Industry on a high as Diggers & Dealers kicks off in Kalgoorlie

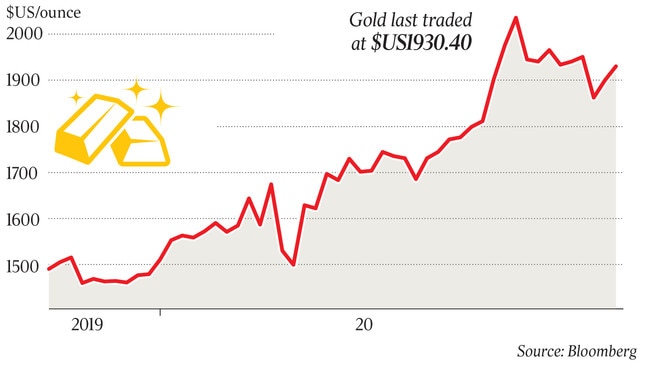

Rampant gold and iron ore prices and growing interest in base metals make for a heady backdrop to the annual Diggers and Dealers conference.

The biggest gold merger in a generation, rampant gold and iron ore prices, growing interest in base metals as the world looks to emerge from the coronavirus crisis and an incredible run of exploration success make for a heady backdrop to the annual Diggers and Dealers conference, which kicks off in Kalgoorlie on Monday.

Border lockdowns have largely limited attendance to West Australian delegates, but the conference will still host more than 1800 attendees and speakers from some of the biggest mining companies in the world.

The headline act of the annual mining bash is undoubtedly the $16bn merger between Northern Star Resources and Saracen, a deal that will create Australia’s first entry into the global ranks of top tier precious metals miners in decades.

Even Barrick Gold boss Mark Bristow hailed the merger, telling a South African mining conference last week the deal was a “great example” of much-needed consolidation in the sector.

It sets an effervescent tone for the conference, amid speculation more deals will flow as mid-tier operators look to lock in the gold price gains and build companies with the scale to prosper beyond current highs.

And adding to the bullish sentiment is the fact that the past two years have been the most fertile period for major new discoveries in decades, with new finds pouring in from both resources majors and juniors alike.

BHP’s Oak Dam, Rio Tinto’s Winu and Newcrest’s Havieron discovery all have their owners talking about a quick path to production, even at relatively early stages of their exploration and development.

They are joined by emerging discoveries by juniors such as Stavely Minerals in Victoria, Alkane Resources in NSW, Chalice Mining’s spectacular new multi-commodity — nickel, palladium, copper and cobalt — Julimar discovery not far from Perth, and De Grey Mining’s substantial new gold project 60km north of Port Hedland in the Pilbara.

Combined, the prospect of both corporate activity and exploration success makes for a heady mix.

Despite the global economic turmoil caused by the coronavirus crisis, veteran Perth deal-maker Liam Twigger says he believes conditions for the sector are the best since WA’s first resources boom more than 50 years ago.

He points to the massive stimulus recovery packages being prepared by countries across the globe, the likelihood that depressed interest rates will keep gold prices high, and a global decarbonisation push that will lift demand for copper, nickel, rare earths and other commodities needed for batteries and other clean energy technology.

“You’ve got a confluence of events that create the best set of conditions for commodities since the 1960s. If Joe Biden gets up (in the US presidential election), for example, he’s been saying he’ll spend $US2 trillion ($2.75 trillion) on infrastructure, and that sends great signals for iron ore and copper and nickel,” Twigger says.

In Australian dollar terms, gold peaked at $2873 an ounce in August before dropping back to settle at trading in a range around $2650/oz — about $450/oz ahead of its levels a year ago.

There is little doubt the Australian sector is ripe for consolidation.

On the one hand a growing group of mid-tier producers are cashed up and in need of a portfolio refresh as their assets age, or for new growth options. Genuine mid-tier players such as St Barbara and Regis Resources sit in this group, along with smaller players such as Silver Lake Resources, Ramelius and Gold Road potentially looking to build scale beyond their smaller portfolios.

On the other side, strong market interest in the sector has helped even the smallest explorers raise cash and ensured companies with later-stage projects have been able to accelerate work to take advantage of prices while they last.

Companies such as De Grey and Bellevue Gold, with its high grade underground project near Leinster, are perennial targets of takeover speculation.

The issue across the sector will be valuation.

De Grey’s $1.55bn market capitalisation is great news for punters that bought the stock when it was trading at less than 5c in late 2019. But it is also at levels that would cause most potential suitors to baulk at making a play for the discovery, still in the relatively early stages of exploration.

The same can be said for Chalice and Bellevue, priced at $830m and $930m respectively.

Twigger says heated market valuations pose a barrier for corporate activity, but points to the all-scrip deal between Northern Star and Saracen, which did not offer a takeover premium to Saracen shareholders, and instead promised to deliver long-term benefits to investors in both companies.

“To pay a big premium you’re betting the price will keep going up for the next five years. No-premium deals make a lot of sense,” he says.

Resources juniors are also cashed up, meaning boards face little pressure to deal.

Collectively they raked in more than $1.3bn in equity in the June quarter, according to figures compiled by advisory firm BDO, and the September period is likely to easily top that figure.

Veteran exploration boss Will Robinson, whose Encounter Resources boasts joint venture deals with Newcrest and IGO as well as its own WA projects, says he believes conditions for explorers are better than they have been in decades — even better than the surge of interest caused by the China-led commodities boom from 2006.

The easy pickings of deposits close to the surface are largely gone in Australia. While it has become more difficult and expensive to find the deeper deposits, Robinson says explorers are able to bring better technology to bear to improve their success rates.

“2019 looks like it could have been the start of a sustained exploration boom. As a sector we’re getting better at finding new things, and all the investment in data by government and in technology by companies is starting to bear fruit,” he says.

But the strong interest in the sector does not mean all is rosy for investors. Last month some of the world’s biggest gold investors sounded a warning that retail investors would do well to note.

In an open letter to miners at Denver’s annual gold conference last month, a coalition of gold investors — including VanEck, Sprott, Franklin Templeton and CI Investments — warned executives their performance “continues to fall short” in many areas.

“Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision and communication with investors,” the letter said.

On top of other complaints, the letter warned companies to maintain shareholder returns and ensure they were open for takeover offers, even if the board was not looking for a suitor.