Raise your voice: ads ‘drive profits’

The business case for treating marketing as a growth lever has never been clearer, according to a new report into advertising effectiveness.

The famous problem that “half the money I spend on advertising is wasted; the trouble is, I don’t know which half” is one step closer to being resolved through new “hard” business metrics unearthed by marketing luminaries.

A new Advertising Council of Australia (ACA) report, To ESOV and Beyond, by former ANZ and Mondelez marketer turned-consultant Rob Brittain and independent UK-based advertising effectiveness authority and author Peter Field found that the business case for treating advertising as a growth lever and not just a cost to the business has never been clearer.

Using the ACA’s Effectiveness Database, containing hundreds of ad campaign award entries that demonstrated effectiveness and proven results in the marketplace, the duo investigated the impact of positive extra share of voice on a broader set of brand and business metrics.

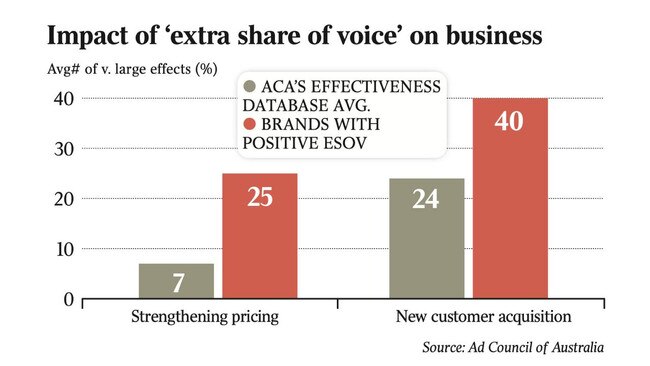

The analysis showed that those whose extra share of voice (ESOV) – that is, advertising spend that is higher than their share of the market – were able to strengthen pricing and acquire more new customers.

About 25 per cent of those with a positive share of voice saw their pricing position strengthen due to significant improvements in brand quality perceptions and 40 per cent drove very large increases in new customer acquisition.

This means brands that over-indexed on their advertising spend, in comparison to their market share, were much more likely to drive significantly higher levels of sales growth while also driving margin expansion.

“These are hard business metrics that need to be taken seriously and proves that advertising is a growth lever that will drive the profitability and growth of your business. It will underwrite margin expansion, but businesses have to reframe the way they look at advertising,” Mr Brittain said.

“The evidence provided adds significant weight to the marketing case and should be used to strengthen marketing’s position in budget conversations.

“Advertising plays a powerful, long-term role in expanding margins and growing future cashflow, and the firms that recognise this and invest accordingly see the benefits.”

The findings are particularly relevant in the current environment as businesses seek to rebuild their sales and profitability growth during the economic recovery.

On the subject of elevating the position and importance of marketing and the benefits of share of voice to C-suite roles beyond marketers, Samsung Australia chief marketing officer Josh Grace said: “What CFO wouldn’t be looking for more proven growth given what the report is showing?”

He added that as most organisations were used to operating in a competitive environment, with CFOs and CEOs measured on their improvement in market share, measuring competitive share of voice was simple for them to understand.

“It just makes sense that if you are seen more often by your customer than your competitors, then by default you should grow it. It’s a logical and simple thing to get, so why wouldn’t you pull that lever as an organisation?” he said.

As advertising is categorised as an expense on the profit and loss statement, it is often one of the first areas to cut when there’s an economic downturn. This can provide a short-term boost to profitability but can come at the expense of future growth.

“The report shows that advertising doesn’t only grow sales, but it also helps grow profits,” Mr Brittain said.

“Instead of cutting and just dropping it to the bottom line, you can boost your margins by investing more in advertising, which might seem counterintuitive to those looking at it as a cost. The effects build cumulatively over time, so it requires patience and a longer-term perspective, hence why the reframe of advertising as an investment is so important. Those that have the fortitude to do so see significant benefits.”

Pricing effects can be slow to manifest as they require brand owners to be highly aware of changes to consumer demand, and therefore willingness to pay. Achieving a strengthening of pricing via extra share of voice can be a significant driver of profitability over the long term as a result. Mr Brittain explained that as long as investment in the brand continues, the effects are not a one-off and will result in a virtuous cycle, creating ongoing impact.

Increasingly, brands are digging deeper into the benefits of extra share of voice, with Samsung and IAG-owned insurer NRMA among many organisations carrying out their own internal investigations to refine their perspectives and improve effectiveness of advertising investment.

“Share of voice in our categories is an important benchmark to go ‘can we legitimately compete in this category and drive the growth we need to achieve?’,” Mr Grace said.

“It has also forced us to make choices about which categories we support – we’ve got to place the bets on the categories that we think can drive profitable growth because of that investment.”

IAG chief marketing officer Brent Smart agrees that extra share of voice is an important concept, as it has proven results for the insurer, but warns that only measuring share of voice is “dangerous”.

“You could be spending a lot of good money on bad creative,’’ he said.

“You need to understand how your share of voice is converting to share of mind.

“That’s where creativity comes in.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout