Call for consistency in digital radio figures

HT & E boss Ciaran Davis has called on the radio industry to stick to the standard audience measurement for digital audio.

HT&E boss Ciaran Davis has called on the radio industry to stick to the standard audience measurement for fast-growing digital audio broadcasting after questioning rival Southern Cross Media’s use of some figures in last week’s analyst briefing.

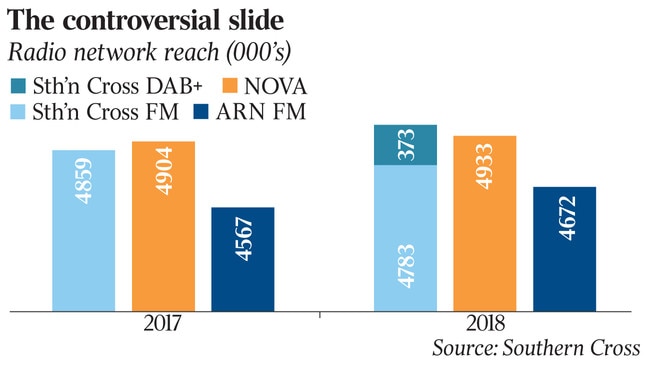

Mr Davis said it was “a little bit cheeky and disingenuous” for Southern Cross to include only its DAB listener figures in a graph that displayed the industry’s overall audience numbers for 2018.

Southern Cross, which operates 80-plus radio stations across its Triple M and Hit Networks, didn’t include the DAB figures for rival networks, HT & E’s ARN network or rival network NOVA Entertainment in the interim financial results presentation to investors last Thursday.

“I think the investment market and advertising market see through it but it’s important for the industry to be consistent in how we report figures and compare apples with apples,” Mr Davis told The Australian.

Southern Cross and ARN are pushing heavily in the fast growing digital radio space.

Mr Davis said the radio industry should stick to using tried and tested industry audience measurement standards to ensure advertisers have as clear a picture of the industry as possible: “We work hard as an industry to make sure that we roll out good audience measurement, consistent audience measurement.

“We don’t want to go down the road of other markets where radio was putting out different figures to suit different operators.

“It just caused confusion among advertisers. Consistency is all really I’m looking for.”

Earlier this month HT & E booked a net profit of $225.5 million for the 12 months to December 31, compared with a net loss of $117.5m in 2017.

ARN, which boasts national radio stations such as KIIS, Pure Gold and The Edge, booked underlying earnings of $84.6m, up 1 per cent from a year earlier.

Its revenue was up 3 per cent to $235.5m. The ARN business delivered an earnings margin of 36 per cent.

Impairment charges against Southern Cross’s television operations pushed the group into the red, with the group on Thursday booking a net loss of $120.3m for the six months to December 31.

Southern Cross said the separation of regional units into audio and television had resulted in a one-off non-cash impairment of $226.9m.

Excluding significant items, the group’s underlying earnings rose 6.1 per cent to $82.9m, with group revenue up 0.2 per cent to $335.7m.

For its part, Southern Cross has been aggregating its digital radio ratings in metro markets.

It claims this provides additional value for advertisers.