Stocks record biggest annual loss in eight years

A stellar June quarter has masked a weak financial year for Australian shares, as investors were hit with their biggest full-year loss in eight years.

A stellar June quarter has masked a weak financial year for Australian shares, as investors were hit with their biggest full-year loss in eight years.

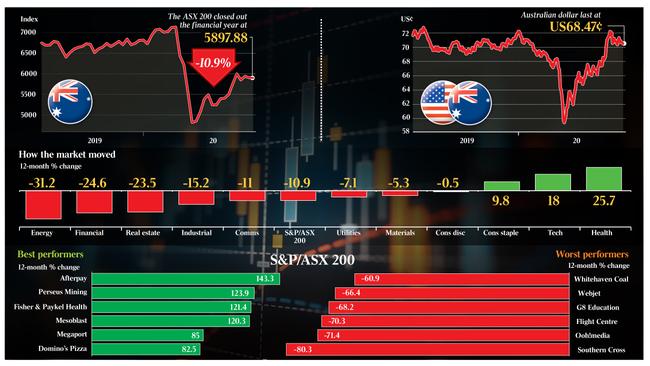

The benchmark S&P/ASX 200 fell 10.9 per cent in 2019-20 — its first decline since 2015-16 and biggest drop since an 11 per cent decline in 2011-12 — as the coronavirus pandemic and associated lockdowns hit economic growth and sapped corporate profits.

But investors can take comfort in the fact that the index rose 16.2 per cent to 5897.9 points in the June quarter after an unprecedented fiscal and monetary policy response and faster-than-expected economic reopening, even as a second wave of the coronavirus caused localised lockdowns across Melbourne.

It was the best quarter for local shares since a 20 per cent rise in the September quarter of 2009.

Still, super funds were set to post a small negative return for the financial year, the first in 11 years.

With one global business day remaining, a median growth fund 61-80 per cent invested in growth assets was heading for negative return of 1.3 per cent, according to Chant West.

“While a negative result is never welcome, containing the loss to such a small number must be considered a good outcome considering the chaos the world has been thrown into by COVID-19,” Chant West senior research analyst Mano Mohankumar said.

Moreover, some analysts said investors were still underestimating the upside potential from a recovery in economic growth and earnings as the world learns to live with the COVID-19 virus.

“Typically you see price-to-earnings multiples expand before earnings recover,” said MST Marquee senior research analyst Hasan Tevfik. “It refutes the view the market is expensive.”

Whereas the market PE ratio on a 12-month forward basis this month hit a record high near 21 times, Mr Tevfik said investors should use a cyclically adjusted or “through-the-cycle” PE ratio.

“Many people are using a current-year earnings number which is depressed by almost 30 per cent, but we use a 10-year average estimate for earnings,” he said. “On our numbers, the market is cheap.

“Valuation by itself is never enough but it probably suggests there’s more upside to come.”

Energy was the worst-performing sector in the past financial year as oil prices plunged on the prospect of weaker economic growth and a massive reduction in travel demand.

The Real Estate sector also suffered the effects of social distancing on shopping malls and rents and the work-from-home phenomenon hit commercial property rents, while the financials sector was hit by a slump in banks as regulators forced them to bolster their capital and property prices cooled.

Notwithstanding a recent switch to value stocks, the S&P/ASX 200 Banks index lost 28 per cent.

The big winners were the healthcare, information technology and consumer staples sectors as the combination of growth risks and low interest rates crowded investors into stocks with defensive and growth qualities, while staples also benefited from panic buying of food and essential goods.

Afterpay was the standout with a 143 per cent rise, followed by gold miner Perseus Mining with a 124 per cent gain, and Fisher & Paykel Health Care, which surged 121 per cent in the period.

Domino’s Pizza, JB Hi-Fi and Xero were big winners with gains of between 43 per cent and 69 per cent. Some materials stocks also excelled, with Fortescue up 54 per cent and James Hardie rising 47 per cent.

MST’s Mr Tevfik said that on a through-the-cycle basis, the long-term average PE multiple of the Australian sharemarket was 21 times and the average over the past decade was 18.5 times. But on his estimates, the Australian market was trading on 17.4 times through-the-cycle earnings.

While extremely low interest rates could be used to justify an even higher valuation, he said such low interest rates also reflected a lower outlook for the economy and corporate earnings.

Analysis by The Australian showed the longstanding All Ordinaries index, which rose 17.4 per cent in the June quarter, has only gained at least 15 per cent for a quarter on 13 previous occasions. In 70 per cent of those events, the next quarter has been positive, by an average of 10.8 per cent.

“I think it highlights where the investment landscape is and it provides a guide to what could actually eventuate,” Mr Tevfik said. “We’re positive on the local sharemarket.

“I’m guessing a lot of the time you see it 15 per cent up (in a quarter) and then a double-digit up (in the next quarter) will be in a very similar situation. You’re just coming out of a downturn.”

But Morgan Stanley Australia head of research Chris Nicol cautioned that the impact of the pandemic had “created a high degree of stale estimates” for corporate earnings.

“Post the onset of COVID-19, increased prevalence of companies withdrawing guidance combined with continued volatility in trading conditions, as reopening phases have waxed and waned with the virus evolution, have seen point estimates embedded within consensus averages continue to age and in many cases become outright stale,” he said.

“Traditional valuation techniques using near-term earnings have been compromised and sequential momentum and snapshot trading updates have taken over from more traditional guidance communication, (but) this window of accepted compromise is closing (with the financial year end).”

Mr Nicol noted that while companies have had some leeway in their continuous disclosure requirement relating to their results, this window forbearance from litigation risks would end.

“We concur with comments made by APRA chairman Wayne Byres that companies continue to promote transparency, and not be tempted to panic and switch the lights-off in the mistaken view that it’d be better for everyone to operate in the dark,” he said.

“So, while companies have less risk of being sued thanks to disclosure forbearance, this does not reduce the requirement to update the market in the spirit of broader disclosure principles.”

But MST’s Mr Tevfik said investors should look through the near-term uncertainty as the world was “learning to live” with the pandemic and vaccine development was an “upside risk”.

“We’re positive on the market, but we’re not assuming any vaccine any time soon,” he said.

The reimposition of restrictions in 10 Melbourne postal areas late on Tuesday saw the S&P/ASX 200 pare its intraday rise from 2.4 per cent to 1.4 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout