Banks slash advertising spending

Banks have significantly reduced their spending on advertising in the wake of the Hayne royal commission.

Australian banks have slashed the amount they spend advertising on metro television in the wake of the financial services royal commission, early data from the Standard Media Index indicates.

The index data, which appeared in UBS’s global investment research and measures ad bookings from major media agency holding groups excluding IPG Mediabrands, reported Australian banks had reduced their spending on metropolitan TV ads by 49 per cent in February, compared to the same month last year.

As a category, domestic banks — including NAB, Commonwealth Bank, Westpac and ANZ — reduced overall media ad spending by 31 per cent year-on-year. The only category with a larger year-on-year decline was food, product and dairy, whose spend fell by 35 per cent.

Other weak categories in agency advertising spend included insurance, down 24 per cent year on year, and travel, which fell by 15 per cent.

The significant reduction in advertising spend follows widespread media coverage around the poor practices of the banks, which were unveiled by the Hayne royal commission, which released its final report in February.

Part of the banks’ spending slump can be explained by a surge in spending last February as the industry amped up its marketing efforts ahead of the royal commission.

Bank ads, combined with Seven’s Winter Olympics coverage and election campaigns in South Australia and Tasmania, boosted television ad spending by 5.4 per cent in February last year.

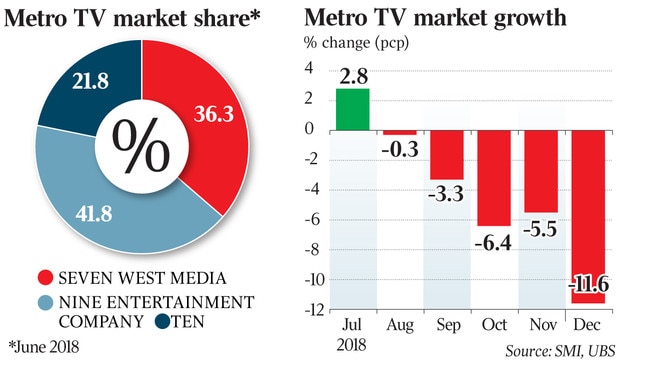

But as revelations of misconduct in the banking and financial services industry emerged and escalated, that spend began to decline. While in first quarter of 2018, the domestic banks category spend climbed 28.6 per cent year-on-year, by the end of the year, the category spend fell by 23.4 per cent.

The interim data shows metro TV ad bookings fell 11.7 per cent compared to February last year.

The figures exclude government spending, as halfway through last year IPG Mediabrands, which is not counted in the index, won the Australian government master media account. SMI also does not capture direct spending that is not channelled through agencies.

Excluding government ad spending, total bookings were down 17.6 per cent year-on-year, according to first look data for the month. However this will be adjusted slightly at the end of the month.

The biggest falls in advertising spend were newspapers and digital, down 17.4 per cent and 36.8 per cent respectively.

Regional TV bookings fell 11.9 per cent for the month, but regional radio was up 0.6 per cent, making it the only segment to report growth. Metro radio fell by 5.9 per cent, and outdoor advertising slipped by 4.4 per cent.

By the end of the month, when late bookings come in, digital and newspaper spending is expected to record a smaller fall.