Eclipx shares soar as sell-off plans updated

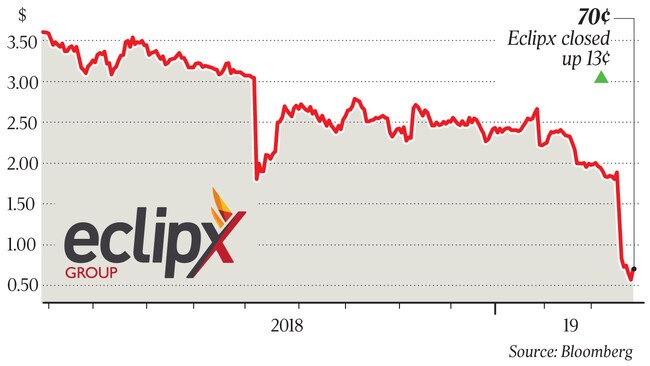

Shares in Eclipx shot up more than 20 per cent after the fleet management group updated shareholders on its business review.

Shares in Eclipx shot up more than 20 per cent after the fleet management group updated shareholders on its business review, following the failure of its proposed merger with McMillan Shakespeare.

In an update to the market, Eclipx said it had received interest for the sale of its troubled Grays and Right2Drive businesses, and it intended to apply any sale proceeds to its debt repayments.

“Following our most recent market update, Eclipx has received interest from a number of parties regarding the Grays and Right2Drive businesses and confirms that these businesses are for sale,” the update said.

Last week, Eclipx had said the two businesses had continued to underperform and were under strategic review, with an eye to possible full or partial sales.

Yesterday’s share surge came after the group lost more than half of its market capitalisation last week when McMillan Shakespeare abandoned its $912 million merger deal, saying it was no longer in its best interests.

The deal had been spruiked as one that would create a leading Australian and New Zealand salary packaging and fleet management company, with about $50m in annual earnings synergies released in three years.

It was kiboshed after Eclipx said its year-to-date net profit after tax and amortisation was down 42.4 per cent on the same period last year, and warned that it would not meet its full-year guidance.

Shares then plummeted to 83 cents on the news, well off the implied value of $2.85 per share under McMillan Shakespeare’s offer and firmly down on the closing price of $1.89 the prior session.

Yesterday, they closed up 22.8 per cent at 70 cents apiece. The company yesterday reiterated its cost-cutting target of about $20m over the next 18 months, accounting for around 10 per cent of the company’s cost base.

The cost reduction program includes rationalisation of the group’s property footprint, simplification of head office and shared services, as well as the integration of NZ Fleet and Commercial and the consolidation of the group’s Novated platforms. Eclipx also confirmed yesterday it would not be paying an interim dividend.

It comes ahead of the company’s first-half results announcement in May.

As at February 28, total group assets under management or financed were $2.46 billion, up 5.85 per cent on the prior year.

Samantha Bailey

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout