Once-dominant breakfast shows are losing their sizzle

The once all-important morning television shows have been struggling to retain viewers’ interest.

Breakfast television was barely a ratings battle before 2002. Nine’s Today show was established with hosts Steve Liebmann and Tracy Grimshaw, and Seven’s Sunrise was still an experimental playground that its executives paid little attention to.

It was 2003 when TV audience researcher David Castran and his team noticed a small increase in engagement with Sunrise up in Queensland. That traction would mark the beginning of a 15-year battle for the consumer’s eye in the early morning time slot.

Sunrise’s initial growth and success was later attributed to the arrival of David Leckie as chief executive of Seven, and the work of former Sunrise producer Adam Boland, a young risk-tasker, who author and longtime ACP executive Gerald Stone once described as having a vision that was a “sure-fire recipe for either disaster or runaway success”.

When Boland began on the show, Sunrise was averaging about 91,000 viewers compared with Today’s 418,000, but by the end of 2003, Sunrise’s average was at 227,000 and Nine’s morning show was averaging 246,000.

That number would continue to grow over the years, with Boland treating the show the same way he did radio: with spontaneity and a focus on establishing a relationship with, and engaging, viewers.

More than a decade on, Sunrise has David Koch and Samantha Armytage at the helm, and Today lost longstanding hosts Lisa Wilkinson and Karl Stefanovic in the past 18 months, with Nine replacing the pair with Georgie Gardner and Deborah Knight. But the breakfast “battle”, as it once was, has slowed.

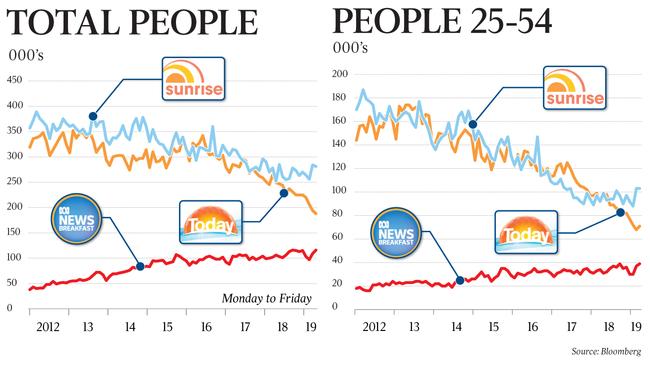

OzTAM data dating back to January 2012 shows breakfast audiences for Sunrise and Today have been steadily falling, while ABC News Breakfast has edged higher every year.

Despite increased scrutiny of Nine’s ratings fall following the departures of Wilkinson and Stefanovic, its not as though the eyeballs have shifted dramatically to their rivals. Instead, the breakfast battle has dwindled.

In January of 2012, Sunrise was averaging 357,000 and Today was at 319,000. In January of 2019, those numbers were 256,000 and 206,000 respectively.

Currently, Sunrise is up year on year, as is ABC News Breakfast, while Today has fallen. The key advertising demographic, 25-54, has also declined.

Globally, breakfast television is still one of the most important timeslots for a network.

Traditionally the shows brought in big advertising dollars, set up the day and were used to cross-promote network assets.

At its peak, sales teams could use the breakfast shows as a negotiating point to get a large portion of advertising revenue in prime time — about 7.30pm. The networks charged a premium for the hour, and more for a live read.

But some believe the shows have become risk averse, and the passion and experimentation has gone.

“In the medium to short term, the fall in Today showratings hasn’t necessarily seen a significant rise in Sunrise’s ratings,” says researcher Mr Castran.

“As a result, while the gap is greater between the two shows’ ratings, that audience is going somewhere else. Is it going to ABC? Is it going off and what is driving this from an audience point of view? The key there is that viewers are looking for innovation and they are looking for more to the story.”

Mr Castran, who runs research company Audience Development Australia, says Nine and Seven both suffer from “copycat syndrome”. There are differences; Seven has a mostly news-focused program in the morning, while Nine is filled with more lifestyle and comparison segments.

For some former producers, however, both shows lack passion and ideas.

“You’re lacking a Bolo [Adam Boland]. You’re lacking people with those big ideas,” says Rob McKnight, who worked across Sunrise, Today and Ten’s Studio 10, and now runs his own website and podcast, TV Blackbox. “The breakfast shows now, even Sunrise, are pretty stale and are pretty much just doing what has been set in place for many years.”

For Mr McKnight, as well as other producers and media buyers, the television shows once known for controversy and dividing the public are “playing it safe”.

He recalls the days of ROS-wall (Response of Sunrisers), where viewers’ issues would be posted on a board, until tackled by the hosts. He says no network is putting the “extra zing” in, and nobody is taking risks.

“They don’t do anything like that anymore,” Mr Knight says. “When the cyclones happened in Queensland, they actually got a planeful of tradies, went up there and started rebuilding.

“Breakfast TV is struggling because there are diminishing audiences, but it’s just not engaging enough for people to say ‘I better watch Sunrise or I better watch what Karl going to do next’.

“Every show has to evolve.”

Victor Corones, managing director of IPG Mediabrands’ investment arm Magna, said the breakfast formats were “tired”, and lacked innovation around content and distribution. However he believes there is an opportunity for the shows to evolve, pointing to the changing consumption of TV by consumers, and the large data offerings mobile providers offer, which allows people to watch shows like Sunrise or Today on the move.

“It’s somewhat of a tried and tested format, but maybe it is a little bit tired and maybe it needs to be thinking about evolving that product to meet the shifting changes, or the shifting tastes of consumers, and the way they want to consume media moving forward,” Mr Corones says.

“I see the real opportunity for them is to develop smarter content strategies that leverage all of their assets together and not just keep focusing on the linear service as their key driver.”

Frank Carlino, NSW and Queensland general manager of Dentsu Aegis Network’s investment arm, Amplifi, has been trading for 20 years, and was involved in buying and selling daytime and breakfast TV timeslots early in his career.

He recalls the day when Sunrise and Today pulled average audiences of about 500,000, but he says that over time, the focus on the timeslot has changed and trading of the timeslot has become automated through buying tools such as 9Galaxy and Code7.

“There’s less emphasis on having to scrutinise the daytime and breakfast from a trade point of view, as much as it used to be in the past,” Mr Carlino says.

“I remember having to go through and just cherrypick certain spots for the Today show, and it was one of those things where certain days would perform better than the others.”

Now, he says, no shows have the numbers to negotiate the premiums of decades prior.

“The media trader has changed over time as well, so … the current media trader only buys what they consume,” he adds.

“So if you’re watching news on Facebook you will be buying on Facebook or chatting to people as opposed to talking to 7, 9 about their breakfast area.”

However, Mr Corones believes the timeslot still has the value it once did.

“From an audience buying perspective, it would be wrapped up in terms of the dynamic trading, but I wouldn’t necessarily think that advertisers are thinking of it being of any less value, so it still has the value that it once did,” he says.

Regardless, reinventing and engaging audiences once again will be crucial for television’s future.

“The window of opportunity is still open for the networks to adapt to the needs of the audience which will, in turn, provide better value to the advertisers,” Mr Castran says.

“If we don’t do this, we’re just going to slip down the crack.”