Nine chief upbeat as digital lifts earnings

Nine’s CEO Hugh Marks is looking to work the enlarged group’s portfolio harder after booking a rise in first-half earnings.

Amid a tough advertising market, Nine Entertainment CEO Hugh Marks is looking to work the enlarged group’s portfolio of broadcasting, digital and publishing assets harder after booking a rise in first-half earnings.

Delivering the broadcaster’s first set of financial results following its $4 billion merger with Fairfax Media in December, Mr Marks was upbeat about the group’s outlook, citing its buoyant digital operations.

“I think as people get their heads around that, and investors get their head around that and start to look at the components of the business, people will start to see what its potential is,” Mr Marks told The Australian.

“The notion that … this is an old television business combining with an old print business — nothing could be further from the truth.”

As well as its Nine Network, the enlarged company consists of streaming video-on-demand service Stan, metropolitan newspapers including The Sydney Morning Herald and Australian Financial Review, and a 54.5 per cent stake in radio network group Macquarie Media, plus a near 60 per cent stake in online property listing group Domain.

Mr Marks told his staff that the merger has “fundamentally changed” Nine’s revenue profile and cut its reliance on broadcasting.

“A year ago, in our half-yearly results 86 per cent of Nine’s revenue came from broadcasting. Today that figure is 54 per cent,” Mr Marks said in a memo sent to staff.

On a pro forma basis, Nine yesterday posted a 6 per cent rise in earnings before interest, tax, depreciation and amortisation of $252 million, with profit after tax and minority interests up 5 per cent at $126m.

The group expects to deliver EBITDA of at least $420m for the current financial year, up more than 10 per cent on a like-for-like basis from $385m last year, bolstered by cost savings of about $50m.

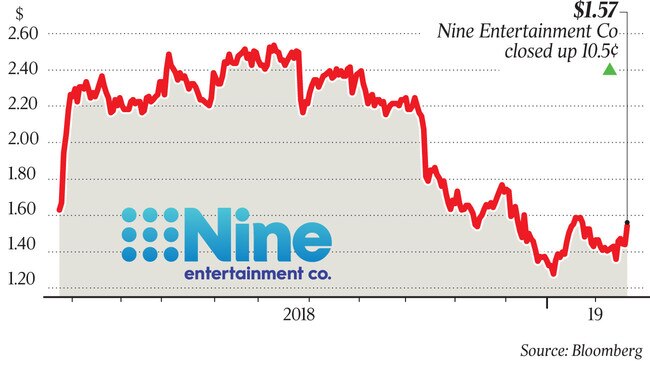

The stock closed 7.2 per cent higher at $1.57 in a higher market yesterday.

Still, first-half revenue was down 3 per cent at $1.2bn, due to the choppy ad market ahead of the NSW election next month and the federal election, widely slated to be in May.

Nine indicated flagged Stan will be profitable by June, with Mr Marks attributing the financial turnaround on an increase in subscribers and a price rise last month. “We’ve actually been increasing our investment in content. We’ve maintained our marketing spend so basically it’s a combination of growth in subscribers and price,” Mr Marks said.

Stan, which is now 100 per cent-owned by Nine following its $4bn merger with Fairfax Media, recorded a “very strong period for sign-ups” in the six months to December 31, with active subscribers of about 1.5 million.

With the popularity of streaming content showing no signs of abating, Stan posted a 50 per cent jump in first-half revenue to $65.2m.

Its earnings loss narrowed to $21.8m in the six months to December 31, from $29.9m, with costs up 19 per cent at $87m as the group added content to its service.

Stan is expected to report a “positive contribution” to Nine’s underlying earnings in the 2020 financial year.

Nine’s broadcast-video-on-demand business, 9Now, booked a 54 per cent jump in EBITDA to $16.4m, thanks to shows such as Love Island, The Block and Manifest.

The group’s digital and publishing division, which includes Metro Media, 9Now and digital publishing titles including Pedestrian and nine.com.au, reported a 39 per cent jump in EBITDA to $60.2m on the back of a 4 per cent lift in revenue to $327.5m.

However, its broadcasting division, which consists of Nine Network and the consolidated results of Macquarie Media, booked a 6 per cent fall in interim EBITDA to $176.6m, with revenue down 10 per cent at $631.7m.