Both Redman’s exit, and the demerger plan, smack of being premature.

Last month the company said that by year’s end it would split into two, with one arm housing its coal electricity-generation assets and the other renewable energy and the retail assets.

But the announcement was short on detail and while the split was to have happened by year’s end, at last month’s investor day there was no detail of the structure or even firm plans to actually float one arm.

In governance terms there is merit in putting new executives in charge of the new companies, with new chairs and some old faces on both boards as a measure of continuity.

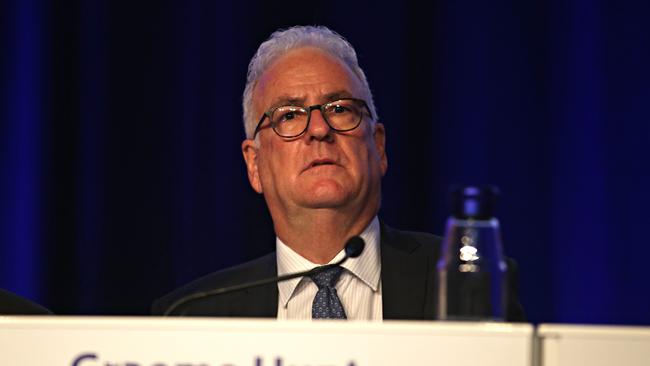

This means chair Graham Hunt, who is filling in as chief executive, should also walk in June when the final details of the split are known.

Whether Hunt sees the good governance light or prefers to be on the director gravy train remains to be seen.

Thursday was too early to send Redman packing because we are yet to get detailed knowledge of just what will be in each arm and what is the form of the split.

As the architect of the split, a long-time executive and former strategist, he is ideally placed to set up the new entities, even if isn’t destined to run either.

An appropriate time to leave would be June when the structures are announced.

The company finished a two-day board strategy session on Wednesday during which Hunt took executive control and Redman headed back by train to his home on Sydney’s north shore.

AGL has a history of marked changes in strategy.

Back in 2012 when Michael Fraser was running the show, being advised by Redman in his strategy role, the company went heavily into coal-fired generation, spending billions buying Loy Yang and more NSW generation.

This followed the Paul Anthony upheaval. Fraser was replaced by the Andy Vesey tsunami, who then handed the reins to Redman.

Along the way it has gone heavily into wind, only to backtrack, with big writedowns on inflated contract prices and talking up all sorts of allied operations like telecoms.

The company insists the plan was always to present the concept of a corporate split in March, followed by the details in June, which would incorporate investor feedback.

So why you would want to wave goodbye to Redman now before the details are finalised beggars belief.

He has been at AGL for 15 years through its abrupt changes in strategy and knows the industry intimately.

Hunt had a long stint at BHP and spent time with other miners before dabbling in infrastructure: a fine commercial background on any score but not an energy insider.

Just who will run the new divisions should also be known in June, with insiders in the frame including former Australia Post executive Christine Corbett in the retail role and Markus Brokof to handle the ageing coal plants.

Redman spent Thursday briefing stakeholders including NSW Energy Minister Matt Kean and federal counterpart Angus Taylor.

The latter wants to make decisions on who is going to build the gas peaking plant to cover the 2023 closure of Liddell, but today’s decision effectively rules out any support from AGL on that plan.

Redman for his part is playing the company line and is publicly supportive of Hunt being the executive in charge.

Logic says it is a dumb move at this time and the wrong person has walked.

Climate risk

Prime Minister Scott Morrison may be a reluctant starter, but prudential regulator APRA has timed its draft guidance note on climate risks to perfection.

The guidance sends a clear message to directors and trustees that climate risk is financial risk.

This means assessment, disclosure and management of an organisation’s climate risk exposure must be clearly identified as being consistent with proper risk management practices and regulator expectations.

The Investor Group on Climate Change welcomed the APRA draft, noting: “Other markets are moving to mandatory climate risk disclosure regimes, including New Zealand, the United Kingdom, Hong Kong and potentially the United States. The draft APRA guidance serves as a good basis to begin moving towards a similar mandatory regime in Australia.”

Price is right at NBN

Next week NBN boss Stephen Rue will put proposed broadband prices to retail service providers (RSPs) Telstra, Optus, TPG et al, which is what the monopoly calls price negotiations.

Rue makes his offer, the RSPs jump up and down, and Rue proceeds with some slight tweaking.

The big fight is over the variable prices charged for extra capacity and the RSPs are hoping Rue might offer bigger capacity bundles. The latest round comes in a year when NBN has all but finished migrating customers onto its network, heralding some marked changes in the industry consolidation and increased prices at the retail level.

This may disturb the sense of calm at the NBN, which has managed to avoid political and consumer backlashes because the phone companies are the ones taking the fall by competing away their profit margins.

Rue finished rolling out the network at the right time, before COVID hit.

NBN has played a game of throwing out more capacity to placate the retail providers, but it’s a question of how much.

Some like TPG are promising increased competition by offering new fixed wireless services aimed directly at the market which NBN has failed to capture, including people renting homes, particularly in high-rise buildings.

As 5G rolls out to more homes the competitive pressure is building on the NBN.

Its aim is to spend money to upgrade more homes to fibre-to-the-premises and ride the digital revolution by being seen as the safe pair of hands to deliver broadband during the lockdowns.

Amid all Australia Post furore, NBN has emerged relatively unscathed despite paying $77.5m in bonuses last year and coming in at peak funding of $51bn against the promised $29.5bn.

NBN is taking the credit for serving the nation during the lockdown, when the phone companies think they should be getting the credit and not the monopoly wholesaler.

Even when there are service faults the NBN technicians are quick to blame the RSPs, which means faults are linked to the retail provider, not the wholesaler.

This is clever for as long as it can get away with it, but if as seems likely retail prices start rising NBN will come into the spotlight, which is why it is targeting high-end users who want fast speeds at home. Competition should deliver better service and prices, and rather than do the latter NBN is aiming at the former.

AGL is once again in apparent disarray with the hasty departure of chief executive Brett Redman before the details of its proposed split are publicly settled.