AGL warns of ‘crash landing’ if coal dumped

Amid forecasts of a ‘messy decade’ for energy, AGL has warned of a crash landing if coal plants exit the national electricity market too soon.

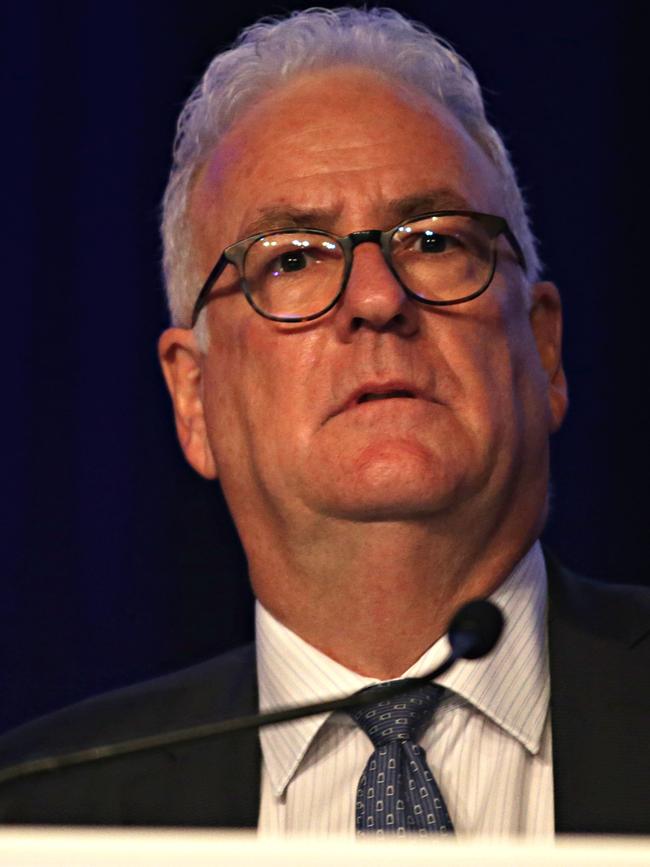

AGL Energy boss Graeme Hunt has warned Australia’s power grid faces a crash landing if coal plants are forced out of the market too early after the government’s energy adviser predicted a faster than planned exit for the fossil fuel.

The nation’s biggest coal generator confirmed it is looking to split its coal plants into a separate company as part of a demerger, but said it was essential they remained operating for decades to come to ensure a smooth transition to a renewable-based system.

“Premature closure is the equivalent of a crash landing,” Mr Hunt said. “The system relies on the coal fired generation and will for some period of time to come. The question is about what is that time and it will vary from generator to generator. The dial needs to move to what’s the right policy settings and plans to address the issues the ESB has raised.”

Under the government’s preferred strategy, electricity retailers would pay the owners of dispatchable generators such as coal-fired, gas-fired and hydro plants as well as batteries to guarantee future capacity when the grid is facing periods of peak demand that threatens reliability.

But Energy Security Board chair Kerry Schott said she expects coal power plants in Australia will be forced out earlier than forecast by renewables.

“For most generators burning coal, their date of retirement will be earlier than their technical life and I would imagine that over the course of the next 10 years, we will see the majority of the black coal fleet in NSW getting very close to disappearing and similarly in some other jurisdictions,” Ms Schott told an ESB briefing on Tuesday, detailing the organisation’s post-2025 reforms.

“It’s going to be a bit messy through this next decade or so but I think we can keep everything together until the technology catches up with us.

However, Mr Hunt said he expected AGL’s power stations - Loy Yang A in Victoria and Bayswater in NSW - would remain among the last standing due to their low cost in the system. Its Liddell plant will shut in the 2022-23 summer.

“We are in a fortunate position that Loy Yang and Bayswater sit at the bottom of the cost curve for coal fired generation and are the youngest of an ageing fleet. They should be amongst the last if not the last to close when that point comes.”

EnergyAustralia brought forward the closure date of its Yallourn plant in Victoria by four years to 2028 but its black coal Mt Piper station in NSW is scheduled to run until 2042. The power operator said it was integral to the national electricity market.

“I think we’re seeing the renewable energy uptake and the pace with which we’re building out solar and wind is faster than the fastest predictions,” EnergyAustralia’s executive for energy Liz Westcott said. “We all recognise coal will transition out of that system and we would like it to be in an orderly manner.”

The ESB‘s post 2025 reforms could see a radical shake-up of Australia’s power grid including mechanisms to ensure enough reliable generation is in place, more closely handling the exit of under threat coal plants and developing a national underwriting scheme to avoid states splintering on energy policy.

New measures suggest governments work with industry to identify back-up sites should coal plants suddenly exit due to technical failure and a new market assessment that would weigh whether coal stations could still operate commercially beyond an early closure date if the system requires it.

Under the proposed AGL split PrimeCo will be the nation’s largest generator, accounting for 20 per cent of supply in the national electricity market and retaining the nation’s biggest fleet of coal output.

“The way we need to manage PrimeCo is not just to think of that business as something where we are putting off the inevitable and the plants are closing. It’s about transitioning that business as well away from a reliance on that form of generation and being part of that transition.”

PrimeCo will also include Torrens Island in South Australia where AGL runs the nation‘s largest gas-fired power station along with a portfolio of wind farms including 1600MW of new development options.

Both PrimeCo and the carbon neutral New AGL retail business expect to have investment grade ratings as it seeks to reposition the company after conceding the power giant‘s huge coal unit has led to capital constraints for its existing business.

Coal, which currently provides 70 per cent of electricity, will contribute less than a third of supply by 2040 and is now widely expected to be forced out earlier than planned retirement dates as competition from renewables and carbon constraints render plants uneconomic.

AGL has also sought to change the closure dates of its Liddell coal power plant units in NSW‘s Hunter Valley after completing engineering studies, seeking an exemption from the national regulator on notice of closure obligations.

The 1680 megawatt electricity generator is due to exit by the end of the 2022-23 summer and the power giant is considering how to phase out the four units in the final year of operation.

It has asked the Australian Energy Regulator if it can switch the closure dates of units 3 and 4 with unit 3 to now shut down on April 1, 2022 and Unit 4 to close a year later on April 1, 2023.

“Following recent engineering assessments of Liddell power station units 3 and 4, AGL now considers unit 4 to be a more reliable generating unit, as compared to unit 3. As a result AGL is seeking to bring unit 3’s closure date forward,” the AER said.

The AER will consider AGL‘s application for an exemption and deliver a decision by July 26.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout