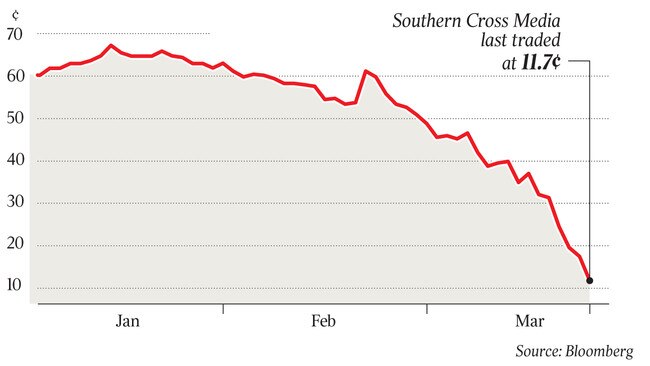

Southern Cross Media, HT&E launch cost-cutting moves

Southern Cross Media announces $169m capital raising and cost-cutting drive, as HT&E trims pay and staff hours.

The financial fallout from the coronavirus continues across the Australian media sector, with Southern Cross Media looking to raise $169m to pay down its debt pile and slash costs across its broadcasting operations by as much as $45m.

Meanwhile, rival HT&E flagged accessing the federal government’s $13obn JobKeeper program, alongside cuts to pay and staff hours to save money during the economic turmoil and advertising spending downturn.

Southern Cross, home of Triple M and Hit Network, plans to use the funds from the equity raising to reduce its $330.5m debt as forecast by The Australian’s Data Room last week.

The broadcaster is the second media company to raise capital to pay day debt in the wake of the economic turmoil after outdoor ad company oOh!media, which last month raised $167m to reduce its $354.5m debt.

oOh!media was also the first to abandon annual earnings guidance followed by Nine Entertainment, Prime Media and Seven West Media with the sector unleashing a raft of cost-cutting initiatives to help ride out the economic downturn.

Southern Cross is looking to save between $40m and $45m this year, and has cancelled its interim dividend to save about $21m. It also won’t pay a final dividend this year or next.

Chief executive Gran Blackley said the initiatives will provide the group with “the balance sheet and a more efficient operating model appropriate for the current uncertain macroeconomic environment”.

“The COVID-19 crisis is causing significant dislocation across advertising markets, but the fundamentals of SCA’s business remain sound,” he said.

Southern Cross also announced on Monday that it has secured support from its banks, with its syndicated debt facility amended to increase leverage covenant to 4.5 times net debt to underlying earnings from 3.5 times from June 30 for 12 months. It has withdrawn $50m to “further enhance liquidity”, and has $57m available if needed.

The company also provided a trading update, with ad revenue down 10 per cent for the nine months to March 31 from a year earlier.

Southern Cross said it was difficult to provide revenue guidance for the remainder of calendar year 2020, but cautioned that ad revenue from April to September is expected to be “materially impacted by COVID-19 and to be 30 per cent more down” from the same six-month period last year.

Within Southern Cross’s cost cutting plans, the group has identified savings of $20m to $23m on mandatory pay cuts of 10 per cent for all directors, executives and employees earning more than $68,000 annually. It’s also cancelling executive bonuses and enforcing mandatory annual leave.

In addition, Southern Cross will save a further $20m to $22m on reducing marketing, promotions and programming spending, plus cutting or cancelling travel and entertainment, conferences and non-essential equipment upgrades. It will also seek “relief from key suppliers and landlords”.

HT&E, which owns radio network ARN, has forecast operational savings of about $10.5M this year, and is assessing eligibility of the JobKeeper package.

The operator of radio stations such as KIIS, Pure Gold and The Edge said its board and management will take a 20 per cent pay cut for an initial six months and forego all incentive and bonus payments for the year.

ARN’s on-air talent, including KIIS FM breakfast stars Kyle Sandilands and Jackie “O” Henderson, will continue to broadcast five days a week as usual, while taking “a minimum of 10 per cent cut in fees across various cost control measures”.

Staff will also work reduced hours, use up excess annual leave and in some instances take short term pay cuts - moves which are expected to generate cost savings of about $1m a month.

A major positive for HT&E during the bleak economic environment is that it has no debt, with net cash of $111m and undrawn facilities totalling $250m.

HT&E said the coronavirus has led to a widespread fall in marketing and ad activity, with the forward ad market “very difficult to predict”.

No jobs have been lost so far, but the company will continue to assess the situation, particularly the revenue performance over the next few weeks and months.

HT&E chairman Hamish McLennan said the media industry will continue to evolve.

“Whilst taking a prudent approach to balance sheet management is the right approach, I am confident the company will emerge through the current trading environment in the best possible position,” he said in a statement.

Despite the cost-cutting across marketing, travel, entertainment, bonuses, incentives and new staff hires, ARN said its radio broadcasting hasn’t affected its metropolitan networks.

In Hong Kong, the group’s outdoor ad business Cody Outdoor has been operating in “challenging conditions” for the past year, which has been further affected by COVID-19.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout