Think Kevin Rudd’s pink batts and school halls stimulus packages; Julia Gillard’s NDIS and failed Gonski education reforms; Malcolm Turnbull’s Snowy 2.0 pumped hydro scheme, the price of which has risen sixfold; and Scott Morrison’s hundreds of billions in JobKeeper payments to close the nation’s businesses.

At least since 2013 the Abbott-Turnbull-Morrison and Albanese governments have stood firm against Chinese bullying and are cementing the US alliance via Morrison’s AUKUS nuclear submarine deal now ratified by Albanese. The ABC and The Guardian criticise the $368bn cost of AUKUS by 2050, yet the NDIS could cost three times that.

When the history of the post-Howard era is less politically contested, these will be the main achievements of some pretty ordinary governments: we legislated foreign interference laws, banned Huawei from the national 5G rollout, demanded to know the truth about the origins of Covid, stood firm against illegal trade bans by a country with which we had signed a free-trade agreement under Tony Abbott in 2015 and finally moved to acquire nuclear-powered submarines to partner the US and UK.

All through this period the pro-Beijing lobby here warned Australia was destroying its own economic advantage as an exporter of raw materials to China. Yet we increased those exports, diversified our markets and showed the world how a middle power can stand up against totalitarian bullying.

Now China is facing the same economic reckoning most East Asian “miracle economies” eventually face. Think Japan, where the Nikkei 225 sharemarket index set its record of 38,915 in 1989. Today it sits at 32,300 after being below 25,000 for three decades.

Back then, the Tokyo property market alone was worth more than all the land in the US. Strategic trade theory spruikers from Canberra’s Department of Foreign Affairs and Trade used to talk to editors about Japan’s “new business paradigm’’ when discussing shares like Nippon Telegraph and Telephone that were trading at 200 times earnings rather than the standard 15 times here.

The idea was the Japanese didn’t work on annual returns but thought in terms of century-long investment plans. It took until Apple in 2015 for any company anywhere to pass NTT’s late 1980s bubble-era peak when in inflation-adjusted terms it was valued at about a trillion Aussie dollars. Today it sits at $160bn.

It was rubbish economics and uncomfortably similar to the ruminations of current Treasurer Jim Chalmers about the government’s vision for Australia’s future in digital technology and green hydrogen. This as China is in the process of proving yet again that free markets are better at allocating scarce resources than central planners in Marxist economies or Japan’s Ministry of International Trade and Industry in Japan’s then mercantilist 1980s system.

This column has argued for several years China would falter before passing the US economy. Yet it would be foolish to overstate things. Just as Japan remains the world’s No.3 economy, China’s economy will stabilise and may even eventually pass the US.

Nor is there any denying China’s communist government has lifted more people out of poverty more quickly than any other government in history. Yet per capita GDP in China sits at just $US12,700, compared with $76,300 in the US and $US64,000 here.

As this column concluded in December 2020 – “The transition from factory to the world to modern economy driven by domestic consumption will be difficult. Without a free-floating currency and with all the rigidities of a Marxist centrally planned state there are many landmines ahead for the Dragon …” – US China business analysts have this month been focusing on deflation risks after a CPI fall, rising youth unemployment, a spending strike by Chinese savers, a collapse in the property market, 50 million new empty apartments and falling population. Total population dropped 850,000 last year. India now has more people than China. China’s fertility rate has fallen below that of Japan.

Yet here, China spruikers such as former ambassador to Beijing Geoff Raby can see only positives. In an astonishing column in The Australian Financial Review last week, he said China critics – and Anthony Albanese – just needed to visit China to look at all the new highways, high-speed trains and public infrastructure to see how wrong China pessimists are. As if all that infrastructure was not at the heart of the problem.

And there is most certainly a problem. Hong Kong’s sharemarket has fallen 20 per cent since January, China’s growth may fall to 4 per cent this year, youth unemployment is 21 per cent, and there is serious financial trouble in the property and shadow banking sectors.

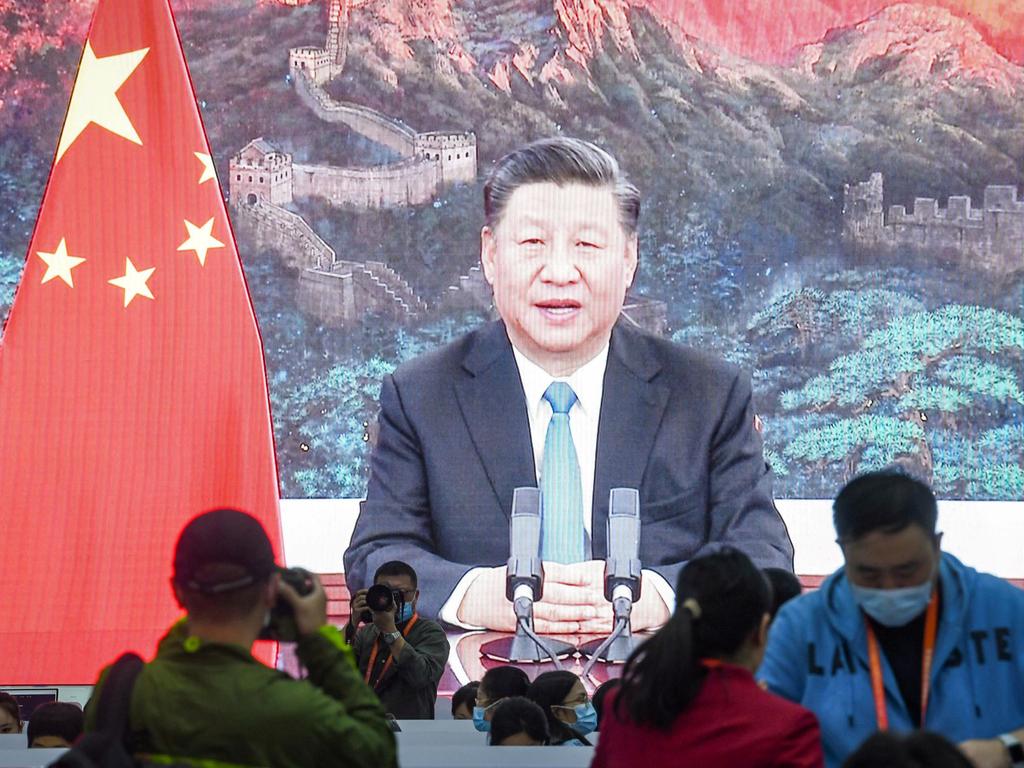

Leader for life Xi Jinping is resisting calls for consumer stimulus and wants to keep spending on building more public assets and more military infrastructure. It is not even clear a change of mind by Xi would be in China’s interests.

Its problem, like Japan’s in its bubble era, is property-fuelled debt. Two of its biggest property developers, Evergrande and Country Garden, are probably insolvent and the property problems are infecting the shadow banking system.

Zhongrong Trust, which manages funds totalling $US87bn, has been unable to make a series of corporate investment payouts. The property squeeze is damaging local government finances as revenue from land sales dries up.

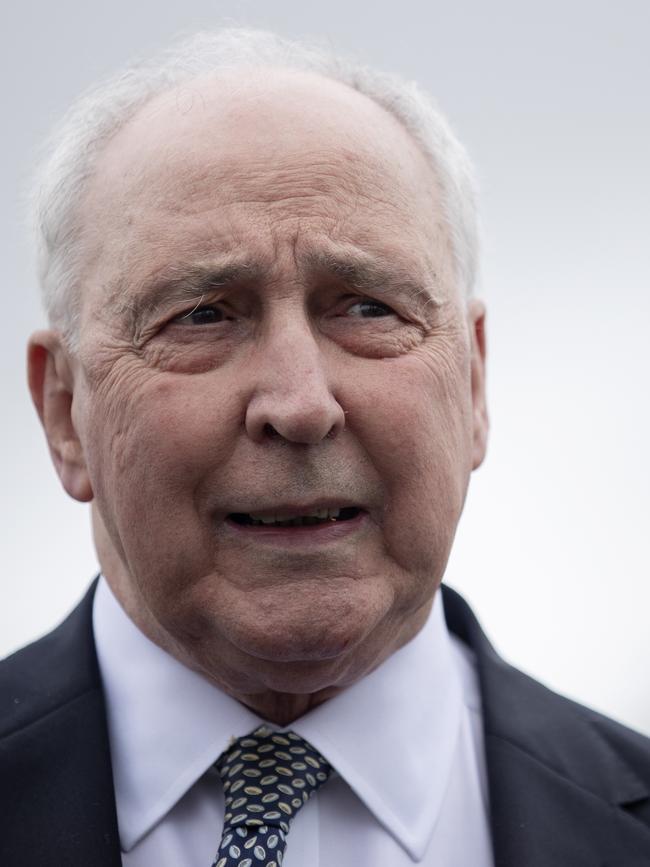

On top of that, Xi – with one eye on Taiwan – miscalculated in offering tacit support for Vladimir Putin’s invasion of Ukraine when the two met in February 2022 at the Beijing winter Olympics. China apologists here such as former Labor PM Paul Keating and former NSW premier and federal foreign minister Bob Carr seem to misunderstand Xi’s interest in Taiwan.

Both have criticised AUKUS and Carr has suggested it would not be too worrying should Beijing emulate its takeover of Hong Kong in Taiwan. This column believes Xi’s Taiwan ambitions are less about historical perspectives on Taiwan than a greedy eye on the nation’s semiconductor industry.

While the media focus here on artificial intelligence has reached near hysteria, there has been little reporting on the role of Taiwan, where most of the world’s chip industry is based and where the main manufacturer of AI chips with 90 per cent of global AI supply, TSMC, is based.

For Australia and the rest of the world, the need to protect Taiwan should be obvious. It is in our region and, with 25 million people, has about the same population as Australia. It is a democracy. And it stands up to Xi Jinping’s bullying.

It also dominates the industry making artificial intelligence possible, and that will have profound military implications.

If there is any lesson to be taken from China’s bullying of Australia these past five years – and its pact with Putin – it is that there is much more to gain by standing up for our own national interest than there is in buckling to unreasonable threats in an effort to preserve export markets.

Talk about the “global rules-based order” means zip to totalitarian dictators who murder their political rivals and invade their neighbours’ countries. Remember, we have a free-trade agreement with Xi that he ignored.

Australian prime ministers since John Howard’s 2007 election loss loaded up the country with useless debt but were too timid to engage in serious economic reform.