The source was the decision to appoint Boe Pahari as head of AMP Capital effective July 1 replacing the highly regarded Adam Tindall.

Responding to media reports, the company has confirmed Pahari was appointed despite a $500,000 fine for a past sexual harassment complaint back in 2017.

Everyone is entitled to make mistakes, pay the penalty and get on with life.

But the way AMP has handled the issue gets worse by the day.

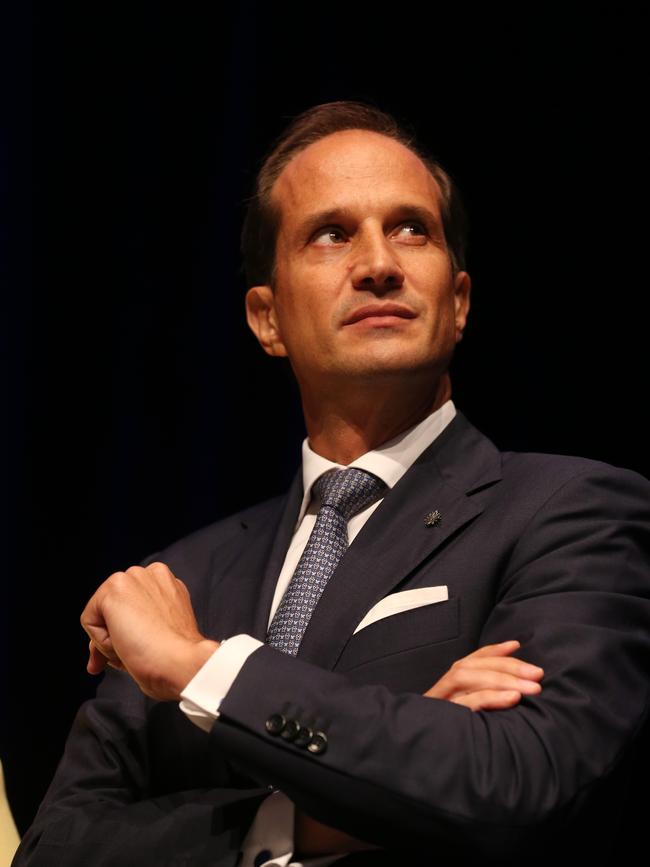

Chief executive Francesco De Ferrari is the person primarily responsible for the appointment so you would think either he or Pahari would have been out front and centre explaining the decision.

De Ferrari instead has kept his head down until a Friday internal staff meeting at which he promised to establish an integrity commission.

That must be a joke.

What is the point of an integrity commission in response to a board decision which from all reports was made with eyes open to appoint someone to a senior position despite some past sins in 2017.

Either the board and De Ferrari as the person responsible made a mistake or not, but an integrity commission just makes the whole issue look sicker still.

De Ferrari it will be remembered is on big promises at AMP having been described by Murray at the time of his January 2019 appointment as “AMP’s last best chance”.

He is on a hefty base pay of $2.2m with a target bonus of $2.2m up to a maximum $4.4m.

He also gets $7m worth of stock in 2023 if, over the period, AMP outperforms the ASX 100 financials index and he gets 10 per cent if it doesn’t.

Share allotments in store include an additional 408,000 next month and another 816,000 in equal allotments over the next two years.

With all that riding on his performance, one might think De Ferrari would be shouting from the rooftop what a great guy Pahari is and why shareholders should be thanking the board for appointing him.

Instead there is a vacuum which the media is greatly filling with more damaging reports about the Pahari affair.

This guy must be something of a genius to be granted this sort of treatment from the board.

Sadly for De Ferrari staff morale at AMP is not great flowing from the dismal Royal Commission performance and as a result of a brand name that has steadily sunk.

The company denies reports that Pahari threatened to quit if he didn’t get the top job at the star performing AMP Capital division.

Earlier this month the company sold its flagship life insurance business, which should have been a breath of fresh air, but instead the brand is soiled by yet another disaster.

Worse still, the AMP leadership is non-existent.

There are not a lot of institutional shareholders on its register, but those still there are shaking their heads.

It’s a tough backdrop to what should have been a celebratory earnings day on August 13.

Judo chief’s alarm bell

Judo Bank has called for a special-purpose equity vehicle to replace small business debt but some in the market are questioning the need, given low market interest rates.

As reported in The Australian on Monday, Judo’s Joseph Healy has suggested a government-backed special-purpose vehicle that would house COVID-19-related small business debt.

The debt would be converted to equity repayable in, say, five years, with an 8 per cent coupon rate, so a $100,000 loan would be equity totalling $140,000.

That way the small business would be free of debt and able to build up the operation to be able to repay the convertible equity in five years.

The 8 per cent coupon rate is high, as an inducement for the small business owner to pay it back as soon as possible.

Healy said the idea is not motivated by personal self interest at Judo, but as a senior banker highlighting the policy issues at stake

The concern is that otherwise the business would be overloaded with debt and unable to do anything.

Healy said the special-purpose vehicle ideally would be owned jointly by the government and the banks.

The concerns are well founded and ASIC for one is keen for the banks to be having frank conversations with customers to pinpoint the reality facing them.

As UBS’s Jonathan Mott has noted, if a customer can’t pay interest on a loan for 10 months they have moved into the category of a problem loan and must be treated as such.

As much as banks talk up their willingness to lend, there are not many struggling homeowners or small business people who really want more debt.

Question also whether any small business would really want to have the government as an equity holder.

Westpac and other banks have in the past steered clear of government proposals to turn them into equity holders when their primary business is debt.

But Healy is right to raise the alarm bell on concerns about what happens when coronavirus support measures expire at the end of September.

Lockdown raisings

Four months into lockdown, corporate Australia on Ownership Matters’ figures has raised $27.2bn in capital.

Investment banks have pocketed $435m in fees.

Victoria’s lockdown hits national economic confidence without offsetting factors like spending up at JB Hi-Fi and Officeworks to establish home offices.

Bunnings also fared well the first time as people at home worked out jobs they could do, but the thrill of this must wear out in time.

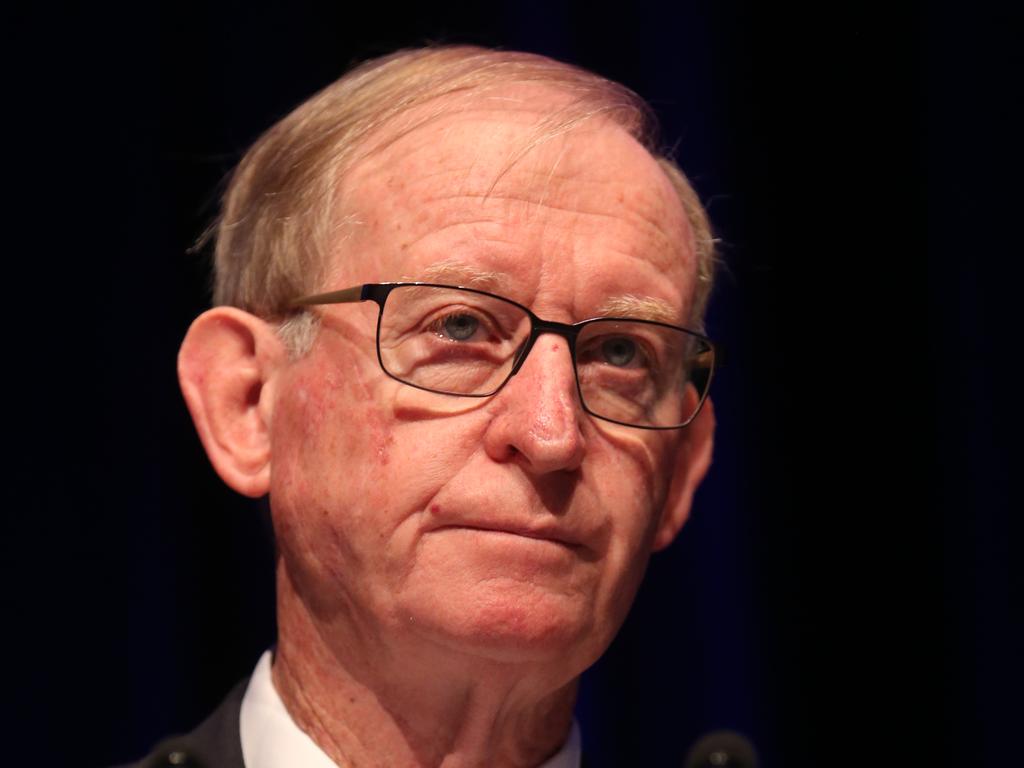

AMP chair David Murray has dug himself into a corporate governance hole from which there are now no easy escapes short of top level departures or corporate action like the long-demanded corporate split.