Government coal ‘subsidy’ sparks fury from green energy investors

A new payment incentive to keep coal in Australia’s electricity system has sparked a furious reaction from big renewable energy investors.

A new payment incentive to keep coal in Australia’s electricity system has sparked a furious reaction from big renewable energy investors, who have written to energy ministers demanding they reject the plan amid fears green investment will be crushed if it proceeds.

Major investors sent a letter to energy ministers on Thursday urging them to oppose a mechanism that would pay coal generators to guarantee sufficient back-up capacity is available in the grid.

“We are writing to share our concerns about the Energy Security Board proposal for a capacity market,” said the letter from more than 20 energy groups, including French renewable developer Neoen and Brighte, the Mike Cannon-Brookes-backed financier. “We urge you to oppose these proposed reforms and withhold your support for further development.”

Both federal and state energy ministers are set to meet on Friday to discuss a set of reform recommendations handed to governments by the Energy Security Board. They include the mooted capacity mechanism, where coal plants would be paid for having capacity available to generate, rather than for the energy they actually produce.

Clean energy companies say the move will blunt investment in new supplies and drive up costs for consumers by subsidising old coal plants. The capacity move could see household bills rise by up to $430 a year at a potential annual system-wide cost of $6.9bn, according to forecasts to be released on Friday by consultancy Green Energy Markets.

While the Australian Energy Market Operator is making an increasing number of interventions to keep the system stable as renewables flood into the system, the letter warns both federal and state energy ministers that there is no clear evidence of a problematic reliability gap that requires major market reform.

“The so-called capacity market threatens to increase costs for consumers, chill investment in renewable energy and set back the transition towards a cleaner energy economy,” said the group, which includes the CBA-backed start-up Amber and business power retailer Flow Power.

But the renewable investors face a clash with Australia’s biggest electricity companies, which are working in a high-level group to strike a united position on the energy blueprint.

One of those companies, power giant Origin Energy, denies that a capacity mechanism is intended to prop up coal plants.

“It’s not about extending coal. It’s about getting the right settings such that you get that investment and you get the orderly transition from one to the other,” Origin chief executive Frank Calabria told The Australian.

“We are part of a group of players in the sector that really want to try and make that work with governments and support a mechanism that enables that to occur.”

Origin runs Australia’s biggest coal plant, Eraring in NSW, but is increasingly having to switch the station off during daytime hours when rampant solar supplies undercut it on price.

Eraring will start closing its first unit from 2030 but Mr Calabria said the capacity mechanism was not intended to extend the plant’s retirement date.

“This mechanism is not prolonging the life of Eraring at all. It’s just designed to make sure that the right settings are in place, and also equally for us, that if we’re introducing new capacity that’s required in the system to get that transition right, that we’ve got that happening in the right way.”

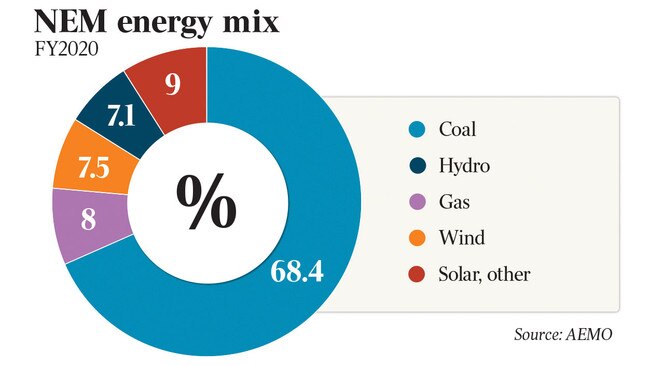

Coal, which currently provides as much as 70 per cent of electricity, will contribute less than a third of supply by 2040 and could be dumped much earlier as competition from renewables and carbon emission concerns make plants uneconomic, AEMO forecasts show.

Still, critics of the mechanism question the need to keep legacy coal assets in the system, given the amount of new capacity expected to come online this decade, compared with when Hazelwood closed in 2017.

“From 2017 to 2027, almost 6500 megawatts of dispatchable power project capacity will be added to the grid,” said Green Energy Markets director of analysis and advisory Tristan Edis.

“To put this into perspective, this is almost double the capacity that will be lost from the next three coal power stations due to close after 2027 – Yallourn, Callide B and Vales Point B.

“This means that all states across the national electricity market have enough power capacity for the next decade to meet the strict reliability standard of satisfying more than 99.998 per cent of demand.”

Energy Minister Angus Taylor has said the ESB recommendations will be considered among reforms before a final package is sent to national cabinet for a decision later this year.

The Australian Energy Market Operator has previously backed plans to introduce a new price mechanism reflecting the important reliability role provided by power stations, which are currently struggling to receive any value for their generation when they get undercut by renewables that can produce at near zero cost.

The ESB noted recent investment in renewables generation had been supported by government subsidies and mechanisms might need to be put in place to ensure the right supply mix is in place for the grid over the coming decades.

Separately, AEMO also hopes a new cloud-based tool allowing energy developers to test their models for new generation projects will cut the time to approve new connections to the grid.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout