APA managing director and CEO Mick McCormack to retire

The outgoing boss of pipeline giant APA Group, Mick McCormack, expects a new takeover bid may emerge.

The boss of pipeline giant APA Group, Mick McCormack, expects a new takeover bid may emerge for the gas operator and says the Australian government’s decision to block a $13 billion bid by CK Group helped trigger his decision to step down from the top role next year.

Mr McCormack yesterday flagged his intention to retire just three weeks after Treasurer Josh Frydenberg rejected a $13bn takeover of APA by Hong Kong’s CK citing national interest concerns.

Mr McCormack will retire no later than the end of 2019, saying he had decided to “call time” after leading the company since 2005 with his 12-year tenure making him one of the longest serving chief executives of an ASX-listed company.

The foiled bid by CK “crystallised that I do want to move on,” Mr McCormack told The Australian. “Had the CK bid been successful for me personally it would have been a very nice way for me to tie a bow around a very long career.”

CK had been set to become Australia’s largest gas pipeline operator if the deal proceeded, swallowing APA’s 15,000km of gas pipelines marking 74 per cent of the nation’s gas transmission infrastructure.

Despite the knockback, Mr McCormack’s departure next year may reignite interest from bidders in considering a fresh tilt for the company.

CKI’s $11 a share offer which received backing from APA’s board had effectively signalled to other potential acquirers the type of premium that would need to be paid for the company, according to Mr McCormack.

“Rumours have been circulating for some time that there is a competing or another bid floating around out there,” Mr McCormack said. “CK’s $11 a unit bid is now a stake in the ground and any other bidder would need to take notice of that. We are not up for sale but we can be bought.”

APA is also now in the process of rekindling its interest in making a US acquisition which the company has been working on for several years but had been effectively frozen once the CK bid emerged.

“We have picked up the tools and we will go about with what we were doing over there which is due diligence in identifying a potential investment opportunity,” Mr McCormack said.

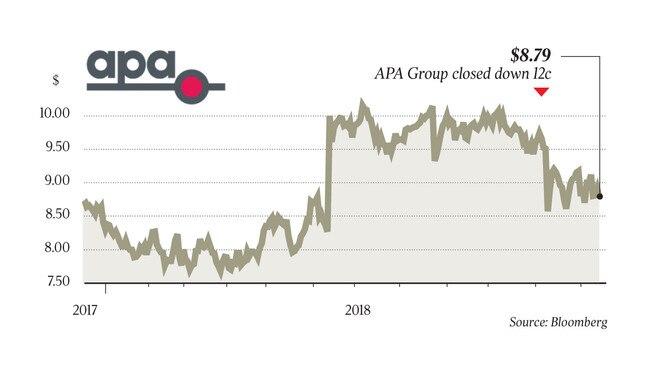

APA’s shares fell as low as $8.57 following the Treasurer’s decision but have since recovered some of those losses although remain 12 per cent lower than the $10 level they reached after the bid was announced in June.

Fears around Chinese influence in Australia played into the decision by the Australian Government, Mr McCormack said last month, noting the hint of a China-linked company controlling a sensitive Australian energy asset was a widely accepted narrative repeated by his mother.

The company’s shares fell by 1.35 per cent yesterday to $8.79.

APA has grown in market capitalisation from $1bn a decade ago to a value nearing $10.5bn after constructing a sprawling pipeline network delivering gas to most Australian states. Shareholders have received annual returns of 14.9 per cent under Mr McCormack’s tenure.

Yet that rapid growth has also sparked talk the pipeline operator may face a regulatory clampdown as the federal government wrestles to lower gas prices on Australia’s east coast.

APA said it had outperformed under Mr McCormack’s leadership.

“Mick’s record speaks for itself in terms of his contribution to APA’s success and to the Australian energy industry,” APA chairman Michael Fraser said.

“Mick will leave having established an unrivalled position for APA in gas transmission pipelines across the country and a strong portfolio of growth projects ahead of it.”

The board has commenced a selection process for his replacement and will consider external candidates, with Mr McCormack to lead the company until his successor is found.

Mr McCormack told The Australian in June that he was unlikely to seek another CEO position if he left APA.

“I don’t know if I have another CEO gig in me. They take a bit out of you, particularly one that has been like this for what will have been 14 years,” he said at the time.

Instead he was more likely to spend time working on his farm in Queensland, he said.

The pipeline boss joined APA in 2000 when it was spun out of parent company AGL and listed on the ASX.

He started as commercial boss and became chief operating officer before taking the top role in 2005.