UGL board mulls CIMIC’s $524m takeover offer

UGL’s owners want certainty about its earnings outlook as they mull a $524m offer from giant contractor CIMIC.

UGL’s owners are looking for certainty about the company’s earnings outlook as they mull a surprise $524 million bid for the engineering and services company from giant contractor CIMIC.

Pitched at a 47 per cent premium to the pre-bid closing price, the takeover offer from the Spanish-controlled group formerly known as Leighton Holdings follows successive heavy provisions by UGL against its contract with the Ichthys liquefied natural gas plant near Darwin.

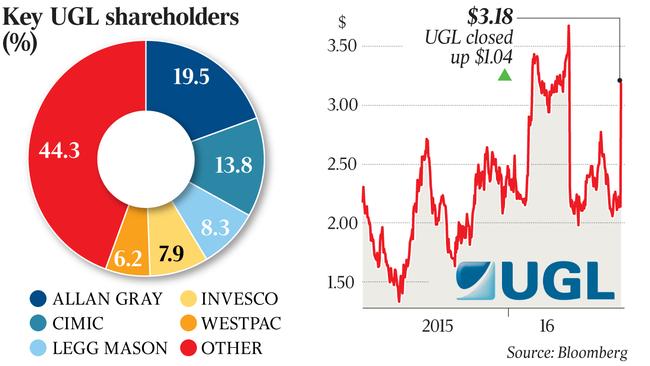

Simon Mawhinney, the chief investment officer of Allan Gray Australia, which holds a critical 19.5 per cent stake in UGL, said the bid could be seen as “opportunistic’’ because it was taking advantage of market disaffection with the mining services industry and UGL’s poor recent earnings record.

“We think that the market is saying they think the Ichthys exposure is going to blow up and so we are going to mark down your share price,’’ Mr Mawhinney told The Australian.

In August UGL made a $200m provision against delays and overruns on the Ichthys project, as it slumped to a $103m annual net loss, following a $175m provision on the same project a year earlier.

UGL hopes to recover the provisions from project operator INPEX, led by French energy giant Total, as the delays are resolved, but investors say it could be long, slow process.

However, company guidance points to earnings before interest and tax of about $100m on revenue of $2.6 billion.

That values CIMIC’s takeover bid at five times EBIT, against the market average of 16 times.

“If that is the case this bid is incredibly opportunistic and substantially below where the rest of the market trades,’’ Mr Mawhinney said.

“If those earnings are right we would be crazy to accept this bid, but we will be looking to the board to clear that up.’’

UGL shares were trading at $3.69 in May before the warning on the Ichthys project and traded at $6.90 in November 2014.

The company lost $106m on revenue of $2.28bn in 2015-16, but said that without Ichthys it made $33m. UGL, chaired by Kate Spargo, said in a statement it would convene a board meeting as soon as possible to consider the offer and shareholders should take no action. Investment bank Goldman Sachs is expected to advise on the bid defence alongside lawyers Freehills.

CIMIC launched the bid yesterday morning after snapping up a 13.4 per cent stake through its adviser Macquarie.

Boutique fund manager Ubique Asset Management sold 13 million shares at the $3.15 a share bid price to CIMIC. It topped up its pre-bid stake to 13.8 per cent with shares believed to have come from BT Investment Management.

Allan Gray was approached but did not sell any shares.

CIMIC said its offer was final and unconditional, meaning that the price cannot be hiked unless a rival offer emerges, and that it will pay the price for as many — or as few — shares as accept the offer.

A darling industry for investors during the resources and investment boom, mining services companies are now deeply out of favour and undergoing a shake-out at the hands of larger players.

“These companies are a product of the boom,’’ Mr Mawhinney said. “They came with the boom and may go away with its demise.’’

CIMIC has already swooped on mining contractor Sedgman and has a stake in Perth’s Macmahon Holdings.

The Australian Competition & Consumer Commission said it had considered the bid and decided that a public review would not be required.

The offer has already cleared the Foreign Investment Review Board.

UGL, valued at nearly $5bn at the height of the mining boom, halved in value in 2012 when it spun out its property services business DTZ. Revenue for its engineering and construction business halved from $507.8m in 2014-15 to $253.9m as the mining investment boom wound down.

But the company is looking to its maintenance and rail & defence division for future growth, including a new contract for NSW’s Tangarra train technology upgrade.

CIMIC said if it gained control it would undertake a strategic review of operations, seek to generate synergies, assess capital management plans, delist UGL from the ASX, seek to retain operational employees and turn over the target’s board. “CIMIC believes UGL’s competencies are complementary to CIMIC’s existing operations or enhance CIMIC’s capabilities in new activities,” the suitor said in a statement.

UGL shares jumped 48.6 per cent to close above the bid price at $3.18. CIMIC shares rose 16c to $27.47.

CIMIC, founded in Australia in 1949 and previously known as Leighton Holdings, is almost 73 per cent owned by Germany’s Hochtief, which in turn is controlled by Spanish construction company ACS. CIMIC occasionally has worked with UGL as part of consortiums and through subcontracts, including on Sydney’s Metro Northwest project, while CIMIC subcontracts UGL for work on the Surat North CSG project.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout