China’s coal ban dashes revenue hope, could force mines to shut

China’s ban on Australian coal may force mines in Queensland and NSW to shut as Beijing’s blacklisting slashes revenue.

China’s ban on Australian coal may force mines in Queensland and NSW to shut as Beijing’s blacklisting slashes revenue from the nation’s second-biggest export industry.

Australia’s commodity forecaster made the dire warning after China’s decision to impose sanctions roiled the local industry and contributed to a forecast $17bn fall in 2020-21 revenue, offsetting record income for the Morrison government from booming iron ore prices.

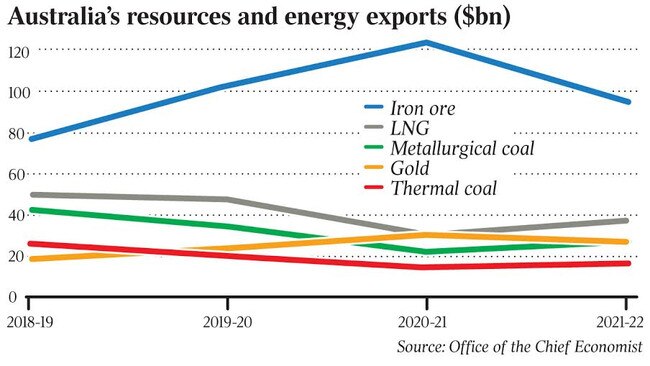

The country’s revenues for metallurgical coal, used in steelmaking, are expected to plummet by 35 per cent to $22bn in 2020-21 from $34bn last year, while income from thermal coal, shipped largely to Asian buyers for use in power stations, is estimated to plunge by a quarter to $15bn this year.

“The bottom line for Australian coal producers is lower profitability and the likelihood of production cuts the longer the Chinese restrictions remain in place,” the Department of Industry, Science, Energy and Resources said in a December quarter report. Australian miners had announced “production cutbacks or temporary closures and the potential for further announcements to follow given the disruption caused by Chinese import restrictions”.

The nation’s top coal producers have been engaged in crisis talks over escalating trade tensions with China, recognising the dispute may continue for much of 2021 and even beyond given Xi Jinping’s retaliatory stance.

Fears are now growing that temporary cuts to coal supplies in the latter part of this year may spark deeper reductions and even mine closures if producers are unable to find alternative buyers.

A move by China to officially blacklist Australia’s coal “poses a downside risk to the forecasts and it is being closely monitored for implications to the outlook”, the government’s commodity forecaster says. “At this stage, there is a high degree of uncertainty around the extent to which this practice will persist throughout the outlook period, as well as the timing and extent to which Australia’s exports can find alternative markets.”

Scott Morrison has warned any move against Australian coal exports would breach World Trade Organisation rules and the China-Australia free trade agreement.

A recovery in prices and volumes is seen eventually lifting the fossil fuel’s fortunes with metallurgical coal export revenues regaining some ground to $27bn in 2021-22. Still, thermal coal will only edge back slightly to $16bn in 2021-22 from $15bn this year against a tough global backdrop, with world trade of the commodity declining this year for only the second time this century.

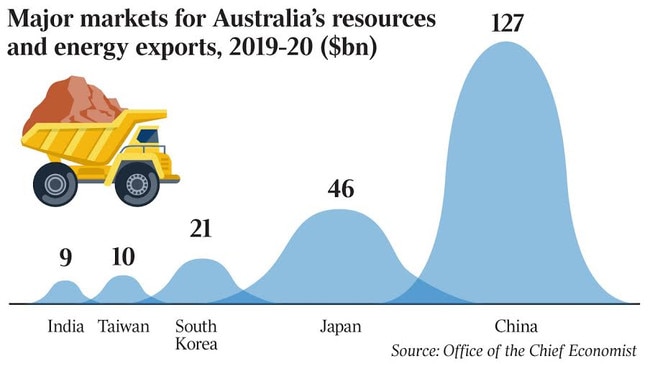

The deteriorating coal spat with Australia’s biggest trading partner will also overshadow China’s seemingly insatiable appetite for Western Australia’s iron ore, with prices at a nine-year high, pushing exports to a record $123bn in 2020-21.

The iron ore boom will help offset lower income for the nation’s coal and LNG supplies and a forecast rise in the Australian dollar, with the nation still on track to reap an estimated $279bn in commodity export revenues this year, down from a record $291bn in 2019-20.

“On balance, it appears that Australia’s production and export of commodities has successfully withstood the most severe global recession in decades, albeit with tough conditions still evident for energy commodities,” the report states.

The country’s resources fortunes, however, face significant volatility from another COVID-19 wave and the success of a global vaccine rollout.

“The stronger global growth outlook underpinning our forecasts predated the news of at least three effective vaccines, and this may present some upside risk to our projections,” the report states.

“However, downside risks could emerge if there are substantial delays in the successful rollout of the COVID-19 vaccines to a large number of the world’s working population, as well as any further disruption to Australia’s trade with China.”

Australia will also relinquish its status as the world’s biggest gas shipper with a forecast cut in supplies to 75 million tonnes in 2020-21 from a record 79 million tonnes last year, handing the top producer spot to Qatar.

The decline reflects both ongoing effects from pandemic-linked demand but also a raft of technical issues at Chevron’s Gorgon LNG plant and the Shell-led Prelude gas export facility.

Revenues will also take a hit due to the crash in energy prices, decreasing 35 per cent to $31bn this year from $48bn in 2019-20. A recovery will take place the following year with income rising back to $37bn in 2021-22.

Producers’ coffers may even receive a further bonus in the new year, given the rapid recovery in LNG spot prices in recent weeks.

The benchmark for LNG spot prices in North Asia, JKM, jumped to a 26-month high of $US11.23 per million British thermal units this week compared with just $US2/mbtu in June, consultancy EnergyQuest says.

“Oil prices took a hit during COVID-19, but are expected to partially recover over the next two years. LNG contract prices are also set to be lower in 2020–21 — driven by the lagged impact of lower oil prices — before recovering in 2021–22,” the government report states.

Gold is on track to set a new record of $30bn in 2020-21

.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout