Fox Corporation offer for Credible Labs is compelling, says CEO Dash

Credible Labs’ boss defends accepting Fox Corp’s offer for the fintech after investor Alex Waislitz calls it “too cheap”.

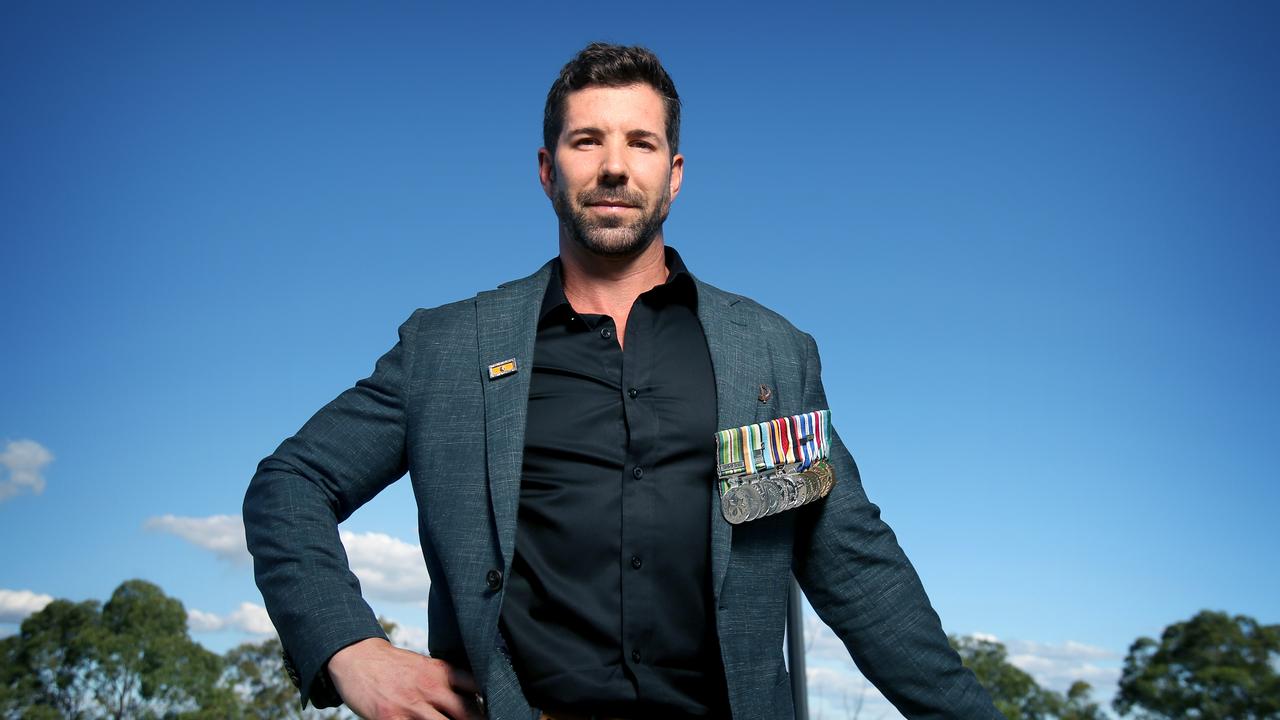

Credible Labs chief executive Stephen Dash says Fox Corporation’s $585 million bid for his fintech company is being made at a “compelling price” and says Credible would be forced to raise more dilutionary capital from investors to fund its emerging US mortgages business if the deal does not proceed.

Billionaire investor Alex Waislitz, who holds a 4 per cent stake in Credible, has questioned the deal, saying the offer price of $2.21 per share is “too cheap” for the fintech, which helps consumers shop for loans for mortgages and schools from financial institutions.

But other long-term shareholders including Regal, Carthona and Alceon Group have welcomed the transaction, which Credible has recommended to its shareholders.

“I respect every shareholder’s opinion and Alex has been a great supporter of Credible over the years,” Mr Dash told The Australian.

“But I look at the price based on a fundamental analysis. This price at $2.21 represents double the revenue multiple of our closest US peer, LendingTree. From a fundamentals perspective it is a very compelling price.”

Mr Dash also noted he was selling the maximum number of shares he was permitted to cash out after Credible floated on the ASX at the end of 2017.

He will be paid $55.25 million for his shares and be left with a stake in the merged group worth around $195 million.

As part of the deal Fox will also inject $US75 million into Credible, which was the biggest technology IPO on the ASX in 2017 and which also counts industry super fund giant Hostplus and former Seven Group executive Peter Gammell among its backers.

At June 30 the company’s cash position was $US24m, down from $US26m at March 31.

“In the absence of this offer we would have been tapping the market at some point for additional capital. We had two years runway as it stood in April. The additional information that has played out over three to four months is the need to invest capital in the mortgage business. It is early days and a complex product,’’ Mr Dash said.

“We could etch it out for 18 months or possibly two years. But we wouldn’t be growing as fast as we potentially could grow. This capital will be deployed to accelerate the growth trajectory.”

Mr Dash said it was still “early days” for Credible’s mortgage business.

“It is nascent. We don’t split it out,’’ he said.

“There are two components Fox brings. One is distribution and a real focus on partnerships. That is where the conversation started. The ability to scale the program and drive customers to us. And they bring capital at scale. And it is non-dilutionary for existing shareholders.”

San Francisco-based Credible has recommended shareholders vote in favour of the Fox Corp offer, which is pitched at a 7.3 per cent premium to Friday’s closing price of $2.06.

However Mr Waislitz said while the deal was a “great endorsement” of Credible’s business model, “on the face of it the offer price is on the low side and we intend to buy more shares at current prices”.

“The proposed purchase price is only a very small premium to last week’s pre-bid closing share price and well below recent stockbrokers’ valuations, one of which had a target price of up to $2.78,” he said.

“The offer price represents a revenue to enterprise value multiple of only five times forward revenue projections, which we think is too cheap for a company which has only just entered the multi billion dollar US mortgage market and has the potential to launch many more verticals in the future.

“We think that if Credible keeps delivering it could easily reach a billion dollar valuation in one to two years’ time which would make today’s offer price look like a bargain.”

Mr Dash said Credible had held conversations with others in the industry before the Fox approach in May. While he would not rule out a counter offer, he said it was unlikely.

Fox lodged its initial confidential proposal with Credible on May 29.

“We received a proposal on May 29. We have been in a due diligence process since that time. The board has a fiduciary duty to assess any inbound inquires from potential interlopers,’’ he said.

“Yes we have spoken with people in the industry. That has been the case over many years.

“Based on all of that history and where this offer is, that gives me confidence that this is a very full price.”

Under the terms of the deal Credible will be housed in a new unlisted subsidiary company of Fox.

Mr Dash said it would be important to maintain his company’s autonomy and independence.

“It is going to be very important. I have been impressed by the focus on digital innovation within the Fox organisation. Our product is very complementary. We will be able to leverage the highly-engaged audience Fox enjoys across business, news and entertainment,’’ he said.

“Autonomy and driving our existing strategy is important. We have always done a lot with a little. I will remain on as CEO and I am excited as I has ever been about the prospects for the business.

“The value Fox brings to the combination, it is a step change opportunity for us.”

The Credible Labs deal is Fox Corp’s first move into the booming fintech sector.

Credible initially made its name in the higher education sector in the US by matching students with loan providers in an online environment.

But after last year moving into mortgage refinancing and since expanding that product into 37 states with six lenders and adding a home purchasing mortgage offering, the group recently struck a trial partnership with Realtor.com, the second-biggest player in the online property space in the US.

Credible’s chairman, Ron Suber, said: “The board, acting on the unanimous recommendation of the special committee, believes the proposed transaction is in the best interests of the company and its shareholders – and unanimously recommends shareholders vote in favour of the transaction.”

Mr Suber also said: “Credible has achieved significant success since its inception. This proposed partnership with Fox will enable Credible to further innovate on its consumer offering and position itself as a leading independent personal finance marketplace in the United States.”

Fox chief executive Lachlan Murdoch said in a statement: “The acquisition of Credible underscores Fox Corporation’s innovative digital strategy that emphasises direct interactions with our consumers to provide services they want and expand their engagement with us across platforms.

“Credible, which has tremendous synergy with core brands such as Fox Business and Fox Television Stations and will benefit from our audience reach and scale, will drive strategic growth, further develop our brand verticals and deepen consumer relationships,” he added.

Besides being a source of information for its Fox Business online platform, Fox executives will also use Credible data on the digital sites for its local TV stations, which reach almost half the country.

Under the terms of the merger agreement Credible shareholders will receive $2.21 cash per CDI (which represents $55.25 per share of common stock in Credible), representing a premium of 12.4 per cent to the volume weighted average price (VWAP) since Credible’s quarterly activities report on July 31, 2019, 20.8 per cent to its 60 day-VWAP, 55.0 per cent to its 90 day-VWAP, and 30.8 per cent to the closing stock price the day prior to receipt of initial confidential proposal on May 29.

Credible shares have more than doubled since early April.

They closed 14 cents lower on Friday at $2.06. In early afternoon trading they were trading 13 cents or 6 per cent higher at $2.19.

After the float at the end of 2017 valued the business — which is also backed by Sydney-based venture investor and advisory firm Carthona Capital and Regal Funds Management — at more than $300m, the shares languished below their issue price of $1.21 throughout last year.

Ben McCallum, portfolio manager at Regal Funds Management, congratulated Credible “for reaching this milestone”.

“It is validation of their business model and position in the market,” he said. “Regal led Credible’s pre-IPO transaction as we were attracted to the disruptive strategy in a large addressable market, and by Stephen’s focus and drive.

“Subject to no superior proposal, we intend to vote in favour of the transaction.”

In May, Fox made its first acquisition following its listing on the NASDAQ after Disney purchased its former parent company Fox Corporation, paying US$236 million for 5 per cent of US gaming giant Stars Group.

The move was by the biggest media investment yet in the burgeoning US sports-betting market and allowed Fox to start its own sport wagering platform.

Fox Corp and The Australian’s parent News Corp share common ownership.