Stockmarket soars to a record high on hopes of interest rate cuts

A faster-than-expected cooling in inflation in the December quarter has fuelled expectations of interest rate cuts as early as August.

The Australian sharemarket jumped to a record high on Wednesday after a faster-than-expected cooling in inflation fuelled expectations of interest rate cuts as early as August.

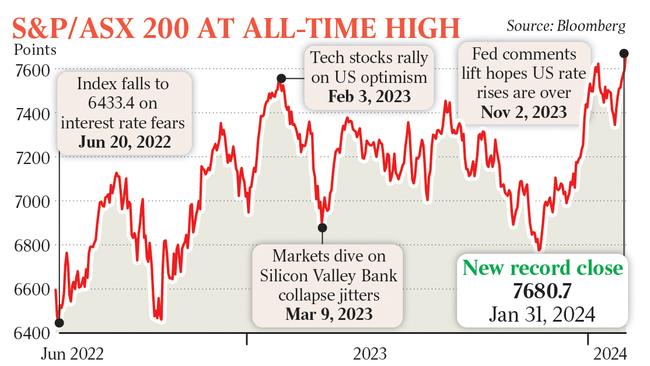

At one stage, the benchmark S&P/ASX 200 Index soared 1.1 per cent to an all-time high of 7682.30 points, surpassing the previous record of 7632.80 points set in August 2021.

The ASX 200 finished the day near its highs, ending 1.1 per cent stronger at a record close of 7680.70 points – exceeding the August 2021 record of 7628.90 points.

It was the sharemarket’s eighth straight day of gains and longest winning streak in 10 months.

The broader All Ordinaries Index rose 1 per cent to 7912.80 points.

The catalyst was inflation cooling more quickly than expected in the December quarter, slowing to 0.6 per cent quarter-on-quarter and an annual rate of 4.1 per cent.

The Reserve Bank of Australia is expected to leave the cash rate on hold at its meeting next week, with financial markets and many economists expecting it to start cutting rates later this year.

IG markets analyst Tony Sycamore said the consumer price index data was “music to the ears” of the ASX 200.

“Following (Wednesday’s) cooler-than-expected CPI data, the Australian rates market is again pricing two 25-basis-point RBA rate cuts in 2024,” Mr Sycamore said.

“The first is priced for August, and the second is now almost 100 per cent priced for November.”

Saxo head of foreign exchange strategy Charu Chanana said the market should be pricing in more than two rate cuts by the RBA.

“The RBA meeting is next week, and we’ve still only priced in about 50 basis points of rate cuts from the RBA this year,” Ms Chanana said.

“There’s a lot of scope for RBA pricing to catch up with the pace the US Fed might have, and of course (taking into account) ongoing China risks.”

Commonwealth Bank head of Australian economics Gareth Aird and economist Stephen Wu said they expected the RBA to start cutting rates in September, tipping 75 basis points of cuts in late 2024 and a further 75 basis points in the first half of 2025.

“The job of returning inflation to the 2-3 per cent target band is not yet done. But the RBA is now on the home straight,” Mr Aird and Mr Wu said in a research note.

While the sharemarket rallied after the inflation data, the dollar fell from about US66c to US65.66c by 5pm AEDT, down 0.5 per cent for the day.

Capital.com senior financial market analyst Kyle Rodda said the dollar slipped as markets priced out the odds of further RBA hikes, and was dealt another knock after more underwhelming Chinese manufacturing activity data.

All sectors on the ASX finished in the green, led by strong advances by real estate, utilities and financial stocks.

The heavyweight banks boosted the ASX 200, with Bell Potter director of institutional sales and trading Richard Coppleson noting heavy trading in the four major banks.

“With rate cuts now coming next (later in the year), we saw heavy buying in the banks,” Mr Coppleson said.

CBA set a fresh record high of $118.24 before closing with a 1.3 per cent gain at $117.53.

NAB and Westpac hit two-year highs, with both ending 1.5 per cent stronger at $32.60 and $24.18, respectively. ANZ also rose 1.5 per cent, to $27.20.

Debt buyer and collector Credit Corp lost 2.6 per cent to $17.21 after booking a first-half loss following an impairment on its US debt ledger.

Market and mining heavyweight BHP rose 0.5 per cent to $47.27, Fortescue lifted 0.6 per cent to a fresh record of $29.88, and Rio Tinto was up 0.4 per cent to $132.92.

IGO, however, dropped 2.2 per cent to $7.56 as it moved to mothball its under-construction Cosmos nickel mine in response to the nickel price plunge.

Energy giant Woodside gained 1.7 per cent to $32.41 and Santos lifted 1.2 per cent to $7.85.

Origin Energy led the utilities sector higher with a 2.7 per cent increase to $8.52, despite reporting a 4 per cent decline in LNG exports in the December quarter.

Mr Coppleson said markets now awaited news, at 6am AEDT Thursday, from the US Federal Reserve after its two-day meeting.

He said the Fed was expected to keep rates on hold but markets were focused on Fed chair Jerome Powell’s comments.

“There has to be a big chance he says that rate hikes are now done,” Mr Coppleson said.

“ … But he’ll without doubt say cuts are still not coming in the immediate future.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout