Wave of profit-taking amid the superpowers’ finger-pointing

Escalating US-China tensions, disappointing US economic data and a lack of progress on US fiscal stimulus sparked profit-taking in risk assets.

Escalating US-China tensions, disappointing US economic data and a lack of progress by US politicians on the next round of fiscal stimulus sparked profit-taking in risk assets this week.

After the US told China to shut its Houston consulate on Wednesday, US secretary of state Mike Pompeo ramped up anti-China rhetoric and Beijing told the US to close its Chengdu consulate.

While there was no indication that this was about to spill into another tariff war, it added to a wave of profit-taking that began when US initial jobless claims rose more than expected.

The tensions came as lingering differences among Senate Republicans and the White House stalled the rollout of their proposal for another pandemic relief package, and Majority Leader Mitch McConnell said the $US1 trillion ($1.4 trillion) GOP plan would not be ready until Monday. The US supplemental unemployment insurance approved in the last relief bill was about to expire with no replacement in place.

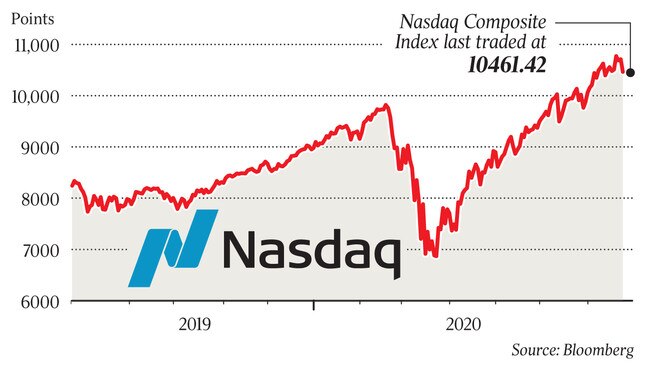

After the Nasdaq dived 2.3 per cent on Thursday, Nasdaq futures fell more than 1 per cent and S&P 500 futures fell 0.6 per cent in Asian trading on Friday, pointing to another fall on Wall Street.

China’s Shanghai Composite fell 3.9 per cent — its third-biggest fall this year — while the tech-heavy Shenzhen Composite dived 5 per cent and the ChiNext index lost 6.1 per cent. Purchasing manager’s indexes for July had the potential to tip the balance overnight, but better-than-expected readings for UK and eurozone PMIs did not stop the sell-off spreading to Europe, with the Euro Stoxx 50 down 2.1 per cent and the FTSE 100 down 1.6 per cent in early trading.

After rising as much as 2.2 per cent to a four-month high of 6160.6 points as vaccine developments boosted global markets and the government delivered a bigger-than-expected extension of fiscal stimulus via its JobKeeper and JobSeeker programs, Australia’s benchmark S&P/ASX 200 index lost 0.2 per cent for the week after dropping 1.2 per cent to 6024 points on Friday.

The dollar had a similar pullback, to US70.75c, after hitting a 15-month high of US71.82c on US dollar weakness, domestic fiscal stimulus and positive guidance from the Reserve Bank.

But highly stimulative fiscal and monetary policies provide a positive backdrop and US fiscal stimulus is likely to be increased by more than the $US1 trillion starting point set by the White House.

However, there is an argument that economically sensitive stocks would benefit more than the tech giants if vaccine progress helps the economic outlook. And the prospect of a Democrat-led White House unwinding US corporate tax cuts could be worse for US mega-cap tech stocks as well.

Canaccord’s chief US equity strategist, Tony Dwyer, says the stage is set for a rotation to cyclicals. “We believe the combination of incredible monetary and fiscal stimulus, historic excess liquidity, a synchronised global economic recovery and significant underperformance of the economically sensitive areas set the stage for a long-term rotation into the industrial, financial, materials and consumer sectors,” he says. “If the mega-cap ‘stay at home’ stocks are still leading over the next six to 12 months, it would mean the economy is still largely shut down, which would likely create a very negative backdrop for credit.”

Given the historic issuance of credit this year, if a very negative outlook for credit were to re-emerge — perhaps from too many downgrades or bankruptcies overwhelming the Fed’s junk bond buying — that would bring about significant market risk.

And there are factors that could create increased near-term volatility, including profit-taking in the “stay at home stocks”, the coming election, talk of tax increases, and the escalating tension with China, particularly if it restarts a trade war, however unlikely that seems now.

“But we believe our core thesis and the very different macro backdrop versus 1999 suggest any pullbacks should prove temporary,” Dwyer says.

Meanwhile, UBS quantitative analyst Pieter Stoltz compared the price-to-earnings valuation of ASX 200 stocks relative to their sectors — adjusted for the effect of high PEs in the healthcare and tech sectors, which have been pumped up by record low rates.

Based on estimates for 2021-22 earnings, Aristocrat Leisure, Aurizon, Crown, Reliance Worldwide and Worley were “relatively cheap” among ASX 200 stocks rated a buy by UBS. Afterpay, ASX, Cochlear, Evolution Mining and Sonic screened as relatively expensive among the sells.