Fortescue shares up as iron ore exports soar

Investors have sharpened their focus on iron ore stocks ahead of this year’s reporting season.

Fortescue Metals touched another record high on Monday as iron ore futures gained and investors sharpened their focus on iron ore stocks ahead of this year’s reporting season.

Iron ore miner Mineral Resources also touched new highs on Monday after port data released last week suggested iron ore miners in WA’s Pilbara region hit record iron ore exports in the June quarter, a bright spot for Australia’s exports amid a grim outlook elsewhere in the economy.

With dividend stocks at a premium after the coronavirus devastated the outlook for shareholder payouts for usually reliable yield stocks among the big banks and other blue-chip companies, the expectation is the strong export performance of Australia’s iron ore miners, as well as strong prices, could make them among the few to maintain or lift dividend payouts.

Fortescue hit a record $15.41 before softening slightly to close at $15.36 a share, up 51c or 3.4 per cent for the day. MinRes touched $23.37 and closed the day at $23.30, up 61c. BHP gained 78c to $36.97 and Rio is again pushing at the threshold of the $100-a-share mark, closing up $1.85 at $99.84.

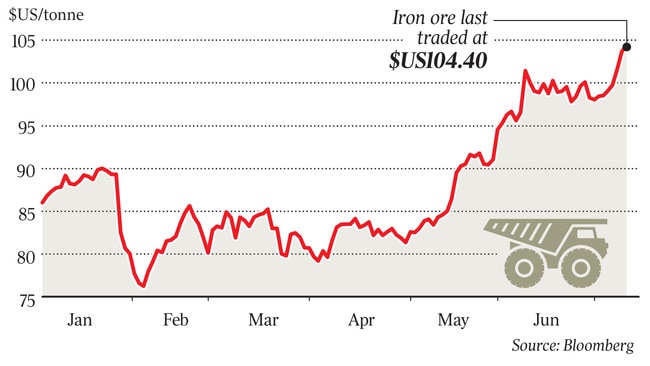

Analysts have been questioning how long the iron ore rally can go on, with Morgan Stanley last week suggesting a “downward price correction seems highly likely” as exports from Vale’s Brazilian operations appear back on track and China’s steel mills replenishes stockpiles at ports.

Morgan Stanley analyst Marius van Straaten said a recovery in Vale’s Brazilian output could bring the seaborne iron ore market back into balance in the second half of the year, with iron ore likely to be on a path back to $US80 a tonne in the September period as China’s steel mills replenished inventory.

Stockpiles

Last week stockpiles of iron ore at Chinese ports rose 0.6 per cent to 108.8 million tonnes, according MySteel Global data, after falling to about 80 million tonnes in June.

But that has not put noticeable brakes on the iron ore rally, with the most active iron ore contract traded on China’s Dalian exchange up 5 per cent on Monday evening, the highest in more than a year, and the iron ore price still hovering near $US105 a tonne.

Iron ore prices averaged about $US91 a tonne for the first half of the year, and about $US93.50 over the full financial year.

Port data shows Australia’s iron ore miners finished the June half with a rush, with shipments from Port Hedland, the Pilbara’s biggest bulk port, hitting a new record of 51.8 million tonnes for the month, easily beating the previous record set a year before.

That brought year-to-date shipments to 281 million tonnes, more than 6 per cent higher than 2019, when cyclones disrupted the operations of major producers.

That suggests a strong half for the miners, according to UBS analyst Glynn Lawcock, who estimates Fortescue could easily beat its annual guidance of 175 to 177 million tonnes for the financial year, with BHP moving 284.1 million tonnes for the year and Rio’s half-year shipments totalling 158.5 million tonnes.

Combined with the strong prices, the shipping figures pointed to a bumper dividend season for shareholders in iron ore miners, Mr Lawcock said.

“We see upside to iron ore-exposed producers, given strong pricing and shipments. We forecast Fortescue to pay a 98c per share final dividend (based on 80 per cent payout ratio), above consensus of 80c,” he said.

“Should Fortescue look to repeat FY19 with 80 per cent payout for the entire year, our final dividend estimate could rise to $1.15 per share.”

In a client note Mr Lawcock said he was also bullish on dividends from BHP and Rio, flagging a US61c full-year dividend from BHP and a $US1.50 interim from Rio.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout