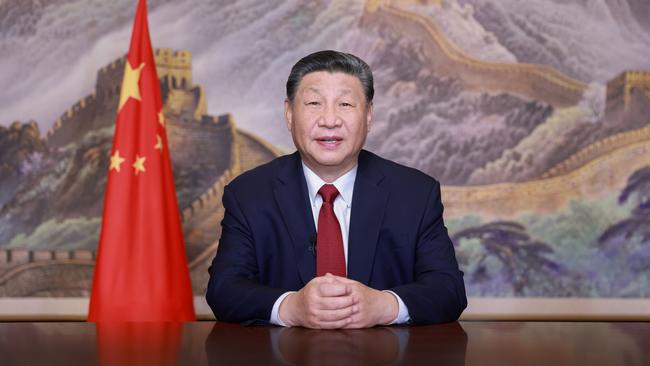

Iron ore slump to continue as Xi Jinping signals that growth is a priority

While Xi Jinping urged confidence in China’s economy, experts project the falling value in Australia’s top exports will continue.

Iron ore prices are set to fall further this year in a blow to the budget bottom line, as Chinese President Xi Jinping warned that Australia’s largest trading partner faced further uncertainty, weeks ahead of Donald Trump’s inauguration.

In his annual new year address on Tuesday, Mr Xi pledged to implement further measures to promote growth to support China’s strained economy amid growing challenges from “external” sources, a nod to president-elect Trump’s vows to hike tariffs on Chinese imports.

“The current economic operation faces some new situations, challenges from the uncertainty of the external environment and pressure of transformation from old drivers of growth into new ones, but these can be overcome through hard work,” Mr Xi said.

“We can prevail with our hard work. As always, we grow in the wind and rain, and we get stronger through hard times.

“We must be confident.”

Despite growing to a ¥139 trillion ($28.6 trillion) economy in 2024, Beijing has struggled to rebuild momentum through 2024 as increasing local government debt, a prolonged downturn in property, and weak consumer confidence have hampered growth.

For Australia, sluggish activity has weighed on demand for key commodity exports, including coal and iron ore, as China’s steel mills moved to slash their output.

Jim Chalmers in December revealed an expected downgrade to company tax receipts worth $8.5bn over the next four years, owing to the projected commodity slump.

Yet even if Beijing did reach its 5 per cent growth target in 2025, AMP chief economist Shane Oliver said the recent decline in the iron ore price – currently trading at $US101 a tonne on the Singapore exchange – would continue.

“This is a problem for Australia, that we’ve relied for a long time on Chinese growth remaining strong and resulting in very strong commodity demand,” Dr Oliver said. “That’s papered over the deterioration in productivity growth and enabled the budget to remain in reasonably good shape despite big increases in spending.

“It will see the budget become more vulnerable to the blowout in spending we’ve seen in recent years without the revenue surprise on the upside to rescue it.”

Forecasts in December’s mid-year budget update assume the iron ore spot price will decline to $US60 a tonne by September 2025, six months later than projected in the May budget.

While Dr Chalmers has delivered consecutive surpluses, owing in part to bumper commodity windfalls, the federal budget is expected to fall to a $26.9bn deficit this financial year as softening revenues fail to cover record government expenditure.

Further threatening to weigh on China’s economy is the risk of a sharp rise in tariffs when Mr Trump returns to the White House, with him campaigning on a 60 per cent tariff on all Chinese goods imported to the US.

If implemented, KPMG chief economist Brendan Rynne said it would be “near impossible” for China to achieve its expected 2025 growth target.

“If Trump were to go through with 60 per cent tariffs, it’s going to be very, very difficult for the Chinese economy to withstand that,” Dr Rynne said, projecting the levy would subtract 0.6 percentage points from Australia’s gross domestic product.

“That will have a negative impact on our terms of trade, which will mean the profitability of our exporters, particularly our coal and iron ore exporters, will come under more pressure.”

In November, Mr Trump fired the opening salvo in a looming trade war with China, announcing plans to slap its imports with an initial 10 per cent tariff on top of existing duties, and proposed plans to implement a 25 per cent levy on Mexican and Canadian products.

Reserve Bank governor Michele Bullock in December flagged that heightened trade tensions between the US and China, risk dragging down Australia’s own economic growth. “If there is [sic] some moves that really impact growth in China, and obviously if growth in China is affected, that impacts the demand for exports from us,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout