Official TV ratings kick off after brutal summer sport showdown between Seven and Nine

Seven and Nine supplied The Australian with different sets of data, with both networks claiming their numbers showed summer ratings dominance.

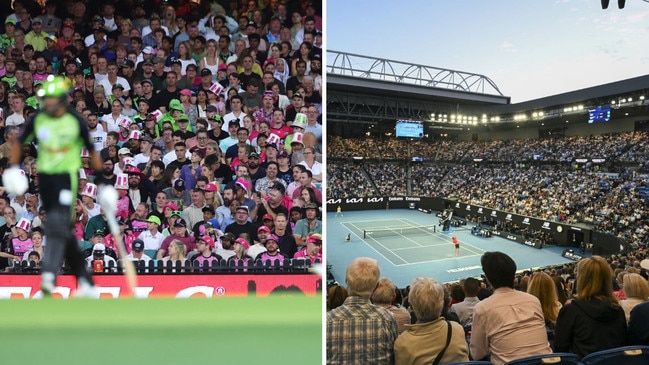

The official 2025 TV ratings year begins this week, following a brutal cricket versus tennis showdown between Seven and Nine that left both sides claiming supremacy in the summer survey.

Predictably, both free-to-air heavyweights are putting their own spin on the annual cricket versus tennis clash but a shortened Big Bash League coupled with the riveting “Indian” summer clearly delivered a ratings shot-in-the-arm for Seven, while the Australian Open – despite lacking the kind of star power it has enjoyed to previous years – still performed solidly.

The two summer sports went head to head in the second half of January – while the Test series had ended by then, the BBL was in direct competition with the grand slam tennis tournament.

Nine had the edge in average audiences on most nights of the Australian Open, but Seven’s cricket coverage was far more competitive this year than in previous years, according to Seven’s chief content officer Brook Hall. And it wasn’t just by adding in the 7plus audience which was watching live cricket for the first time.

“The biggest growth we had in the Big Bash was during the Australian Open where our audience was up 30 per cent, year on year,” he said.

Speaking about Nine’s summer, 9Now programming director Hamish Turner told The Australian: “The Nine Network has dominated the summer ratings period, winning across all key (metro) demographics and total people, reaffirming our position as Australia’s favourite network.

“Our dominance has also been powered by the Australian Open, which delivered its highest-ever BVOD audience for the men’s final.”

According to data from TV measurement system VOZ, the Australia versus India Test series had an average total daily TV audience (including 7plus) of just over one million viewers, an increase of 39 per cent year on year, while the Big Bash League delivered the biggest linear audience for Seven in five years.

While the Foxtel Group is not yet publicly releasing Kantar data regularly, Foxtel Media CEO Mark Frain told The Australian earlier this year that cricket had delivered the best ratings start to a calendar year ever.

“The fifth Test was the most-watched Test match in Foxtel history,” he said.

Kantar reported a subscription TV audience over 500,000 for some sessions during the Indian Test series. “That’s a colossal audience across the platform,” Mr Frain said.

From December 1 to February 6, Seven won the national ratings battle with a 44.4 per cent audience share of “all people”, ahead of Nine on 38.9 per cent. The race was tighter among the key 25-54 sector, with Seven drawing 42.8 per cent of viewers compared to Nine’s 39.4 per cent.

Network Ten was a distant third among all demographics, failing to rate above 18 per cent in any category of audience share.

Seven and Nine supplied The Australian with different sets of data, with both networks claiming their numbers showed summer ratings dominance. Nine’s win was based on examination of metro-only and BVOD results, while Seven include regional audience numbers as well.

“Sport and news are absolutely key to driving record summer ratings,” Seven’s group managing director television Angus Ross told The Australian.

“We invest a lot of money in sport and news and they’re key to us remaining absolutely relevant to all Australians.

“What sets us apart from the SVOD (streaming) players is having that hyper local content that brings huge audiences together. This summer we broke audience records for the Tests and for the Big Bash League.

“That sort of outcome doesn’t ever happen just by accident.”

Mr Hall acknowledged that Seven and Cricket Australia haven’t always seen eye to eye when it came to scheduling.

“We’ve had an interesting relationship over time, but now it’s the best it’s ever been from both sides,” Mr Hall said.

Seven’s ratings numbers were some of the strongest it’s ever had in summer, he said, with the Test series between Australia and India out-rating the most recent Ashes Test series in Australia.

The addition of digital rights for cricket helped build Seven’s reach, Mr Hall said. “Our digital audiences hit the targets. It was great that we could reach all Australians.

“We just wanted people to watch our content. We don’t care how.

“We had times where we had over two million people watching cricket across the day, then nearly two million people watching 6pm news and then pushing the audience into the Big Bash.”

Seven has invested more money into sport, meaning it has less to spend on news and entertainment.

That sports spend includes its annual share of the $214m cricket rights deal and its share of $642m annually in the first year of the new AFL TV deal.

Commenting on the spend, Mr Ross said: “Brook (Hall) and I look after entertainment and sport and have the ability to shuffle budgets around, working with (director of news and current affairs) Anthony De Ceglie.”

On the overall health of the FTA sector, Mr Hall said Seven and Nine were both in a strong position.

“We are both growing our linear audience. Australian Idol is up this year for us. But Married At First Sight is also up. The Australian Open is still a very strong performer. Tipping Point has improved its timeslot at five o’clock,” he said,

“At Seven and Nine, news, sport and entertainment are getting bigger and bigger.”

The entertainment pillar kicked in for Seven when Home and Away returned early in January as did The Chase at 5pm. Both have started with improved numbers, year on year.

The Chase was challenged in 2024 by Nine’s Tipping Point. This year, Seven has reviewed the format, giving players the chance to win more money.

Seven West Media will reveal its half-yearly numbers with the market later this week, including its ad share, indicating what incoming chief commercial officer Henry Tajer will be able to take to market.