Anger as Nine bids for Macquarie Radio

Macquarie investors have hit out at Nine’s low-ball swoop on the radio network that hosts Alan Jones and Ray Hadley.

Macquarie Media investors have hit out at Nine Entertainment’s low-ball swoop on the radio network that is home of Sydney kings Alan Jones and Ray Hadley.

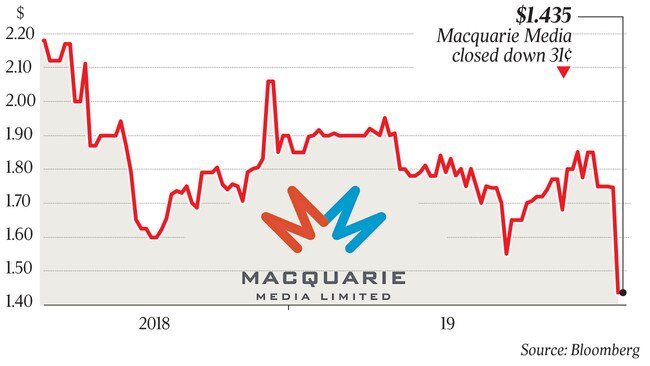

Nine, which inherited its 54.5 per cent controlling stake in Macquarie Media following its $4 billion merger with Fairfax Media, lobbed a $1.46 a share cash offer, which values the radio network at $275.4 million.

The offer is well below Macquarie Media’s closing share price of $1.70 on Friday and is significantly below the near-$2 level it was trading at at the start of the year, but has still won the backing of the radio network’s independent directors.

Macquarie Media’s share price fell about 17 per cent on Monday as a result of the offer. The takeover of the owner of Sydney’s 2GB requires the backing of key shareholders, including advertising boss John “Singo” Singleton who is Macquarie Media’s second-biggest shareholder with a 32.4 per cent stake and venture capitalist Mark Carnegie, who owns 3.6 per cent.

Mr Singleton will receive about $80 million from the sale of his minority shareholding in Macquarie Media if he accepts Nine Entertainment’s offer. But it could have been more: Nine moved to take over the radio station in March, when Singleton’s 32.2 per cent stake was worth more than $100 million.

Minority shareholder Geoff Wilson led the outcry, wondering why Macquarie Media’s independent directors would recommend the offer.

“We are extremely disappointed with the independent directors recommending a bid that is 15 per cent below the current share price,” Mr Wilson told The Australian.

“We are therefore assessing all of our options.”

Nine’s move comes just days after Macquarie Media, which owns stations 2GB, 3AW, 4BC and 6PR, booked a 18.7 per cent drop in annual underlying profit of $14.4 million, hurt by legal costs, impairment charges for its Perth operation and difficult advertising market conditions. Macquarie Media’s No 1 star Jones, 2GB and 4BC were ordered in September to pay more than $3.4m in damages, plus interest, for defaming Queensland’s Wagner family.

After months of uncertainty about Jones’s future at 2GB, he re-signed on a two-year deal, worth $8 million, at the end of May, which paved the way for Nine to buy the remaining shares in Macquarie Media.

Morningstar analyst Brian Han said Nine’s 54.5 per cent interest in Macquarie Radio is a “half-pregnant position that was never going to last”.

“So, once Nine decided it was not part of ‘assets held for sale’, mopping up the minorities was just a matter of time,” he said, adding that perhaps that inevitability is the reason why Macquarie Media’s stock price has held up so well until Monday, given the challenging operating and sector market conditions.

“At the end of the day, there is only one buyer for MRN and that one buyer only really needs to convince one MRN shareholder,” Mr Han said.

Mr Singleton told The Australian in March that a sale of his stake was “inevitable” to avoid future business tensions. “It’s inevitable I will sell it. I will not hang on to it and be a minority shareholder,” he said.

“I am not a great minority shareholder. I would rather have things myself. I don’t like disagreements. It’s best to sell and move on.”

Mr Singleton, who built up 2GB and then listed Macquarie Media on the ASX in 2005 at $1.00 per share, couldn’t be reached for comment yesterday.

Nine boss Hugh Marks said full control of Macquarie Media would strengthen its position in the media industry, which is suffering from weak advertising conditions and pressure from technology giants Google and Facebook.

“The acquisition of Macquarie Media consolidates Nine’s position as the leading provider of news and current affairs content across all of the key platforms: television, digital, print and now radio,” Mr Marks said yesterday.

Mr Marks said the group was investing more than $400 million annually on “providing premium news and editorial content, entrenching Nine as the go-to place for all news needs, for all Australians.”

In addition to cost-cutting at Macquarie Media, bringing the two businesses together would realise further annualised synergies of more than $10 million, he said.

2GB has been Sydney’s most popular radio station for the past 15 years, accounting for 14 per cent of the market, down 0.8 percentage points from a year earlier, according to the latest radio ratings survey by GfK.

Jones, who dominates the breakfast radio market in Sydney, saw his audience slip 0.2 points to 17.4 per cent, while Ray Hadley, who rules the 9am to noon radio airwaves, was down 1.7 points to 16 per cent.

In an email to staff, Mr Marks said the move was a “real positive”, saying he was excited about the “additional string it adds to our bow”.

“The dedicated and talented people who bring the airwaves to life each day will continue today as they did last week, but with the certainty and support of the broader Nine business to enable them to be bold and speak to and for their audience each and every day,” he said an email seen by The Australian. Mr Marks wasn’t available for further comment.

Nine expects to complete the Macquarie Media deal, which includes net debt of $22 million and payment of its August dividend, by December.