Nine investors demand answers on Hugh Marks departure

Nine Entertainment investors are demanding answers about the circumstances surrounding the departure of chief executive Hugh Marks at the weekend.

Nine Entertainment investors are demanding answers about the circumstances surrounding the departure of chief executive Hugh Marks at the weekend, with concerns over when and who knew about the office relationship that ended his time at the top of the media giant.

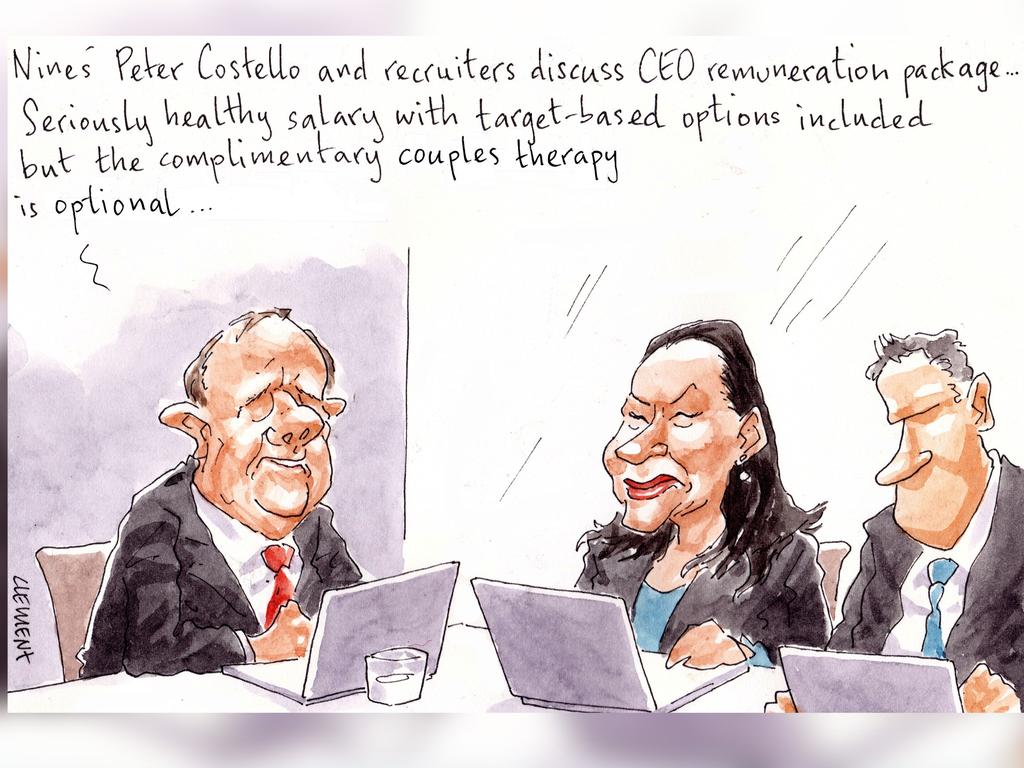

Nine chairman Peter Costello had yet to speak to several major shareholders on Monday, despite questions about the timing of Mr Marks’s exit days after investors approved a $2m long-term bonus at the company’s annual general meeting.

The Australian reported on Monday that the board was split on the issue, with former Fairfax Media directors who stayed when the publisher merged with Nine in December 2018 concerned Mr Costello had known about the relationship with commercial director Alexi Baker for some time. Ms Baker left Nine on September 30.

Martin Currie chief investment officer Reece Birtles said he would be seeking answers from the Nine board, in particular about their governance processes.

Martin Currie’s parent company Legg Mason is the third-largest Nine shareholder after billionaire Bruce Gordon and fund manager Pendal Group.

“We will be engaging with the company in terms of the governance process that occurred around all that to understand and be clear that it was appropriate,” Mr Birtles told The Australian, noting the lack of information about what had happened leading up to Mr Marks’s departure.

“Who knows what’s true and what’s not?” he said. “We’ll engage with them on our own basis.”

Mr Marks quit Nine after a board phone hook-up on Saturday, after the company’s publication, The Sydney Morning Herald, published details of the relationship.

The Australian reported on Monday that some Nine directors, including former Fairfax Media chairman Nick Falloon, had become aware of the relationship only on Wednesday.

The SMH has since reported the board was sent an anonymous email containing complaints about behaviour at the company in the days before Mr Marks resigned.

Despite his resignation, Mr Marks will remain in the job until next year and on Monday he briefed investors about the company in a call organised by investment bank UBS.

Mr Costello, who made his first public statements since Mr Marks’s resignation, calling his tenure “extremely successful”, did not return calls from The Australian.

Nine is scheduled to meet investors later this week, briefings scheduled before Mr Marks’s resignation.

Angus Gluskie, managing director of investment company Whitefield, said it appears Mr Marks and Nine “wanted to act pre-emptively, rather than waiting for further problems to brew”.

Nine shares dropped 1.6 per cent to $2.40 during a shortened trading session on Monday.