The Pfizer vaccine still has a lot of testing to be approved, but there are rival vaccines that are just as advanced so the markets have assumed success.

There were dramatic rises in US and European share prices but what fascinated me was the switch in direction in share investing and the sudden rise in bond yields as bond prices collapsed.

Currently the world is awash with cash. It has been sitting in bank accounts with holders not sure where to place it. The safest place seemed long term bonds but recent bond investors have lost heavily.

In the last year vast sums have been poured into the great US high growth technology stocks, such as Facebook and Amazon. But overnight they declined in price as money swirled to a different direction as those looking into the post COVID-19 crystal ball deserted them in favour of value stocks.

Among the best gains were the small smaller enterprises as measured in the Russell 2000 index, which skyrocketed more than 5 per cent. But the very big rises came in the stocks most hammered by COVID, such as cruise operators and movie theatres. Cruise line Royal Caribbean jumped 25 per cent.

Of course as always happens in sharp upward movements in the stock market, those who were shorting stocks – selling shares they didn’t own and borrowing the securities – had to buy back. And normally these traders when they cover go “long” hoping to ride the higher market and cover their losses.

That propels the share market even higher and Wall Street last night was a classic illustration of that phenomena.

This shorting and covering process often causes markets to rise too quickly when there is a change in direction.

But the sort of movement we have seen on Wall Street this week is larger than a simple short cover correction.

Challenging assumptions

The markets are signalling that they expect that in the second half of 2021 and beyond that the virus will be under control and there will be a much stronger US and world economy.

Of course the vaccine may fail, but if the markets are right then a lot of the assumptions we have been making about the future will be challenged.

The assumption that everybody has made for the next two or three years is that interest-rates are going to remain at token levels.

The latest rise in US bond yields is the first challenge to that assumption. It’s certainly not a conclusive challenge but for some weeks now the US bond yield has been rising and so the latest movement above 0.9 per cent in 10 year bonds is the continuation of a trend.

Once American 10 year bond yields rise above 1 per cent then the very low rates at which corporations have been borrowing will need to rise. And any such movement will spread around the community. I emphasise that we certainly have not reached anywhere near that stage yet, but we will need to watch those 10 year US bonds very closely. Gold investors got a whiff of that fear and the yellow metal fell sharply.

Sharemarkets traditionally look further ahead than immediate trading and what Wall Street is signalling is that we are headed for much more prosperous times.

We have a world awash with cash so people with spare cash are now buying physical assets that earn returns and the quickest way to do that is via shares.

But there is an additional boost that is peculiar to the United States although the vibrations spread around the world. In many ways it was a perfect US election result for markets.

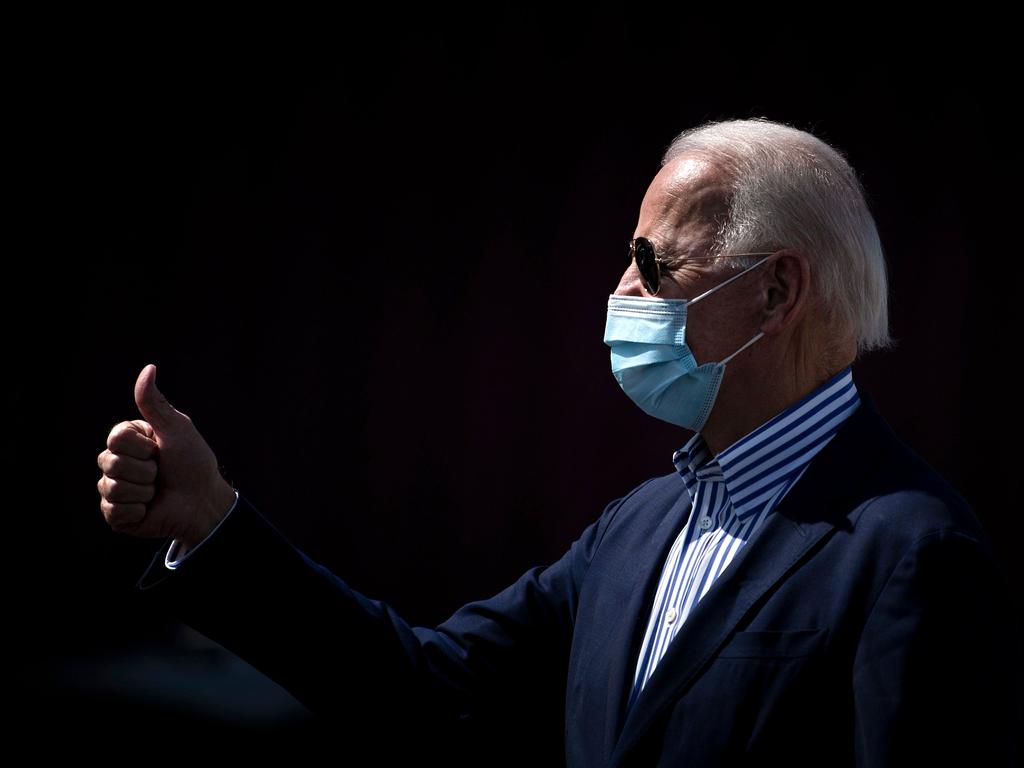

President elect Joe Biden wants to spend at a higher rate than Donald Trump was prepared to do. That means a big boost to the economy. But Biden has a rampant left wing in his party with nasty anti-market agendas. But stunningly, although Donald Trump was defeated, the Senate is almost certainly set to stay in Republican hands and the Democrat majority has been reduced in the House of Representatives.

Rightly or wrong this is accentuated the power of the Democrat’s moderates in the Biden administration, who are blaming the left wing of the party for this reverse.

At the same time Republicans encouraged by their strong total vote will take a tough line in the Senate against radical Democrat proposals. This is manna from heaven for markets.

Australian situation

Here in Australia we are unique in the world among developed countries because our infection rate has dropped to token levels. If the rest of the world can get COVID-19 under control by 2022 and then Australia will look a very attractive place for visitors, migrants and investors. This is the scenario that NAB chief executive Ross McEwan outlined last week.

But if the world resumes a highly stimulated growth path in the wake of the virus then we will see rising world economic activity and a high demand for minerals.

Our sharemarket has always been closely linked to world trends and that won’t change. But the world post-COVID will be different. The one area of clear agreement between Trump and Biden is that there should be much greater manufacturing of goods and provision of services in America.

And that means less in China, so to the extent that our growth depends on China, it will be curbed. We will need to be offset that threat via new markets.

If Wall Street is right we are set for a very different world. And last night we were given a market-created preview of that world and what will happen when COVID-19 is brought under control.