Australia sets near record for exports to China in 2020 despite nine months of trade warfare

Australia recorded its second-highest level of exports to China in 2020, despite trade war. But there are grim signs for 2021.

The bill for Beijing’s ferocious nine-month trade attack on Australian exports is $6bn, or about a 4 per cent fall, as official figures reveal Australia recorded its second-highest ever level of goods exported to China in 2020.

Despite interference on coal and lobsters, crippling tariffs on barley and wine, and bans on timber, Australia exported $148bn ($US114.8bn) of goods to China in 2020, according data released on Thursday by Beijing’s customs agency.

That was $6bn below the record of $154bn ($US119.6bn) set in 2019 but almost 10 per cent higher than 2018, the third-biggest year.

-

“If the aim was to turn these specific sectors into political lobbyists for Beijing, the evidence also suggests that this strategy has failed miserably.”

— economist James Laurenceson

-

But the outlook for 2021 is grim, after The Australian revealed on Thursday that Beijing had extended its ban on Australian coal in China — worth $14bn a year — as it escalates a campaign of trade retaliation that began last April.

Resources Minister Keith Pitt said he was disappointed by the ongoing standoff, which has trapped 1,500 seafarers of the Chinese coast in 73 bulk carrier ships carrying more than $1bn of black-listed Australian coal.

“It’s incredibly frustrating for those owners to be stuck in that stack. They are foreign flagged ships and I’d certainly say to anyone they should consider the human cost,” Mr Pitt told The Australian.

“It’s owned by the Chinese buyer and managed by Chinese authorities in terms of offloading, but the Australian sector is still strong. Companies have been through these challenges before and are operating their own contingency plans,” Minister Pitt said.

Much of the damage of China’s trade campaign has been undermined by the elevated price of iron ore. Australia accounts for more than 60 per cent — worth about $85bn — of the iron ore sold to the Chinese steel industry, mostly by BHP, Rio Tinto and Fortescue.

Sales of liquefied natural gas, Australia’s second-biggest export to China worth around $16bn annually, were also undisturbed during 2020. Australia is China’s biggest gas supplier, with ASX-listed suppliers including Woodside Energy, Santos and Origin accounting for more than 40 per cent of China’s imports of that strategic resource.

Prices of the gas are at record highs as China, along with Japan and South Korea, scramble to secure supply during a colder than usual winter.

James Laurenceson, an economist and director of the Australia-China Relations Institute at UTS, said the annual export numbers revealed China had to date been “unable or unwilling to inflict economy-wide damage on Australia”.

“That assessment is, of course, comes with a caveat about the significant harm inflicted on specific sectors,” Professor Laurenceson told The Australian.

The $1.3bn wine export industry, for example, was shuttered overnight in late November when Beijing imposed a 212 per cent tariff on Australian wine, while the $600m lobster trade has been halted since a planeload was held up and spoiled weeks earlier.

“Still, if the aim was to turn these specific sectors into political lobbyists for Beijing, the evidence also suggests that this strategy has failed miserably. It’s certainly failed among the broader Australian public,” Professor Laurenceson said.

China’s state-controlled media continues to chide Canberra for “poisoning ties”.

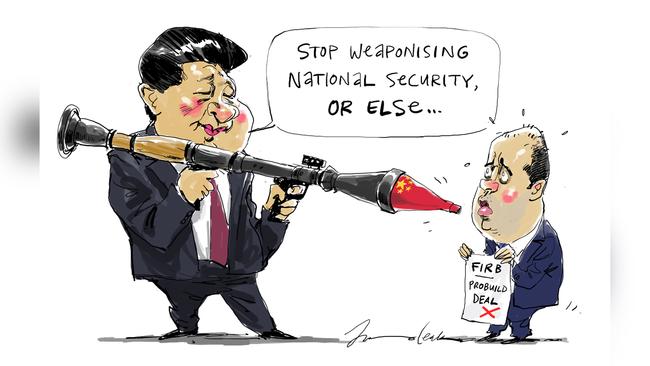

In an editorial on Friday, the China Daily said Treasurer Josh Frydenberg’s decision to block a $300m takeover of construction firm Probuild by a giant Chinese state-owned company was “another nail in the coffin Australia seems intent on building for pragmatic co-operation”.

“The Australian government claims it wants friendly relations with China but its actions repeatedly reveal its lack of sincerity. Rather than seeking to sweeten the climate for bilateral co-operation, it instead continues to sour it further,” the state-controlled outlet editorialised.

“Canberra only has itself to blame for the consequences of its actions.”

The ban on Australian coal has forced Chinese coal users to pay an almost 40 per cent premium to secure supply, with shortages contributing to power outages during an unusually cold late December. It also spiked the cost of coking coal for China’s steelmakers.

But Beijing has continued to rebuff pleas by Chinese steelmakers and power generators to allow cheaper, higher quality Australian coal to be imported.

The ban has also led to a profound reordering of the global coal supply chains, with new data compiled by Refinitiv showing Indonesia is poised to overtake Australia as China’s biggest source of imported coal.

Meanwhile, Australia in December replaced Indonesia as India’s biggest source of coal exports, according to the financial data provider.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout