Western Australia rides iron ore ‘miracle’ to budget surplus bail-out

Western Australia’s ability to keep the massive iron ore mines of the Pilbara in production throughout the pandemic has led to a multi-billion-dollar windfall.

Western Australia has again been bailed out by a surge in the iron ore price, with the commodity’s recent highs driving the seemingly miraculous delivery of a budget surplus in the middle of a global pandemic.

Rather than an act of financial wizardry, it was the state’s ability to keep the iron ore mines of the Pilbara in production throughout the coronavirus crisis that led to the multi-billion-dollar windfall that kept the budget in the black.

Royalties have effectively been pouring into Treasury coffers faster than they can be spent.

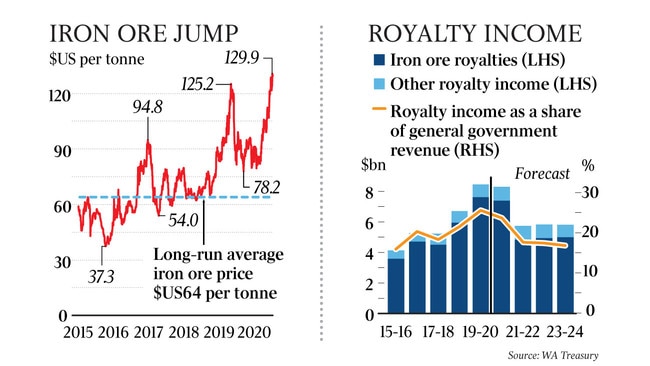

Surging iron ore prices saw WA collect a record $8.45bn in royalties last financial year, almost double the average of recent years.

Another $8.29bn in royalties is expected to pour in again this year, even as iron ore prices are expected to soften.

The steps taken by WA to protect its iron ore industry through the pandemic, even as other parts of the economy were forced to shut down, meant Pilbara mines enjoyed the full benefits of an iron ore price that soared as other rival sources of supply — most notably Brazil — were curtailed from the virus.

Just as WA’s economy is arguably better off if borders stay closed, so too is WA paradoxically better off if a coronavirus vaccine is found later rather than sooner.

The longer it takes those other sources of iron ore production to recover, the better it will be for iron ore prices and WA’s royalty receipts.

State Treasury expects the benchmark iron ore price to average $US96.60 a tonne this year — it is currently at $US123 a tonne — before easing back to $US64 a tonne (including shipping costs) in financial 2022 and beyond.

That long-term forecast is broadly in line with $US55 a tonne (excluding shipping) figure used by the commonwealth.

The budget forecasts iron ore royalties to pull back to $4.8bn by financial 2022.

“The iron ore price is expected to remain strong into 2020-21 but decline to its long-run average from June 2021 as Chinese economic stimulus unwinds and iron ore production from Brazil recovers,” the budget said.

WA’s heavy exposure to the vagaries of iron ore prices has long been a cause for concern for its governments, but with coronavirus knocking out sectors such as international tourists and foreign students, that exposure has proved a blessing in 2020.

The health in iron ore has had a positive knock-on effect across the rest of the economy.

The state economy actually grew during the June quarter, when the shock of the pandemic was most pronounced, thanks to iron ore, while business confidence has bounced back solidly.

The health in iron ore is also helping get West Australians back into jobs faster than previously expected. Treasury has forecast for unemployment to average 8 per cent this financial year, but the rate has already fallen below that mark since the budget forecasts were finalised.

Online job advertisement levels in WA are now higher than they were pre-COVID.

And a push by the government to encourage the big Pilbara miners to move interstate-based FIFO workers permanently into WA has also helped it offset some of the impact of a sharp drop in international migration into the state.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout