Fortescue Metals payout ratio dips as green energy war chest grows

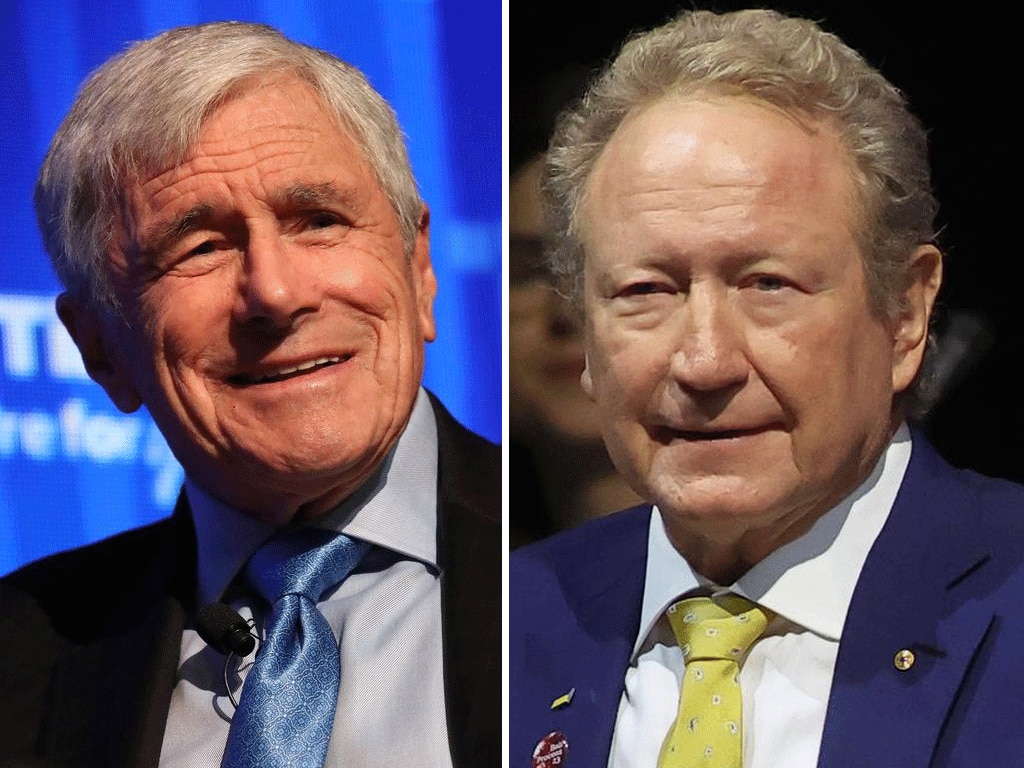

Executive chairman Andrew Forrest defends the group’s interim dividend cut, says its 75c a share payout is still ‘breathtaking’ compared to historical standards in the mining sector.

Fortescue Metals Group executive chairman Andrew Forrest has defended a fall in the miner’s payout ratio for the first half of the financial year, saying the 75c a share interim dividend is still “breathtaking” compared to historical standards in the mining sector.

The company will pay a reduced dividend after booking a $US2.4bn ($3.46bn) net profit for the six months to December 31, down 15 per cent on the back of lower iron ore prices.

The dividend is slightly above the 73c a share expected in consensus analyst expectations, and will deliver just under $850m to Fortescue founder and executive chairman Andrew Forrest.

But it represents a 65 per cent return of Fortescue’s net profit, lower than the 70 per cent paid out in February 2022.

Fortescue also said on Wednesday its green energy arm, Fortescue Future Industries, now has a $US793m war chest from its 10 per cent share of the company’s profit, with the two issues underlining analyst concerns that the company’s move into green hydrogen could undermine future returns.

This month, Credit Suisse downgraded Fortescue to underperform, partly on concerns about the ongoing lack of detail on its future spending on FFI.

Goldman also cut Fortescue to a sell recommendation, saying the company was overvalued relative to its peers, and on “uncertainties around Fortescue Future Industries diversification and Pilbara decarbonisation and impact on dividend and balance sheet”.

Fortescue has a policy of paying out 50 to 90 per cent of net profits in dividends but, as the iron ore price has surged in recent years, has generally paid towards the top end of its target range.

But Dr Forrest defended the payout ratio on Wednesday, telling analysts it was still very strong by historical and industry standards.

“That 65 per cent ratio would have just been breathtaking only a few years ago, and is a very high impact payout ratio relative to what we’ve seen,” he said.

“Yes, it makes sure that we’ve got a huge amount of headroom, but I’m having no shareholder complain that 65 per cent is not generous.”

Fortescue booked underlying earnings before interest, tax, depreciation and amortisation of $US4.4bn, down from $US4.8bn in the first half of the previous financial year, on revenue of $US7.84bn.

Analysts expected Fortescue to book a $US2.3bn net profit for the half-year, according to consensus estimates published on Vuma, on the back of EBITDA of $US4.3bn.

Fortescue realised an average$US87 a dry metric tonne in the first half of the financial year, down from $US96, and its costs lifted 14 per cent to $US17.43.

Asked about talk of major cost-savings and job cuts at the company, both Dr Forrest and Fortescue Future Industries chief executive declined to give details of potential job cuts.

The Australian reported last week that Fortescue was considering a plan to potentially slash more than 1000 positions across its corporate back office and at FFI, with its board due to consider a management proposal ahead of Wednesday’s half-year results.

Dr Forrest declined to comment on the board discussions, saying he had an obligation to stick to boardroom confidentiality, but said the company’s history included multiple cycles of growth and consolidation.

“Are there going to be wanton job cuts coming? Absolutely not. Are we continuing to constantly improve and evolve? Absolutely we are, but this is just business as usual,” he said.

Fortescue’s shares closed down 0.8 per cent at $22 each, in a lower market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout