Silver Lake’s last minute intervention into the St Barbara saga has put the company’s board in a tough spot.

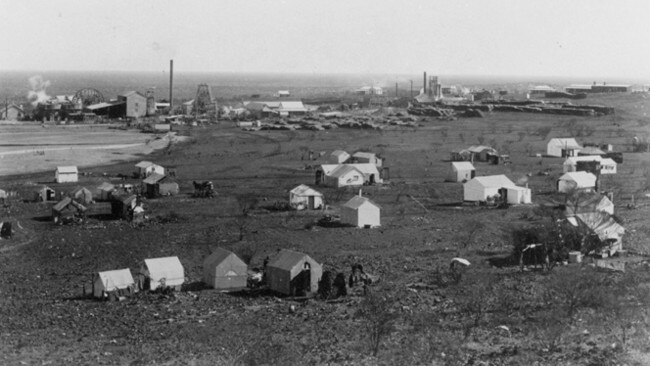

Right now it has a deal with Raleigh Finlayson’s Genesis Minerals that will solve the company’s immediate cash problems, and offers some hope that St Barbara shareholders can eventually share in the promise the Leonora gold district offers.

But Silver Lake is offering more for St Barbara’s assets – less cash, but more stock, and therefore a greater exposure to the upside of the deal for St Barbara shareholders.

St Barbara’s board argues that the premium to the Genesis offer – 9 per cent by its own count, and 14 to 28 per cent by Silver Lake’s reckoning – doesn’t satisfy the “fiduciary out” exceptions to the “no talk” and “no due diligence” obligations as part of the company’s binding asset sale agreement with Genesis.

Silver Lake’s requirement for two weeks of “targeted” due diligence on Gwalia looms as the sticking point.

Two weeks isn’t long enough for St Barbara to do its own investigations on Silver Lake in enough depth to inform any change in its recommendation of the Genesis deal, the company says.

And what if Genesis walks away as a result? If Silver Lake also fails to make an offer, St Barbara is left standing at the altar and could be forced to sell its assets on the cheap as a result.

The former seems unlikely. Without Gwalia, Genesis is all hat and no cattle. And Silver Lake’s track record is available for all to see.

If a 9 per cent premium is not enough to trigger the board’s “fiduciary out”, what is?

The Silver Lake argument essentially boils down to this: its management can run a mine. Its operations are steady, reliable and growing, and total returns to shareholders over the past five years have been close to 200 per cent, which is at the very top end of Australia’s mid-tier gold sector.

Managing director Luke Tonkin has even made a couple of value-accretive acquisitions, including a Canadian mine that is not a complete disaster.

But Silver Lake has no other assets in the Leonora area and would have to begin any regional consolidation from scratch – although it’s worth remembering that St Barbara’s former management had a plan to grow its output from within its own resources, which could still be dusted off.

The promise of the Genesis offer is the regional consolidation play, of which Gwalia is the centrepiece.

Add Gwalia and St Barbara’s other deposits to Genesis’ own resources – and those of Dacian Gold – and a regional powerhouse could indeed emerge. And Finlayson’s team also has a track record of success.

But it has failed to complete its takeover of Dacian, and can’t consolidate those assets into its own. And, as promising as its own Ulysses underground development might be, Genesis is yet to even put out an economic reserve on the deposit.

The Leonora regional consolidation idea is an enticing one but it rests on assets that Genesis does not yet control.

St Barbara shareholders have little reason to trust the company’s board. But they have limited options, even if the new offer seems more attractive.

Silver Lake could launch a hostile takeover bid and take the matter directly to the market, although that’s unlikely as nobody really wants to get saddled with St Barbara’s Canadian and PNG assets.

Shareholders could vote the Genesis deal down, but without a firm Silver Lake offer that carries a genuine risk of company collapse. Any move to spill the St Barbara board carries similar risks.

Still, if St Barbara’s board’s ultimate response is to simply ask for more trust where little is warranted, shareholders will have further reason to be aggrieved.

Do St Barbara shareholders have an obligation to let Silver Lake Resources have a look at the company’s books, in the hope of getting a better offer for its crown jewel?