Domain shares dive as Antony Catalano quits as CEO

Nervous investors wiped over half a billion off real estate firm Domain and key shareholder Fairfax after its CEO resigned.

Nervous investors wiped more than half a billion dollars off real estate business Domain and key shareholder Fairfax Media’s market value after the shock resignation of chief executive Antony Catalano just two months after the company listed.

With no succession plan in place, Domain chairman Nick Falloon’s explanation for Mr Catalano’s sudden exit — “he had decided to put his family first” — raised more questions than it answered.

Major shareholders speculated other reasons were behind the colourful character’s resignation, but Fairfax insiders stuck to the company line and downplayed the suggestion that he had an uneasy relationship with Mr Falloon, who also chairs Fairfax and will now act as executive chairman.

As a domestic and international search for a new CEO begins, former REA Group chief Greg Ellis has been mooted as an external candidate in the mix to succeed Mr Catalano in the top job.

Mr Ellis, who runs private equity firm Hellman & Friedman-controlled German internet portal Scout24, is an independent non-executive director of Domain.

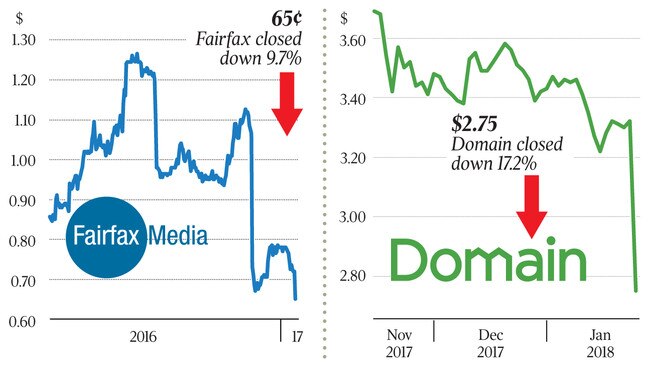

Domain’s share price plunged 17.2 per cent, or 57c, to $2.75, erasing $420 million from the company’s valuation. It was trading around $3.90 a share on its ASX debut in November last year as a $2.2 billion company.

Fairfax, which owns 60 per cent of Domain, ended yesterday’s session down almost 10 per cent, at 65c, removing a further $150m in value from the publisher.

As a top 20 Fairfax shareholder, Mr Catalano’s rise to the top had been anything but boring.

A former property editor of The Age, Mr Catalano moved into the advertising and marketing side of the business, but was fired in 2008.

He used his near $1m redundancy payout to set up a network of suburban newspapers that ended up being acquired by his friend and Fairfax CEO Greg Hywood in a deal that made him a personal fortune, now estimated to be worth more than $70m.

His resignation is a major blow to Mr Hywood, who has been a backer of Mr Catalano through his career.

At the time of Domain’s listing, Mr Catalano received a package that included fixed remuneration of $1.2m a year. There were also short and long-term incentives including $5m worth of options.

He owns a luxury hotel in the coastal NSW town of Byron Bay and last year took delivery of a yacht and a private plane.

In 2015, Mr Catalano had his driving licence cancelled for 16 months and was fined $500 after a court found him guilty of drink driving.

Mr Catalano has told friends he is not retiring and wants to be back in business after a 12-month non-compete clause expires, and that he does not enjoy the scrutiny and responsibilities that come with running a publicly traded company.

Hellman & Friedman’s Mr Ellis is said to have a strong relationship with Mr Falloon, who recruited the executive to the board after being impressed by him when Fairfax was conducting a trade sale.

Mr Ellis was part of the Hellman & Friedman bid team that considered a takeover of Domain early last year. After four weeks of due diligence, Hellman opted not to lodge a binding bid, while rival bidder US private equity firm TPG Capital and its consortium partner, Ontario Teachers’ Pension Plan, withdrew from the process.

It has been rumoured in industry circles that Mr Ellis could return to his native Australia after a successful four years in Germany running Scout24.

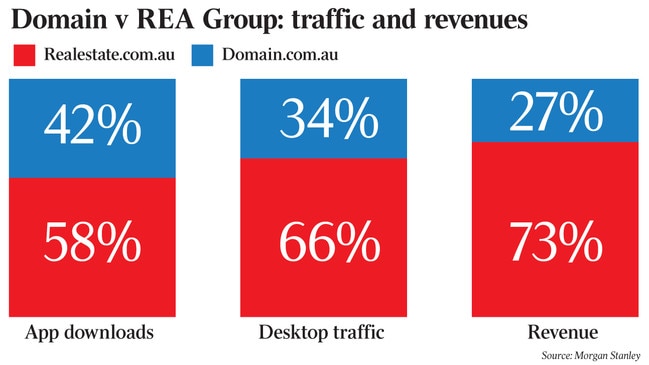

Before joining Scout24, as chief executive of REA he competed with Domain for lucrative property advertising listings for more than five years. REA is majority-owned by News Corp, publisher of The Australian.

During the bid process, Mr Catalano aligned himself with TPG and it is believed he has stayed close to the company and its local boss Joel Thickins.

It had been rumoured in media circles that TPG could return and mount a takeover of

Fairfax’s prized asset, although sources close to the investor dismissed the suggestion.

According to Fairfax insiders, internal candidates to succeed Mr Catalano include chief financial officer Rob Doyle, chief operating officer Graeme Plowman, chief commercial officer Tony Blamey and group director Simon Kent.

After more than four years at the helm of Domain and just two months fronting a publicly listed company, Mr Catalano said in a statement it was “becoming apparent that I needed to relocate to Sydney and that was something I wouldn’t ask my family to do”.

Mr Catalano cited “schooling and family requirements” and said time away from his wife and eight children was “not fair on the family”.

Investment bank Citi described the move as a “big surprise given the stock has only been listed for two months”, maintaining a sell recommendation on the stock.

“The chief executive was a significant factor in the success of the spin-out,” Citi analyst David Kaynes said.

“Antony Catalano was a key factor in the success of the separation of Domain from Fairfax in our view, with the next level of management not nearly as well known to investors.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout