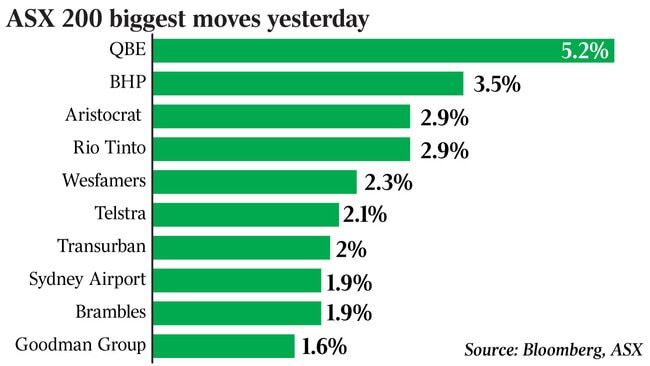

After breaking its October peak at 6248.3 points in early trading, the benchmark S&P/ASX 200 index closed up 1.8 per cent at an eight-month high of 6298.8 points.

After falling 39 per cent from a record high in February to a seven-year low of 4402.5 in March amid coronavirus lockdowns, the ASX 200 has now bounced 43 per cent amid unprecedented fiscal and monetary policy stimulus. As of Monday it was 14 per cent below its pre-COVID peak.

“The market has finally broken out of a six-month trading band to an eight-month high,” said Richard Coppleson, head of institutional sales and trading at Bell Potter.

“Many bears still don’t believe it can hold and are still waiting — a few remain heavily cashed up — despite them being wrong now for eight months.”

It came as Wall Street futures burst higher in anticipation of a further positive reaction to diminishing political uncertainty in the US and the prospect of moderate fiscal stimulus without the tax hikes and more radical policies feared under a clean sweep by the Democrats, despite record new US cases of COVID-19 and the threat of fresh lockdowns.

“For markets, the irony is that this rollercoaster of an election has meant relative tranquillity,” said Morgan Stanley’s chief cross-asset strategist, Andrew Sheets.

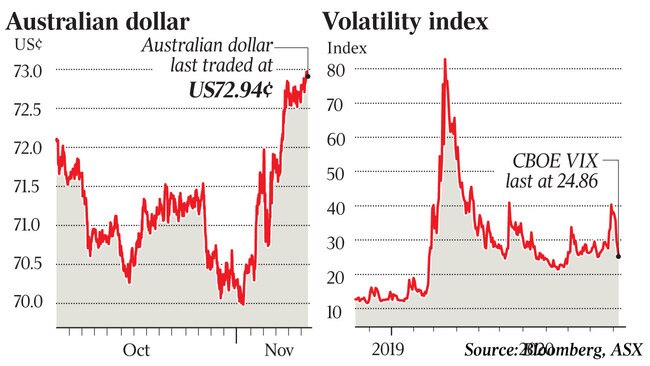

“Implied volatility has dropped sharply, and equities and credit have rallied back near local highs.”

Mr Sheets said markets were already braced for uncertainty, making it easier for them to follow the usual pattern of struggling ahead of an election and improving afterwards.

Nasdaq futures were up 2.6 per cent — later pared to 1.9 per cent — amid expectations that “reactive” rather than “proactive” fiscal policy in the US will keep Treasury bond yields in check and leave the onus on the Federal Reserve to stimulate by increasing its asset-buying program, helping support the valuation of high-flying tech stocks, many of which are also “COVID winners”.

Elsewhere in the region, Japan’s Nikkei 225 rose 2.1 per cent on Monday, China’s Shanghai Composite was up 1.9 per cent, the Hang Seng in Hong Kong rose 1 per cent, South Korea’s KOSPI rose 1.7 per cent and New Zealand’s NZX 50 gained 1.8 per cent.

The Australian dollar rose to US73c for the first time in six weeks despite interest rate cuts and the start of a major bond-buying program by the Reserve Bank last week.

“Markets were left with a scenario that suggests fewer legislative changes and thus fewer portfolio changes,” said Mr Sheets.

He also noted that with Democrats likely to control the White House but with congress set to remain divided, the chance of a larger and more proactive fiscal stimulus had fallen.

“Proactive is the operative word here, as our US public policy team sees divided power leading to increased risk that more fiscal help wouldn’t arrive until economic problems worsen,” he said.

“Reactive fiscal stimulus or none at all also means that developments relating to the pandemic become more critical for markets.

“We’ll be closely watching COVID-19 case numbers, which are rising again in the US and Europe, and announcements on a vaccine, which our biotechnology team expects later this month.

“While we’re hopeful on the latter, mounting case numbers and no new fiscal relief have created some downside risk to the economic data in the near term.”

Also reflecting the “risk-on” mood, industrial commodity prices rose despite worsening COVID trends in Europe and the US, with West Texas crude oil futures surging 2.6 per cent to $US38.12 a barrel and Comex copper futures up 0.6 per cent in Asian trading.

“Greater political certainty following the US presidential election is driving sharp declines in cross-asset implied volatility,” said Axi chief global markets strategist Stephen Innes.

“This dynamic is especially pronounced in US equities and the Chinese yuan, which pushed the S&P 500 to its best week since March and USD/CNH to the lowest level since June 2018.”

In his view investors were working off the remnants of election risk, recognising that a split Congress was still suitable for stockmarkets on the “silver-lining premise” that the two parties will keep each other in check on issues like taxes and regulation, as investors rotate back into global risk assets on the “Biden bounce”.

Meanwhile, traditional safe haven investments including the US dollar, the Japanese yen, US government bonds were mostly weaker, although gold was supported by US dollar weakness.

“Gold investors seem to like the idea of just enough stimulus to weaken the US dollar, push gold higher but will not necessarily cause yields to rise sharply — kind of the best of both worlds for gold,” Mr Innes said.

“The US dollar is looking like a lousy safe haven given the US political and economic uncertainty, which looms ominously.”

Still, he warned that bears were lying in wait for the recent bout of market-pressured buying — driven by the post-election implosion of volatility — to fade.

“The bounce could prove short-lived and once exposures rise back to high levels, hedges need to be put back on and at that point, extreme positioning could exert short-term bearish pressure due to rising COVID case counts,” he cautioned.

A euphoric reaction to Joe Biden’s narrow win in the US presidential election saw investors add $35bn of market value to the local stockmarket on Monday.