‘Don’t pull the plug’: call for zombie company rescue plan

We need creative ways to rescue businesses burdened by COVID debts, and the government may have a role, says Judo’s Joseph Healy.

Leading business banker Joseph Healy has called for a public policy response to the emergence of “zombie” firms unable to invest and grow after taking on $40bn in unproductive debt to survive the coronavirus pandemic.

Mr Healy, a co-founder of specialist SME lender Judo Bank and former head of business banking at National Australia Bank, also flagged two important milestones for Judo, with the lender turning its first cash profit this month and passing $2bn in loans in the coming weeks.

On the emerging issue of debt-plagued zombie firms, the Judo chief said he had raised the matter with Josh Frydenberg’s office and the federal Treasury, as well as the Reserve Bank and the Australian Prudential Regulation Authority.

“It needs a creative solution and some good discussions are under way,” he said.

“I don’t subscribe to the view that we should simply pull the plug on these businesses because the issue is not poor management; it’s sheer bad luck.

“So you have to find a way of carrying them, and the best way to do that, assuming the underlying business is viable, is to allow conversion of part of the unproductive debt to some kind of equity instrument.”

His comments come as Commonwealth Bank chief executive Matt Comyn warned of “difficult decisions” for banks and those on loan repayment pauses in the months ahead.

Mr Comyn told Business Weekend on Sky News many borrowers would be urged to restart their loan payments, even though an extension was available for those that genuinely required a full 10 months without repayments.

“This next (deferral) round will be much more of a case-by-case assessment. So certainly, all of the banks will be working hard,” Mr Comyn told Sky News.

A three-page discussion paper by Judo outlines the basis and scope of the problem, with repayment deferrals ($13.5bn) and the Morrison government’s SME loan scheme ($6bn) adding an estimated $19.5bn in debt to the overall system.

Of this, about $17.5bn would not add any productive capacity to the economy.

Judo says a further $7.5bn would be soaked up by deferral arrangements with other parties, such as landlords, resulting in a $25bn surge in the sector’s unproductive debt burden to $25bn.

This would lift bank debt to SMEs from 20 per cent of gross domestic product to 25 per cent, assuming a 10 per cent contraction in GDP.

The higher $40bn figure covers the period until March 2021, after the banks agreed last week to extend business loans to eligible customers for a further four months once the current program expires in October.

Judo warned of an “unhelpful triangulation of higher debt, lower profits, and reduced investment” in a post-COVID world.

“There is no magic wand to solve this problem, but ignoring it carries a great cost,” it says.

“Importantly, the ‘debt overhang’ problem is not one that the market will solve — we need a solution to get SMEs back to the ‘right size’ debt levels, minimising the deadweight of zombie firms, helping give ‘strugglers’ the capacity to grow and avoid damaging the future borrowing prospects of entrepreneurs through damaged credit data.”

Judo says there are many ways to structure a private/public sector COVID equity vehicle to support economically viable outcomes, avoiding losses for taxpayers or bank investors.

It notes the Government has already created the Australian Business Growth Fund to encourage private sector equity investment in growing SMEs.

“The mandate of the ABFG, however, is shaped and sized for a different world than the one we find ourselves in,” Judo says.

“A different response is needed, given that we now face the greatest economic challenge of a generation.”

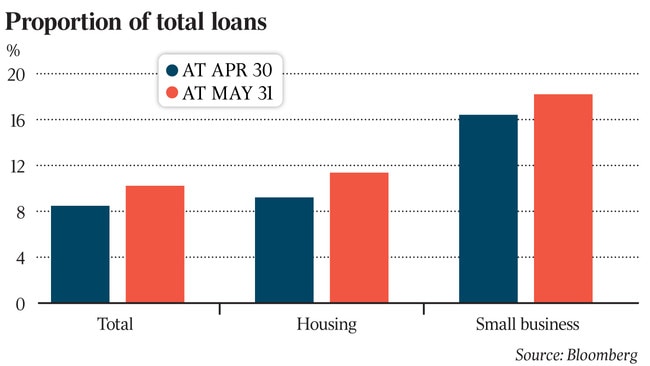

Recent APRA lending data for the month of May shows Judo remains on a strong growth path, despite the impact of the pandemic.

Since the beginning of the COVID period in March, Judo’s loan book has increased by $202m, or 15 per cent, to $1.5bn.

The growth rate since the beginning of the year was 50 per cent.

While business loans by the major banks include credit extended to the big end of town, the size of the NAB and Westpac loan books has contracted since March.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout