AGL’s board had spent the last three days locked in board meetings as it sought to work out how to create two ASX-listed companies through a demerger - splitting its retail and supply arms to form a green electricity retailer and generation giant dominated by coal power.

The mystery is why Redman is suddenly not part of the board’s plans. The 50-year-old said he could not commit to the normal five-year tenure expected once he took up the CEO role of the restructured business.

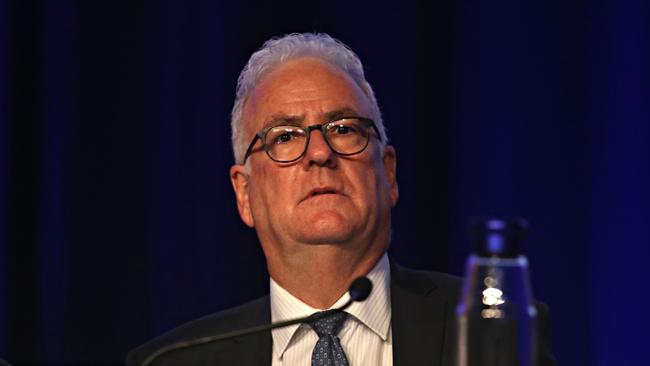

But putting low-key chairman Graeme Hunt in charge during one of the most critical restructurings in the company’s 180-year history is hardly ideal and will further unsettle investors already wary after the share price halved in the last year.

MST Marquee analyst Mark Samter was immediately wary, drawing a parallel with Woodside Petroleum’s bizarre ousting of long-time boss Peter Coleman.

“I know we will get the usual spin, like we did from Woodside, that this is all terribly cordial and doesn’t say anything about what is going on in the business, but it is hard not to read a lot into it.

“I really like Brett, and thought he was outwardly doing a good job of presenting a hard message, for him to jack it in two and a half years into the big job, hardly rings of a resounding endorsement of what AGL is trying to do,” Samter told clients.

It had been Redman, then CFO, who had convinced the board in 2018 he was the safe pair of hands needed to lead the company after several turbulent years under predecessor Andy Vesey.

He found a receptive ear in Hunt, who had tired of Vesey’s combative relationship with the federal government, including a tit-for-tat battle with Malcolm Turnbull and Josh Frydenberg over the future of the Liddell coal plant.

Redman provided the reset with Canberra but the challenges kept mounting.

AGL earnings began to plummet as wholesale prices fell and its giant coal power plants in Victoria and NSW made any plans to give the company brand a green polish a real stretch in the eyes of investors.

Pressure was rising on AGL to find new sources of revenue - and fast.

Redman signalled a major strategy shift in May 2019 after bidding $3bn for telco Vocus as part of a mooted move into data communications. After being beaten to the punch by a higher bid, there appeared no solid Plan B for growth.

Two years on, AGL has now made a pitch that it will boost the number of services it offers to customers initially driven by internet and mobile and later this decade by solar, batteries and electric vehicles.

But whether that - and splitting the company - is enough to mask a fundamental challenge to AGL’s core business remains the big question for Hunt.

After 15 years with the power giant and 30 months in the CEO role, the end for Brett Redman at AGL Energy was as swift as it was brutal.