Mick McCormack ponders farm life after APA

APA Group chief executive Mick McCormack has never been the retiring type.

Mick McCormack has never been the retiring type.

The shrewd and long-serving chief executive of APA Group, McCormack is proud of having created a unique and irreplaceable east coast gas network.

He bristles at suggestions the company is misusing that network to fatten its profits and has fought a running battle with regulators that he sees as unfairly blaming him for soaring gas prices.

But the 18-year veteran of APA, nearly 13 of them as chief executive, may soon have to consider the retirement question.

Just regulatory ticks stand in the way of the combined $87 billion might of the Li family’s three Hong Kong-listed utility companies taking control of APA at a huge 33 per cent premium to the pre-bid price.

In an interview this week, McCormack seemed taken aback when asked whether he had considered life after APA.

“That’s interesting,” he says.

The last of six executives who ran the company when it was spun out of AGL in 2000, McCormack, 56, says he is mindful of becoming “part of the furniture” at the company, but still sees plenty to do.

“If it comes off, I won’t retire,” he says, before adding that the Cheung Kong group is unlikely include him in their plans.

APA is in the early stages of opening up to due diligence, with a dozen people from the suitor inside the company agreeing on terms for access to the books.

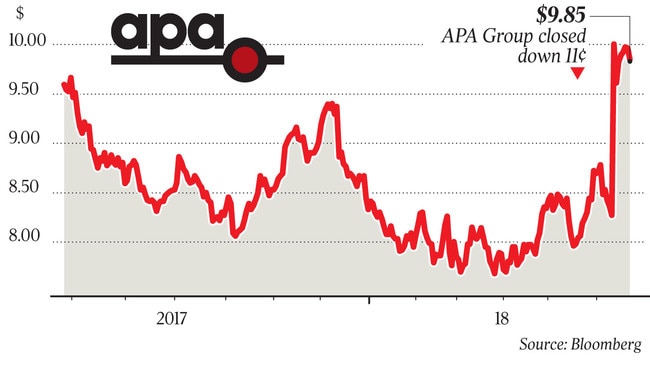

Cheung Kong Infrastructure, Power Assets Holdings and CK Asset Holdings have offered $11 a share, 33 per cent above the pre-bid price and more than $1 above the highest price APA shares have ever traded.

But the share price remains stuck at a near 10 per cent discount to the offer price, reflecting uncertainty about the regulatory path.

CKI needs to convince the Australian Competition and Consumer Commission that its bid will not substantially lessen competition in the east coast gas pipeline industry. It must also convince a newly vigilant Foreign Investment Review Board and national security community that it is an acceptable owner of APA’s dominant infrastructure, which is responsible for moving more than half the country’s gas around.

The surprise bid appeared well timed: APA is in the middle of $1.15bn investment program and there is maximum uncertainty about the impact of new rules strengthening the hand of customers in negotiations with APA.

The rules were put in place after an ACCC inquiry into gas networks that pitted commission chairman Rod Sims in a war of words with McCormack over pipeline charges at a time of runaway energy prices.

Driving the point home, CKI highlighted its plans for further investment and that it “supports increased regulatory oversight and transparency in the gas transmission sector”.

It’s an approach that observers think could appeal to regulators.

“If they are bringing a lower cost of capital and a mandate of growth instead of margin, that could be a better result for users,” says analyst Saul Kavonic.

The flip side is that it may be worse for owners, in this case APA shareholders. CKI’s vast scale and international reach (the three companies in the bidding group are worth a combined $87bn on the Hong Kong stock exchange and boast more than $13bn in cash) means it can easily afford the bid.

Its lower cost of debt (its A3 rating from Moody’s is two notches above APA’s BBB rating) means it can afford the big bid premium as well as the risk of lower regulated returns that may flow from the takeover.

McCormack says that since the new rules came in last August, the company has negotiated 30 pipeline contracts and has not seen any adverse effects.

“A lot of people have speculated, hypothesised on that,” he says.

“Yes it is a possibility. Have we seen any evidence of our customers not wanting to deal with us in the interim? No.” APA has not raised tariffs in real terms for 15 years, he says.

The company has an average of 13 years to run on existing contracts, meaning any impact on returns is likely to take some time to emerge. Earlier this month it committed to build a pipeline for AGL Energy’s proposed Crib Point gas import terminal in Victoria on a 20-year contract.

“We are a long-term business so short-term policy changes won’t affect us in the short term,” McCormack says

Kavonic, who is moving from industry analyst Wood Mackenzie to investment bank Credit Suisse, says the industry is a “soft target” for governments and regulators intent on slashing runaway costs.

Transport costs can be as much as 30 per cent of the price of gas, and the change in supply away from Bass Strait fields to southern Queensland coal-seam projects means the gas has to travel further to the main markets.

“The pipelines haven’t caused this issue, but the gas has to travel further, so it costs more,” Kavonic says.

Margin and investment won’t be the only criteria that the boffins at the ACCC will have to decide. There is also the issue of competition, as APA accounts for 11 of the 26 major gas transmission lines on the east coast. CKI’s existing assets in the same region, built up by its Australian Gas Networks, have just 1100km of transmission lines but 24,000km of distribution networks around Adelaide, Melbourne Brisbane as well as regional South Australia, Victoria and NSW.

Putting them together has been described elsewhere by Tony Wood of the Grattan Institute as “the mother of all monopolies”.

While a deal would be swapping one monopoly operator for another, it would place even more onus on the regulator to keep a tight rein on the operator.

Kavonic says keeping competition in the market to build new pipelines is also likely to be an issue, as concentration of ownership affects the ability of new or competing players to bid for pipes that would connect to the existing assets.

The ACCC is likely to have plenty of material to work with, given the year-long study of pipelines in 2016 that led to the latest regulations.

FIRB is also likely to have plenty to consider. The Critical Infrastructure Centre, set up in the wake of controversy over the 2015 sale of the Port of Darwin to Chinese company Landbridge, will be advising FIRB on any national security issues.

Peter Jennings of the Australian Strategic Policy Institute has also suggested that the deal could trigger concentration risks centred on having so much of the east coast pipeline market in the hands of a foreign owner.

CKI was knocked out of the bidding for NSW electricity network Ausgrid, along with State Grid of China, on unspecified national security grounds. But it already owns electricity transmission and distribution businesses in SA and Victoria and was approved shortly after the Ausgrid knockback to buy the gas networks business Envestra.

In the meantime, McCormack and his team have plenty on their plate. As well as executing the $1.15bn investment program, there are June 30 accounts to prepare and due diligence teams to be shepherded through.

McCormack, who has a Queensland farm where the family lives while he works in Sydney, says he does occasionally think about how long he has been in the job and how long he wants to continue. “I have had a marvellous career. If it finishes today or whenever I have got a property to go back to so there is plenty to do.

“But I don’t know if I have another CEO gig in me. They take a bit out of you, particularly one that has been like this for what will have been 14 years.

“If nothing else, I’ll get back and fix a few fences and muck around with the cattle for a bit.”