BHP seen as Singapore market maker for coking coal

BHP Billiton appears to be moving to accelerate the end of quarterly coking coal contracts.

BHP Billiton, the world’s biggest coking coal exporter, appears to be moving to accelerate the end of quarterly coking coal contracts as a surge in prices of Australia’s second biggest export causes a standoff between other Australian miners and Japanese steel mills.

Futures trading markets are buzzing with talk that BHP, which has moved most of its coking coal contracts away from negotiated prices to index-based spot pricing, will become a “market maker” on the Singapore Exchange, effectively guaranteeing trades can be made and giving traders confidence to participate.

The move comes as a standoff between other Australian miners and Japanese steel mills adds to pressure on the quarterly pricing system for Australia’s coal and puts export earnings at risk.

BHP would not comment on its plans to enter the futures market. But trading sources in Singapore said most market participants were acting on the expectation that the big miner was set to enter the burgeoning coking coal futures market this month and they were getting ready for increased trading.

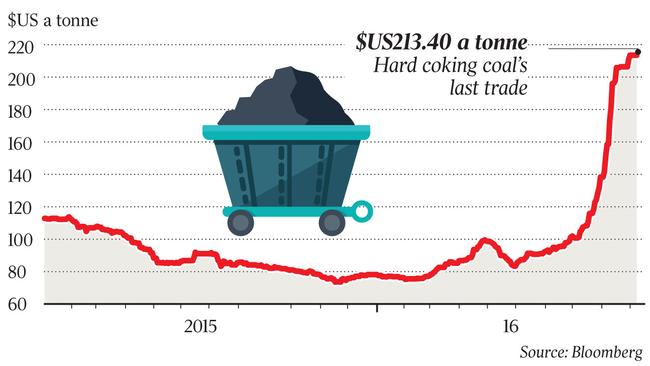

As reported in The Australian yesterday, talks to settle the December quarter Australian coking coal contract continue after a 155 per cent surge in spot prices since the start of June to $US213 a tonne.

This has left Japanese steel mills unwilling to follow the accepted practice of locking in the spot price at the start of the quarter for the next three months.

A lower price settlement could mean miners — and Queensland, NSW and federal coffers — miss out on the full impact of the price gains. On the flip side, a high settlement price could lead to a windfall, and price pain for steel mills, if prices plummet quickly after settlement.

According to Macquarie, Nippon Steel has been pushing for fourth-quarter contract prices of $US160 a tonne, up from the September quarter price of $US92.50.

But Anglo American is calling for prices close to spot, in line with previous settlement practices, and this has resulted in the standoff.

There is talk that a stalemate could lead to the end of the negotiated contracts, as has happened with iron ore in recent years, in a move also driven by BHP.

Singapore Exchange head of commodities research Adrian Lunt said the standoff over prices between Japanese mills and Australian miners showed the contract system did not reflect market pricing and made little sense in today’s market

“There are clear signs we are on the cusp of a landmark period for the coking coal market, with momentum swinging firmly towards a more widespread transition to index-linked pricing across the industry,” Mr Lunt said.

“Price discovery in coking coal has already moved to the spot market, with quarterly benchmark settlements largely following spot pricing in recent years.”

Of course, a move to index pricing and more futures trading would benefit the exchange.

Tim Hard, a director at price compiler and analysts The Steel Index, said the entry of a two-way trader into the market could increase futures trading, which was limited to just 22,000 tonnes in September. “Despite high market appetite for a liquid price risk management tool, the coking coal market has never had a market-maker,” he said.

Mr Hard said expectations were high and several traders and banks were looking forward to trade for themselves or clients and that increased trading could end quarterly pricing.

“With the quarterly system stressed, price risk running high and the opportunity for basis risk between physical supply contracts and financial contracts to be eliminated, the results could be explosive,” he said.