The corporate shake-up engulfing AGL Energy has deal-makers sharpening their pencils, looking to pounce on a rare opportunity to make a play for the power giant as it explores a demerger.

While the board‘s focus has been handling the narrative around the sudden resignation of boss Brett Redman, newly anointed chairman Peter Botten may have a bigger dilemma on his hands as he investigates a split of the 180-year-old company.

Speculation is growing that energy giant Shell may dust off its long-rumoured interest in AGL and consider a tilt for its mooted green retail arm.

Under AGL’s proposed restructure, the new AGL business will provide electricity, gas, internet and mobile services to 30 per cent of Australian households and plans to target full carbon neutrality to chase a higher valuation as a green retailer.

Shell has long been linked with AGL as it chases a potential mass market play, allowing it to pair its considerable gas and renewable generation and deliver power supplies direct to households.

The Anglo-Dutch major is undergoing its own revolution, switching from a dependence on oil and gas to lower-carbon generation, mirroring its bet the energy system will rely much more on electricity over fossil fuels for its future needs.

Australia has been identified as one of six target markets where Shell will look to create a fully integrated electricity supply business with the potential to scoop up a “mass market” customer base through deal-making.

Its takeover of Trevor St Baker’s ERM Power went some way to quenching that thirst but insiders expect it may still want to go further by scooping up AGL’s 4.5 million retail customer base.

The big stumbling point historically for Shell was AGL’s huge coal portfolio, unattractive to an energy major trying to refashion itself as a green player.

But under AGL’s proposed separation, coal will be hived off into PrimeCo leaving a player with a big balance sheet like Shell the chance to pounce on its prey.

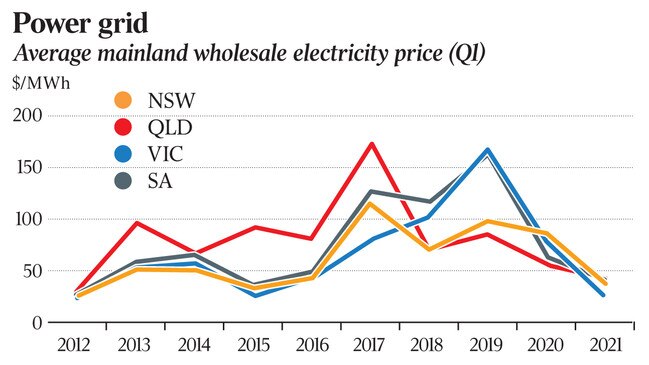

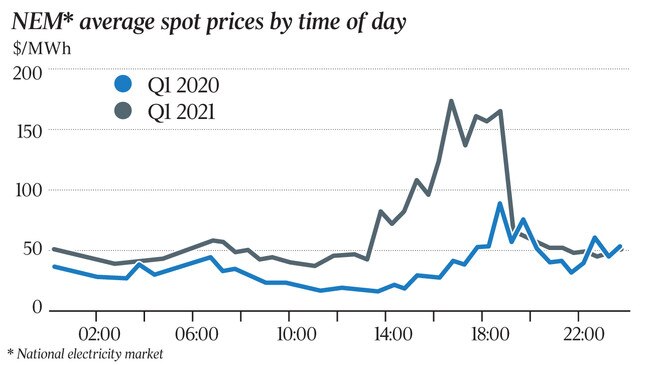

Shell has previously said its power business will achieve equity returns of 8 to 12 per cent compared with 12 to 15 per cent for its legacy oil and gas business. A sceptic might suggest even those levels could prove problematic given rock bottom wholesale electricity prices which have squeezed earnings for the three big utilities: AGL, Origin and EnergyAustralia.

If interest from Shell’s camp does materialise, Botten and the AGL board will face a difficult call. With the demerger plans off to an inglorious start — Botten’s predecessor Graeme Hunt was forced to step in as interim boss of AGL after Redman’s exit — pressure is growing for AGL and advisers Macquarie to demonstrate what sort of value lurks beneath.

Many in the industry will be analysing the assumptions AGL presents to investors sometime in June — and whether the forced split might spark a bid.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout