Stakes raised as Posco play makes Rinehart a $20bn woman

SOUTH Korea's Posco has unwittingly upped the stakes in a war that is tearing apart the billionaire's family.

WHEN South Korean steel giant Posco moved this week to acquire 15 per cent of Gina Rinehart's next money-spinning mine in the Pilbara, it unwittingly upped the stakes in a war that is tearing apart the billionaire's family.

Posco confirmed from Seoul that it would spend about $1.5 billion to become a key investor in Rinehart's Roy Hill project, which is scheduled to begin shipping iron ore within two years.

To the boffins who crunch the numbers for the annual Forbes and BRW magazine rich lists, Posco's valuation of Roy Hill is a "crystallising event" in helping to estimate the rapidly growing fortune of Australia's richest person.

It means they can ascribe a notional value of about $10bn to the Roy Hill prospect.

And it means Rinehart's estimated personal wealth is set to grow to at least $20bn on this year's rich lists, as a result of Roy Hill, her half share in the highly profitable Hope Downs joint venture with Rio Tinto, the $125 million in iron ore royalty cheques she banks each year and other smaller investments, including stakes in Fairfax Media and Ten Network. That's double last year's $10bn estimate, which did not include Roy Hill.

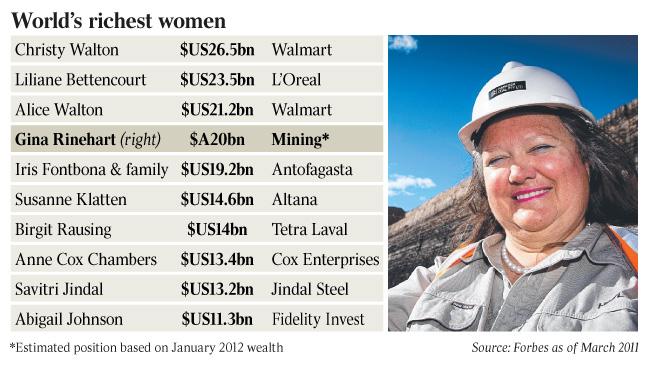

Such is the extent of Rinehart's eye-popping wealth, she is now on course to become the world's richest woman.

If she can obtain debt funding for Roy Hill and successfully bring it into production, and assuming iron ore prices stay strong, she could soon overtake Walmart heiress Christy Walton's $US26.5bn ($25.54bn) at the pinnacle of Forbes' global rankings.

It's estimated Rinehart's 50 per cent share of Hope Downs is generating about $1.7bn in annual profit, as a result of fat margins involved in digging up iron ore for $40 a tonne and shipping it to China for $140 a tonne.

The mine is due to expand its annual production from 30 million tonnes to 45 million tonnes later this year, which would lift Rinehart's profits to more than $2.5bn a year.

Rinehart is also sitting on plenty of cash after Indian group GVK paid $US1.26bn last year for majority stakes in three of her Queensland coal projects.

The money due from Posco will boost her cash reserves. It's a spectacular achievement for Rinehart, who inherited a debt-laden Hancock Prospecting from her father, Lang Hancock, the legendary prospector who pegged vast tracts of red dirt in Western Australia's Pilbara.

The news that Rinehart, 57, is now worth $20bn won't simply be a source of fascination and envy to ordinary Australians struggling with the cost of living.

It will also be eagerly noted by her three eldest children (John Hancock, 36, Bianca Rinehart, 33, and Hope Welker, 26).

They are suing Rinehart in the NSW Supreme Court in an ugly battle over their inheritance.

And it will be of even greater interest to Rinehart's daughter Ginia, who is the only one to have sided with her mother in the dispute and becomes the most likely heir apparent to the family empire.

Rinehart appointed Ginia on December 5 as a director of the family's flagship Hancock Prospecting.

A few weeks earlier, Ginia was named a director of Hope Downs Marketing Company, the joint venture with mining giant Rio Tinto that runs Hope Downs.

Ginia will learn about running a big mining project sitting on a board alongside hardened veterans, who include Rio Iron Ore senior executives Greg Lilleyman, Paul Shannon and Warwick Smith.

Ginia also replaced her elder sister, Bianca, on the board of family company HMHT Investments, which is linked to the Hope Margaret Hancock Trust at the centre of the dispute in the NSW Supreme Court.

The four children are beneficiaries of the trust, which controls about 25 per cent of Hancock Prospecting and was set up by Lang Hancock. But John, Bianca and Hope are attempting to remove Rinehart as the trustee.

Reading the tea leaves at the House of Hancock has never been easy.

At various times, Rinehart has groomed John and Bianca to take the reins of the business one day.

But Bianca left Perth a couple of years ago to start a family.

And John changed his name by deed poll in the early 2000s -- from Rinehart to Hancock -- after a bitter falling-out with his mother.

A sign that Hope was also on the outer came in an announcement last year that her husband, American Ryan Welker, had resigned after a short stint as Rinehart's representative on the board of Perth mining company Mineral Resources.

The resignation occurred just weeks after Hope and her two siblings launched the legal action.

Rinehart won't talk about her succession plans and a request yesterday for comment on the significance of the Posco deal was met with a polite refusal.

"There is no comment at this time," Hancock Prospecting spokeswoman and former state minister Cheryl Edwardes said.

"At the appropriate time, if there is to be a comment, I will keep you in mind."

Even the details of the court battle have remained shrouded in secrecy after Rinehart applied to suppress them.

But time appears to be running out for the intensely private Rinehart to keep hidden the reasons her children are suing her.

The NSW Court of Appeal found yesterday that disclosing information on the case could be embarrassing for Rinehart but would not expose her to any financial loss.

The judges ordered a suppression order to remain in place until February 3.

So unless Rinehart can convince the High Court to intervene, it appears the family's dirty linen is set to be aired.

Rinehart is said to be deeply saddened by the ugly dispute with her children and has thrown herself into her work.

This, after all, is a once in a lifetime mining boom and there are billions more dollars to be made.