Polls reflect ALP’s trouble with inflation

Now it’s showing in the polls, just as this column predicted last year. The latest Newspoll published here on November 6 showed the Coalition leading Labor on primary voting intentions 37-35.

This column on December 4 said the left media had forecast the demise of the Liberal Party after the election of the Rudd government in November 2007. Wrong. Within six years Labor had lost power federally and in Victoria, NSW, Queensland, South Australia, Western Australia and Tasmania.

Queensland could prove the present legion of Coalition doom predictors wrong with an election Labor Premier Annastacia Palaszczuk looks likely to lose next year.

Don’t believe pundits claiming Albanese’s polling downturn is all about the lost voice referendum. It’s about cost of living. The electorate is just starting to understand imported high prices for gas and oil are no longer the main drivers of inflation and Reserve Bank interest rate rises.

The government is deliberately presiding over record high immigration and record foreign student numbers that are pushing up house prices, rents and homelessness. It has deliberately introduced industrial relations changes favouring the union movement and repudiating Labor’s own history of IR reform. Its climate commitments are pushing up power costs to consumers, while also driving up the costs of wages, wind turbines, solar panels and network expansion in the renewable power sector.

The International Monetary Fund on November 1 formally added ballooning state government infrastructure spending to the list of inflation drivers. Think the up to $200bn Melbourne Suburban Rail Loop that has no cost-benefit analysis but is receiving $2.2bn of federal funding. Add the Brisbane Olympics and vast rail and road spending in Sydney.

Government spending is pushing in the opposite direction to monetary policy.

As former RBA board member Warwick McKibbin told last Wednesday’s Australian Financial Review after Tuesday’s 0.25 per cent rate rise: “To cut inflation, raise supply through productivity (or) cut demand through less government spending, or higher taxes or raise interest rates.”

Reflect too on the blowout in federal spending on the National Disability Insurance Scheme and the Gonski education reforms bequeathed by the last Labor government in 2013. The Gonski spending comes as education results fall. Soaring NDIS spending is creating a crime wave in the disability sector where costs are projected to top $60bn a year by 2030.

Add rising costs in aged care, where the government lifted wages 15 per cent in this year’s budget, and childcare, where families earning right up to $530,000 a year can now receive partial subsidies. Canberra has still not learned from decades of childcare market interference that subsidies just get absorbed by higher charges and profits for private operators.

Albanese’s senior ministers – Treasurer Jim Chalmers, Minister for Employment and Workplace Relations Tony Burke, Minister for Climate Change Chris Bowen, Minister for the NDIS Bill Shorten and Minister for Home Affairs Clare O’Neil – are impervious to facts. While publicly claiming to be emulating the reforms of Labor’s Hawke-Keating era, they look ever more Whitlamesque.

Chalmers has refused to engage in debate about population growth, the biggest single driver of house prices, rent rises and housing shortages. O’Neil in April released plans from a review by former Treasury secretary Martin Parkinson that aims to increase the proportion of skilled migrants and may cut annual migration by 31,000 a year.

Total net overseas migration this year rose to 2.2 per cent of the population – an annual rise of 563,000, or 100,000 more than the entire population of the ACT in one year.

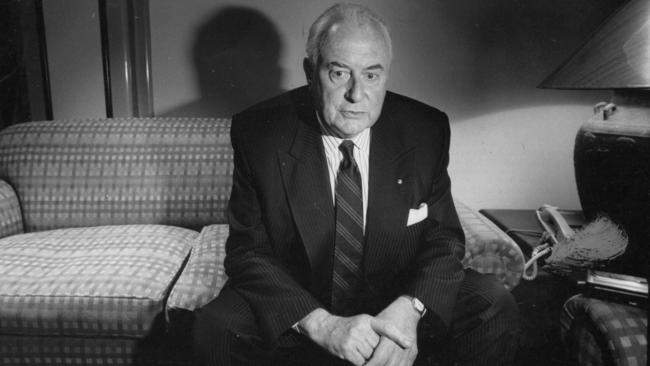

A former Labor political operator with a feel for the public mood, Graham Richardson, was quoted by this column in August 2018 when population growth was half what it is today. “Richardson … discussed the 25 million (total population figure), a landmark reached the previous week but projected in 2002 to hit in 2042. The nation had achieved a projected 40-year population growth in 16 years but most certainly had not built 40 years of infrastructure in 16 years.”

It’s not just migration adding to pressure on infrastructure, houses and apartments. Judith Sloan here reported last Tuesday that student visas in September totalled 650,000, up from a pre-Covid peak of 550,000 and 340,000 a decade ago.

These numbers will push up inflation even if many students engage in low-paid work. All will need accommodation and many will want to stay in Australia after their studies.

Also inflationary are changes by Burke designed to lift wages in line with government promises before last year’s election. The introduction of virtual pattern bargaining last year was good for trade unions, as will be this year’s changes designed to make casual employment harder for businesses to offer.

Given high inflation is still exceeding average wage rises, the RBA is not yet worried about increasing pay, but many in the Business Council of Australia and most large miners are.

The Minerals Council of Australia last Thursday said mining was now contributing more company tax (50.6 per cent) than all other sectors combined, compared with only 30 per cent of corporate tax in 2017. The MCA said: “The Albanese government’s so-called Closing Loopholes legislation will … (put) monumental cost pressures on miners, service contractors and small businesses across the economy.”

BHP has said the bill could cost its local operations more than $1.3bn. Its vice-president of government relations, Nick Park, told a Senate inquiry late last month: “These laws will add to inflationary pressure on the economy and undermine the nation’s global competitiveness.”

By far the most inflationary pressure is in the electricity sector. How could Albanese and Bowen not have foreseen soaring global prices for wind turbines and solar panels as the entire planet tries to meet emissions reductions targets almost no country is likely to meet.

A World Economic Forum paper released on October 26 outlines the shelving of several large wind projects in Europe and the US as the costs of making and shipping turbines rises steeply.

The paper says 10 projects worth $30bn have been put on hold. The WEF blames “soaring inflation, supply chain disruption and high interest rates”.

Domestically, the latest Gencost report by CSIRO and the Australian Energy Market Operator says rising prices for solar panels and turbines will not ease until well into the next decade.

Consider too the cost of building our 10,000km of extra power lines to send electricity across a continent, and compensation payouts to local landholders across whose farms these transmission networks are being built.

Then add a skills shortage and tight labour market to already high wages being paid to people building the network.

In the ABC and Guardian Australia, all this spending is treated as an unarguable positive. Yet this spending threatens to derail a government only 18 months old. It will give Coalition politicians scope to fight back from their well-earned 2022 drubbing.

No federal government has received more warnings from media and public policy experts about the inflationary dangers of its core policies and been so determined to ignore them.