprised 11,855 wet metric tonnes (WMT).

Liontown said concentrate stockpiles continue to build between site and the Port of Geraldton, and the company continues to ramp up production with 28,000 WMT of concentrate produced to date.

The company’s first spot sale for its uncontracted production was 10,000 tonnes of spodumene concentrate to a Singapore-based trader, which achieved a reference price, at a premium to spot, of US$802/dry metric tonne of SC6, with shipment scheduled for early in the fourth quarter of the 2024 calendar year.

Liontown said it will continue to execute its spot sale strategy going forward to ensure it maximises value for shareholders by creating a long-term reliable price index that is truly reflective of global supply and demand dynamics for lithium.

In addition, the company said it would progressively start to fulfil its strategic offtake agreements with LGES, Tesla and Ford.

With material decreases in spot prices for lithium chemicals and spodumene concentrate, which have led to significant reductions in short-and medium-term price forecasts, Liontown has commenced a number of “initiatives and mitigating actions” to optimise operational plans, reduce production costs and defer or cancel discretionary expenditure.

The initial objective was to undertake underground development work to increase output to 4 million tonnes a year, however, Liontown is reviewing its plans to preserve capital and reduce the near-term funding requirements.

Mr Ottaviano said it has been a year for “transformative growth and achievement”.

“We have not only delivered on our commitments, but also built a company around our world class Kathleen Valley Lithium Project which sets the foundation for future continued success,” he said.

“As we look ahead, we continue our ramp up progress towards steady state production and remain committed to enhancing shareholder value with confidence in the long-term success of the Kathleen Valley lithium operations.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout