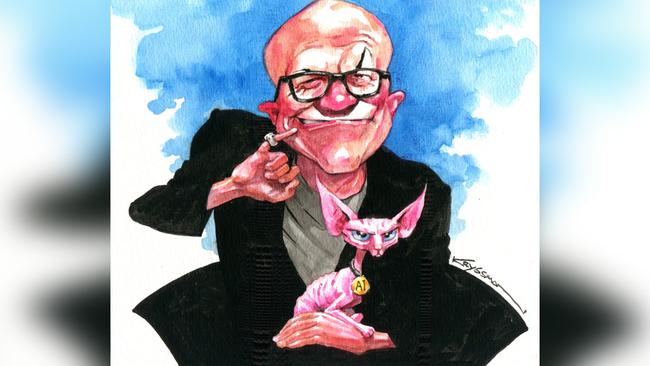

The action for breach of copyright is a long shot but if successful could have dramatic consequences, particularly in Australia which has tougher copyright laws than in the US. It could raise the bar for big tech as it negotiates with News Corporation, the publisher of this publication and others.

Deals have already been reached with German-based Alex Springer, and Associated Press in the US, and others are potentially in the works.

Ultimately the case is important in setting the guard rails for AI, its legal boundaries and a guide for compensation owed for using other people’s work.

The case argues that ChatGPT’s artificial intelligence tools damage the NYT’s relationship with readers and deprives it of subscriptions because, by copying articles and presenting them in search engines, it diverts readers from the main source.

The battleground with generative AI is search, as Microsoft’s Satya Nadella attempts to grab market share from Google.

Google generates more than 70 per cent of its revenue from search and, such is its power, it pays Apple $US16bn a year simply to ensure its search engine takes prime place on Apple devices.

The more that private companies take action to test boundaries the better, particularly for small Australian publishers which lack the clout of the international majors and also given the apparent profound lack of interest in the issue by the federal government.

Former ACCC boss and task-force reform member Rod Sims described the government’s response to the ACCC’s 18-month-old reform proposals on digital platforms as “insipid” as it will undertake another 12 months of consultation.

In a recent paper, law firm King & Wood Mallesons said: “Whether one supports or opposes intervention, a more substantive response (from the government) would have enabled more focused debate, and made a more satisfying holiday read.”

Copyright is a complex area because if a black box computer has read 167 million words and uses the same phrase as you did in a newspaper article, how can you say the computer stole your words?

Media companies are also exploring technological responses to prevent computers from stealing content.

Federal Industry Minister Ed Husic’s response to submissions on AI regulation was due this month but is on hold for the holidays.

The government clearly plans to simply piggyback on international development, failing to take advantage of an early lead of digital issues.

This hurts both innovation and established media, digital companies and consumers.

Artificial intelligence is arguably the output of a statistical process and a predictive technology which has both positive and negative consequences.

The problem with opaque rules

Macquarie University academic Rita Matulionyte argues that the lack of transparency means copyright owners will have difficulty enforcing their rights.

Matulionyte proposes a two-stage approach: the first being a licensing system covering output which competes in the market with creative content.

The second is an exception to data mining used for specific business and scientific purposes, including medicinal and existing use like AI to help retailers know which products are used when.

Everyone except the platforms (which includes Microsoft) wants increased transparency, ethical principles and measures to mitigate bias, but words are not much use without the means to enforce lability for breaches.

Unfortunately, the government response does not provide a clear indication of its regulatory intent and is not the Christmas gift we hoped for. The Digital Platform Services Inquiry has been going since October 2020 with seven interim reports so far and is due for completion in just over 12 months.

Big Aussie stocks cumbersome

A look back at Australian big company stocks shows just why the local bourse has lagged the US and other international exchanges with a distinctly old money and resource base against the US’s so-called Magnificent Seven.

Microsoft, Apple, Google (Alphabet), Amazon, Nvidia, Tesla and Meta have bounced around in value but, with a distinct artificial intelligence ring about them, look a touch different to the iron ore companies and five banks that account for some 75 per cent of the value of the top 10 Australian stocks.

After falling 40 per cent in 2022 and losing $US4.7 trillion in value, the Magnificent Seven tech stocks in the US S&P 500 index, which account for 30 per cent of the index’s value, have powered through this year gaining 75 per cent.

In total return terms, including dividends, the Australian bourse has had a respectable 14 per cent total return (8 per cent gain on price) this year against the S&P 500 which is up 26 per cent in 2023.

Looking back at the top 10 since 1948 it is extraordinary how many of past members have been swallowed by today’s members, including Rio which along the way snapped up North Broken Hill, Hammersley, EZ industries and Consolidated Zinc.

Non-members like Japanese brewing giant Asahi snapped up what was Tooth, Elders and CUB. BHP took over Western Mining.

The Bank of NSW was renamed Westpac and acquired AGC while US giant Citicorp acquired Industrial Acceptance Corp.

ANZ was created from the roots of others such as Australasia Bank and Union Bank of Australia while NAB cleaned up Commercial Banking Co.

These are but a handful of top-10 deals showing just how consolidated Australian industry has become and why the ACCC was leery about ANZ snapping up Suncorp Bank.

Telstra is a classic example, up 973 per cent in total return terms (against the market up 972 per cent) since topping the charts in May 1998 valued at $48.4bn against $45.6bn – increasing by just 8 per cent in price over the period against the market up 195 per cent.

The bottom line is none of the top five are going to power significant moves on the Australian bourse.

Eight months of negotiations between Microsoft’s ChatGPT and the New York Times have broken down. The publisher has drawn a line in the sand and is seeking a jury trial to exploit anti-digital platform sentiment in its landmark law suit.