Anti-dumping rules ‘essential to protect economy’: BlueScope

Australia should ‘sharpen the focus’ on its anti-dumping regime if it wants to keep a domestic manufacturing sector.

BlueScope Steel boss Mark Vassella says Australia should sharpen the focus on its anti-dumping regime if it wants to keep a domestic manufacturing sector as the nation recovers from the coronavirus, despite rumblings of tit-for-tat trade measures from China.

China’s move to slap tariffs on Australian barley exports over alleged dumping into its market has put a renewed focus on Australia’s own use of anti-dumping measures, particularly against Chinese steel and aluminium exports.

Writing in The Australian on Thursday, Mr Vassella mounted a spirited defence of Australia’s “clear-eyed” anti-dumping tariffs, arguing they are allowed under global trade rules and are targeted, transparent and generally imposed only a moderate penalty on dumped imports.

“While some have alleged that trade measures have targeted certain countries, Australia takes an even-handed approach to all exporters, based on the facts and data of each case. Globally an average of over 80 per cent of steel trade measures include China, whereas in Australia the proportion is 36 per cent,” he said.

“And despite headline-grabbing claims that duties are regularly imposed at more than 100 per cent, the average level of dumping duties currently in place on imported steel products in BlueScope’s range is 11 per cent.

“As Australia heads out the front door with the giant task to resurrect our economy post-COVID-19, we should check we have locked the back door — and that means a well-resourced, effective anti-dumping system. The risk of a COVID-induced surge in dumped steel from our region is very real and would be disastrous for Australian industry and jobs.”

Mr Vassella said the risks to global supply chains highlighted by the coronavirus crisis and the enormous economic damage caused by COVID-19 had demonstrated the value of domestic manufacturing.

And with China’s economy and steel sector climbing out of the crisis faster than other developed economies, he said steel supply could outstrip demand for some time to come, increasing the risk surplus product would be dumped into local markets at heavily discounted rates, as it was in the years following the global financial crisis.

“If we lessen the attention on this now, with steel in excess capacity globally, then we run the risk of people finding this market and destroying manufacturing,” he said.

“We’re living this right now in New Zealand where we’ve just announced the closure of part of our steel business because the New Zealand government takes the view there should be no such thing as anti-dumping.

“And what happens is you just find overseas producers go to markets where they know the rule of law works, where they know they get the bills paid, and they just dump surplus steel and undermine local manufacturing.”

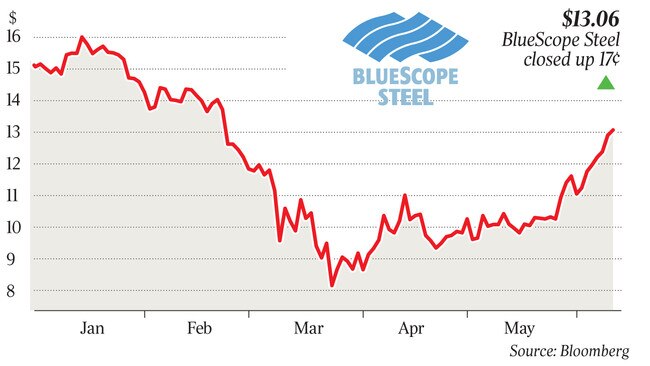

Like other parts of the economy, Australian steelmakers may come out of the coronavirus lockdowns in better shape than initially expected.

Goldman Sachs analyst Owen Birrell said in a client note this week that demand for steel products in Australia had held up better than expected through the coronavirus lockdowns. Initial expectations that steel demand would be down 20 per cent in the second half of the year had moderated, he said, and Goldman now expected only a 10 to 15 per cent fall in steel demand.

“The effective control of viral activity across the Australian market and absence of Stage 4 restrictions has ensured that both construction and manufacturing activity continued over recent months, underpinning continued order book activity and improved sentiment through to September,” he said.

But even though the outlook for BlueScope is better than it was a few months ago, Mr Vassella lashed critics of Australia’s anti-dumping regime that have focused on the cost of tariffs to downstream construction businesses — and particularly the complaints about steel imports lodged by BlueScope, arguing the company uses Australia’s anti-dumping laws to protect its market share to the detriment of its customers.

“China currently produces about 800 million tonnes of steel a year. We produce 3 million tonnes. China currently exports more steel on a monthly basis than I do in a year. And we happily compete, happily operate — we are competitive, we’ve found niches in products like Colorbond that allow us to maintain a manufacturing base in Australia,” Mr Vassella said.

“This is not about stopping imports. Two million tonnes of imports come into Australia a year — I make 3 million tonnes. But the picture that gets painted is that there are tariff walls that stop anything from coming into the country, and nothing could be further from the truth.

“So the argument that BlueScope is the only company that is doing this, that it’s protecting its own markets and there shouldn’t be any anti-dumping rules, is naive at best and mischievous and downright dangerous at worst.”

Australia’s Productivity Commission has been one of the most trenchant critics of anti-dumping tariffs, most recently arguing in an April paper that they lead to “distortions throughout the economy”.

“The imposition of input penalties artificially inflates costs in the services sector, which eventually flows through to higher prices for consumers — from building construction to hospital health care,” the report says. The Productivity Commission says that tariffs and countervailing trade measures added about $1bn to costs in the Australian services sector in 2018-19, and about $400m to the construction sector alone.

Mr Vassella said he did not doubt the Productivity Commission figures, but the commission took only a “very narrow view” of the economic costs and benefits of anti-dumping rules.

“I would never argue the commission analysis is inaccurate. I just think it’s a very narrow and naive view that doesn’t take into account the broader contribution of local manufacturing. They’re not taking any account of the economic value that’s added by local manufacturing. They’re just looking at the straight — dumped — price for steel, versus what they’re assuming the industry gets charged,” he said.

“So there’s no offset for having a steelworks in Port Kembla, or us paying payroll tax, or company taxes, or our people being employed and paying income tax and spending money in the regions in which they operate.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout