Capital raising craze isn’t over

Investors expect this year’s capital raising frenzy by ASX companies may slow — but it is far from over.

Investors expect this year’s capital raising frenzy by ASX companies shoring up their COVID-19 balance sheets, which sparked the biggest quarter for issuance in a decade, may slow — but it is far from over.

The pandemic and the nation’s first recession in almost 30 years prompted a capital raising rush in the past three months, as large parts of the economy went into hibernation. The five largest capital raisings this year were executed by National Australia Bank, Qantas Airways, Vicinity Centres, Ramsay Health Care and QBE Insurance.

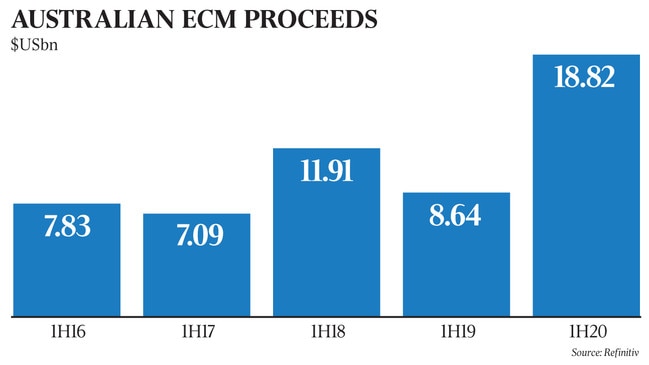

Total issuance of new shares in Australia amounted to $US14.9bn ($21.8bn) in the June quarter, more than double the amount in the same period last year, and the strongest quarter since late 2010, according to Refinitiv data.

For the first half of 2020, equity raisings totalled $US18.8bn, which marked the biggest tally since $US20.1bn in the first six months of 2015.

The 2009-10 period, in the wake of the global financial crisis, saw ASX-listed companies tap investors for a record $100bn as funding markets froze.

This year’s pandemic has hit some parts of the economy very hard, particularly travel, tourism and education, while the banks are dealing with repayment pauses for up to six months on a combined $236bn in loans.

In the equity raising stakes, Macquarie Capital leads the pack in the league tables so far this year, working on deals amounting to $US4.3bn.

It is followed by Goldman Sachs, JPMorgan and UBS.

Globally, investment banking fees surged to a record $US57bn in the first six months of the year, underpinned by large equity and debt raisings to navigate COVID-19.

Macquarie’s head of capital markets Hugh Falcon said ASX companies that raised equity had been “well supported” by their shareholders.

He said the challenges posed by COVID-19 would see others continue to assess funding options via equity or debt markets.

“Australia benefits from very efficient equity capital markets as well as a deep pool of superannuation and investment funds that can be accessed quickly and on very competitive terms,” he said.

He also noted that some companies would step up efforts to find acquisition opportunities.

“We will see an increased number of companies looking to fund growth including M&A (mergers and acquisitions) through equity markets as opportunities arise for their businesses,” he said.

Regal Funds Management’s investment chief Philip King cited the better-than-expected performance of the domestic economy during COVID-19 to explain why there had been fewer raisings than he had initially expected, but noted there would likely be many more 2020 capital calls.

“The success of Australia’s fiscal stimulus means the economy hasn’t been as affected ... but obviously that fiscal cliff in September is looming and that will be an important test,” he said.

“We still expect more (capital raisings) in the next six months.”

Regal sees a “tremendous amount” of opportunity in the smaller end of the ASX, particularly in the technology and healthcare sectors.

The capital raising rush has also been buoyed by fund managers looking to deploy higher cash stores, some of which were allocated to safer asset classes when valuations soared early this year and as the pandemic started to grip markets offshore in March.

Cyan Investment Management director Dean Fergie said as the market bounced back share price discounts for equity raisings had become “less attractive”, and fund managers were also being more selective about which ones to participate in.

“The door got flung wide open and every company that thought it could raise money did,” Mr Fergie said.

“All that easy capital has been raised and I think the next quarter will be fairly quiet,” he added.

But Mr Fergie cautioned that risks posed by the reopening of the economy and second waves of COVID-19 infections could see some companies return to shareholders in the December quarter for a “second bite” of capital from investors.

“The whole (COVID-19) outcome is so knife’s edge,” he said, noting more capital raisings could hit the market in 2020’s final quarter.

The Refinitiv data showed a large slump in M&A activity this year as the pandemic largely saw companies focus on funding, supply chains and keeping workers safe.

Australian deal activity dropped to $US24.9bn in the first-half of this year, compared to $US48.2bn in the same period in 2019.

Investment banking fees across the domestic industry hit $US1.03bn in the six months ended June 30, compared to $US1.02bn in the first half of 2019.

Mr Falcon said it was difficult to pinpoint when the pipeline of ASX floats would recover.

“It’s probably too early to provide a lot of insight on that, other than the early signs are encouraging,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout