Fairfax merger drives Nine profit lift, but costs rising

Rising costs have eaten into Nine’s profit, as it deals with a soft property market and falling TV revenue.

Nine Entertainment is betting on market share gains in a tough television advertising market, to help reverse a revenue decline in its flagship Channel 9 broadcasting arm.

Chief executive Hugh Marks said the outlook for the free-to-air TV market “looks better from September onwards” after more than a year of tough ad conditions, which crimped the recently-merged group’s earnings momentum.

The fall in TV revenue at Nine and cross-town rival Seven West Media has been amplified this year by a slump in advertising around the federal election. But extra consumer money from tax cuts and lower interest rates would draw advertisers back in, he said.

“It just feels like there’s some confidence coming back in the market after probably 12 to 18 months of negative movements,” Mr Marks told The Australian.

“A few things will drive it, obviously the tax cuts will play a part, I think the decline in interest rates will play a part. It all puts money back in the hands of the consumer, and when the money goes back into the hands of the consumer they tend to reignite their spending patterns.”

“I think the policies that the government and Reserve Bank have in place, I think are providing a framework of opportunity for recovery, so I feel confident that we’ll get there,” he said.

The company, born out of a $4 billion merger with Fairfax Media last December, expects the weak market conditions in July to result in a 4 per cent fall in its free-to-air television revenue in the first quarter. However, conditions are expected to improve into the second quarter of the 2020 financial year.

Over the year, Nine expects the free-to-air market to fall by “low single digits, partially offset by growth of at least 1 revenue share point”, the company said after reporting a 3 per cent rise in profit after tax from continuing operations to $216.6 million for the year to June.

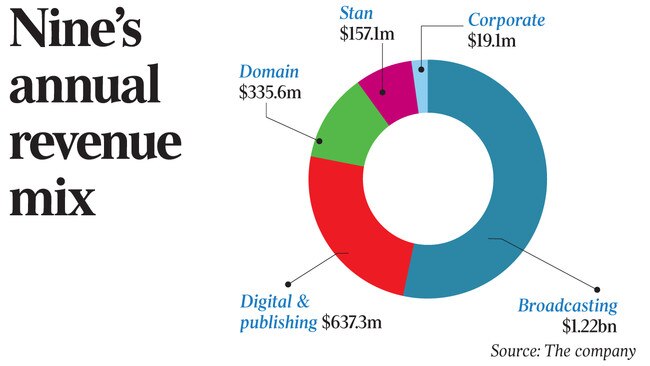

Nine’s broadcast business booked a 11 per cent fall in full year earnings on the back of a 5 per cent drop in revenue. Nine Network reported a 6 per cent drop in revenue to $1.09 billion, with the free-to-air TV market down 5.2 per cent in the second half of the year. TV costs rose 4 per cent to $876.6m.

The group’s broadcast video-on-demand platform 9Now, which allows consumers to stream its TV programs whenever they want, booked earnings of $36m, up 87 per cent from a year earlier.

Earnings at its publishing arm which includes former Fairfax Media titles, The Sydney Morning Herald and The Age, rose to $82.7m, from $50.2m a year earlier. Print revenue was flat at $133.1m.

Nine’s radio business, Macquarie Media, in which it holds a 54.5 per cent shareholding, booked a 3 per cent fall in revenue to $132m, due to a tough ad market.

Its streaming business Stan booked an earnings loss of $21.3m in the year, despite delivering its first earnings contribution of $500,000 to Nine in the second half of the 2019 financial year.

Stan’s costs jumped 23 per cent to $178.4m, while its revenue rose 62 per cent to $157.1m, on the back of 200,000 new subscribers this year and a $2 price increase in March.

Nine expects Stan to move “strongly into profitability” in the current year, but stopped short of provide any specific forecasts ahead of the arrival of US entertainment giant Disney’s streaming offering, Disney+. Stan’s one-year content deal with Disney is also expected to end in December.

Nine also felt the pain of the soft Australian property market, with online property listing group Domain, in which it holds a 59.2 per cent stake, booking a 15 per cent drop in earnings to $98m on the back of a 6 per cent fall in revenue.

Mr Marks ruled out buying the remaining stake in Domain following Nine’s tilt for Macquarie Media a few weeks ago.

“No, we’re pretty happy with our position at the moment. I think our shareholders can benefit from growth in equity value in Domain

“Unlike MRM, where its really about day to day operational synergies, Domain is more of a strategic investment,” he said.

Domain will benefit when the listing environment, particularly in Sydney and Melbourne, improves, Mr Marks said.

Nine faces cost headwinds, with its TV costs set to increase by around 4 per cent during the current financial year, due to contracted sports rights inflation of around $27m, and incremental costs of about $15m associated with The Ashes and World Cup Cricket.

The group has forecast corporate costs of about $20m as it moves its headquarters from Willoughby to North Sydney, where it will also house the former Fairfax operation that had been located in Pyrmont, and capital expenditure of $110m-$120m for the 2020 financial year.

Meanwhile, Nine also announced the appointment of Paul Koppleman as its new chief financial officer, who will start on September 3, replacing Greg Barnes.

The company has declared a flat final dividend of 5c, taking its total for the financial year to 10c. Shareholders can expect a similar payment for the 2020 financial year,

Nine shares closed 8 per cent higher at $1.95 yesterday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout