BHP, Woodside agree $40bn petroleum merger

BHP will merge its petroleum arm with Woodside, making the combined company one of the 10 largest oil and gas producers in the world.

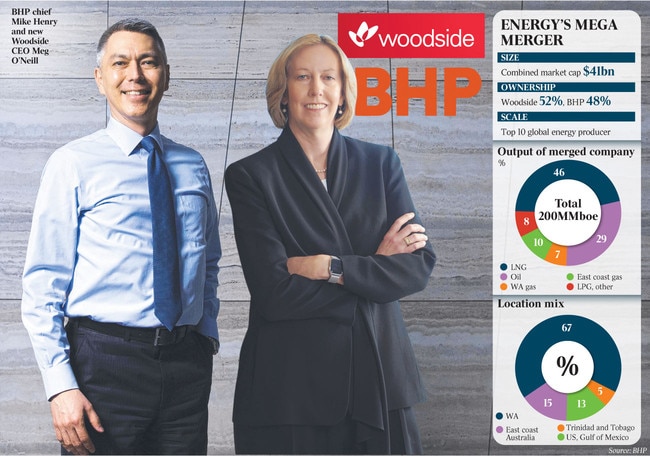

BHP and Woodside have agreed a historic petroleum merger deal to create a global energy giant headed by newly appointed chief executive Meg O’Neill, catapulting the company into the top 10 producers in the world and radically reshaping Australia‘s energy sector.

BHP shareholders will own 48 per cent of Woodside as part of the deal which values BHP Petroleum at $US13.9bn ($19bn), with the merged company boasting a market value of more than $40bn on current prices.

Woodside will be led on a permanent basis by Ms O’Neill, its interim boss since April, as the Perth-based producer embarks on a major strategy shift that will see it operate on multiple continents with assets spread across Australia, the Gulf of Mexico and Trinidad.

Woodside will gain 100 per cent control of its $16bn Scarborough gas project that it hopes to sign off on by the end of this year and will also double its share of the North West Shelf, Australia’s biggest LNG plant.

“We see this proposal as one where we are much better together than we would be apart,” Ms O’Neill said.

“It doubles our production and will create tremendous growth optionality and when you look at the numbers in a comparative sense we will be a top 10 independent energy company and a top 10 LNG producer.

“And importantly for our shareholders we will have the balance sheet, the cash flow and the financial strength to fund both our near term developments.”

Woodside shareholders will vote on the merger deal in the second quarter of 2021 with a 50 per cent vote needed to get a deal over the line.

“We actually see that the BHP shareholder register has significant overlap with the Woodside register,” Ms O’Neill said.

“There’s also folks who are in BHP today who hold other energy companies and don’t hold Woodside so we see them as attractive potential future investors.

“When we do the math, we actually see higher demands for Woodside shares than we see leaving BHP. So I guess I’d say now’s a great time to buy.”

Additional sharemarket listings will be considered in London and New York to keep “high value” investors on board while the clean-up liabilities for ageing fields has also been included in the deal.

Investors have been concerned by hefty abandonment liabilities running into the billions of dollars including the old Bass Strait assets offshore Victoria but Ms O’Neill declined to disclose the burden on its balance sheet.

“We’re taking everything that BHP is responsible for today,” she told analysts. “We feel good about how we valued the decommissioning obligation in our process of setting the merger ratio.”

Both Ms O’Neill and BHP petroleum chief Geraldine Slattery were slated for the top job and it was unclear if Ms Slattery will have a role in the bigger company.

“In the fullness of time, I’m sure that there will be further news about Geraldine’s future,” BHP chief executive Mike Henry said.

The merged company will double Woodside’s production to 200 million barrels of oil equivalent and reserves topping 2 billion boe while it expects annual synergies of more than $US400m.

Both companies are in the cross-hairs of investors piling pressure on their emission records but Mr Henry said the decision to do the deal with Woodside was not driven by climate concerns.

“It creates a more resilient company to be able to better navigate the energy transition which we’ve also been clear on previously. BHP shareholders will be able to continue to access the strong near term investment opportunities that I’ve previously spoken about so we see this as a bit of a win-win-win,” Mr Henry said.

Resources Minister Keith Pitt said the move “creates a new ‘Big Australian’ in the global energy business. The new entity will have the resources to grow our traditional strengths of oil and gas production and to take advantage of new opportunities that emerge in energy production.”

One of its biggest shareholders Allan Gray already threatened to oppose a deal earlier this week.

Still, Ms O’Neill said she expected strong support from its investor base.

“It’s a very compelling story and the way the merger ratio was developed is one that’s very fair to both companies.”

Rumours of a potential tie-up have been circulating in the sector since early this year when Woodside made the bizarre decision to allow former boss Peter Coleman to leave ahead of schedule, without announcing a permanent replacement in its top job.

Australia’s energy sector is undergoing its most profound restructuring in a generation as companies look to bulk up through consolidation after last year’s pandemic-sparked oil price rout.

Santos is in talks with Oil Search on a $21bn merger, the biggest local move as part of a global deal spree, while Woodside’s ambitious play will see it enter the world’s 10 largest energy producers.

BHP and Woodside are also in the cross-hairs of investors piling pressure on their emission records.

“What I think is really important and will be valuable for our ESG-oriented shareholders to understand is that our decarbonisation targets will be applied to the entire portfolio,” Ms O’Neill said.

“So we’ve committed to reduce our emissions by 15 per cent by 2025, 30 per cent by 2030 on a pathway to net zero by 2050, and we will deliver on those commitments for the totality of the portfolio.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout