ARN Media regroups to work on new bid for Southern Cross Media

The radio group remains committed to continue its bid to take over Southern Cross Media after a private equity firm bailed.

ARN Media remains committed to pursuing Southern Cross Austereo after a private equity firm unexpectedly pulled out of negotiation on the weekend over the planned takeover.

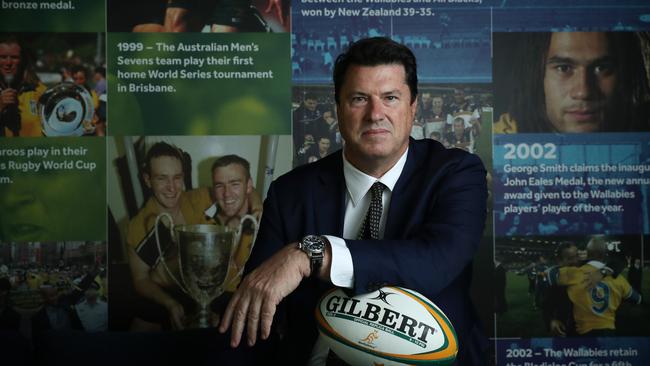

ARN chairman Hamish McLennan said he was surprised when Anchorage Capital Partners elected to cease participating in the planned takeover in what would have been Australia’s largest listed radio deal.

“I thought it was an excellent deal for all shareholders, and we’re more committed than ever,” he told The Australian after the company’s AGM on Tuesday

“ARN wants to see the deal through. We’ve had some extremely interested inbounds since Anchorage pulled out. We are regrouping and looking forward to engaging with SCA again.”

The issue and ARN’s future direction was dealt with and the company’s AGM on Tuesday, with a significant portion of shareholders unhappy with the company’s executive team by 20.2 per cent voting against accepting the renumeration report.

However, Mr McLennan said shareholders were very supportive of the proposed SCA takeover by ARN – which is the home of KIIS’ The Kyle & Jackie O Show.

“ARN will survive very nicely as the leading audio company in the country,” he said at the AGM.

“But all Australian-based media companies need to gain scale.

“The overseas tech giants are wreaking havoc on the entire media industry, and the only long-term way to compete is to get scale. That's why we are so keen to re-imagine both companies.”

ARN kicked off the takeover process in June 2023, when it acquired a 14.8 per cent stake in SCA which then saw the company form a consortium with Anchorage, and make a non-binding indicative proposal in October to acquire SCA through a scheme of arrangement.

Under the proposed transaction, SCA shareholders would have received ARN shares and cash, plus the potential benefit of franking credits. It represented an 29 per cent premium to the SCA share price of 73c in October, and a 46 per cent premium including franking credits.

In March, the consortium indicated that it was willing to increase the offer by up to 10c per SCA share, subject to the satisfactory completion of due diligence.

However, Mr McLennan confirmed that the major sticking point was that Anchorage had grown increasingly concerned about SCA’s regional television assets.

Mr McLennan, who is also the chairman of REA Group, also said SCA was slow to engage formally and appoint advisers.

“Unfortunately, SCA shareholders currently lost the opportunity to work with the old consortium deal and perhaps Anchorage is happier now,” he said.

On Monday, in a statement to the ASX, SCA said it was “disappointed” and "frustrating” and said they were open to other proposals.

As announced to the ASX on Monday, ARN intends to engage with SCA on a revised

proposal. Under the revised proposal, ARN would acquire the same radio assets, and assume 100 per cent ownership of the combined digital audio assets of ARN and SCA.

SCA shareholders would receive up to 0.870 ARN shares for each SCA share. They would also retain their shareholding in SCA, or in a newly listed demerged entity, that would hold the radio and television assets previously expected to be acquired by Anchorage.

ARN said it was also willing to work with SCA to explore any alternative proposals it may receive that provide greater value or cash certainty for SCA shareholders.

This includes any alternative proposals from a third party acquiring NewSCA’s radio or regional TV assets, on a combined or separated basis.

ARN chief executive Ciaran Davis told the AGM that the indicative proposal submitted to SCA would mean ARN would become a focused metro radio network with 10 quality stations across five capital cities, anchored by the KIIS and Triple M brands in each location.

“It will have a significantly larger, growing and profitable regional radio footprint connected with local communities and benefiting from ARN learnings from the successful acquisition of stations from Grant Broadcasting,” he said.

“Revenues would be $440m plus with EBITDA of $105m plus excluding the opportunity for accelerated growth via 100 per cent ownership in scaled digital audio business that is expected to contribute meaningfully to profit and cash flow in the near term.”

NewSCA would own a national network of 44 radio stations, comprised of five HIT branded, and three Gold branded metro stations and 36 regional markets and 96 regional television signals.

Mr Davis said the new entity would be ASX listed with an independent board and management, and is expected to have about $350m of 2024 financial year revenue and $40m of combined radio and television EBITDA on a stand-alone basis before adjusting for expected margin expansion from identified material cost efficiency initiatives.

The NewSCA would enter into a long term content supply agreement with the ARN-owned digital audio platform unlocking a new revenue stream and enabling both parties to benefit from combined scale and efficiency of investment in digital audio.

“This highly strategic proposal proactively positions both businesses for the future as the Australian media sector evolves,” Mr Davis said.

“The commercial rationale is well understood. It aims to unlock both immediate and long term value creation for both sets of shareholders.”

Just after lunchtime, ARN shares were 2.9 per cent lower at 83c and SCA was 1.2 per cent to 85c.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout