Shares still best game in town, despite ‘one-off’ hit

One of Australia’s best known fund managers has urged investors to look past a slump in corporate earnings in the August reporting season.

One of Australia’s best known fund managers has urged investors to look past a slump in corporate earnings in the August reporting season due to a “one-off” impact from the coronavirus and focus on the fact that shares offer significantly better returns than bonds.

“There’s no doubt that earnings are going to take a big hit when companies report their results,” Regal Funds Management chief investment officer Phil King says.

“Earnings growth, which has been trending down for over 10 years, should be negative but I’d encourage investors not to get too distracted by earnings announcements and the headlines.”

In an investment update and overview of the Regal Investment Fund — a listed trust targeting risk-adjusted and non-correlated returns over the medium term via selection of hedge funds managed by Regal — King says the coronavirus may be “one of the largest one-offs in history”.

“It’s important that investors look through short-term earnings and try to forecast future earnings,” he says. “In many ways, 2019 could be your best base to estimate earnings going forward.”

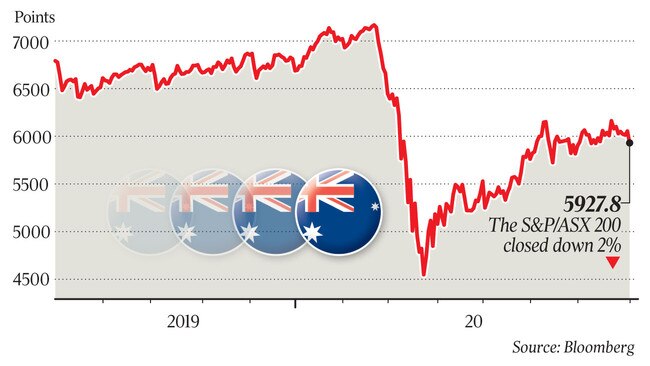

His comments came as the S&P/ASX 200 index dived 2 per cent to a three-week low of 5927.8 points on Friday amid worsening coronavirus outbreaks at home and abroad. The index fell 1.6 per cent for the week, its worst week in four, after Victoria reported 627 COVID-19 cases for the preceding 24 hours. NSW reported 21.

Banks underperformed, with Westpac down 3.3 per cent to a two-month low of $17.09.

Qantas dived 3.9 per cent to four-month low of $3.23, leaving investors who bought shares in airline’s capital raising last month down 12 per cent.

But stocks directly exposed to COVID-19 impacts — including Vicinity Centres, Scentre Group, Transurban, Crown Resorts, Sydney Airport, Flight Centre and Webjet –— outperformed the broader market on Friday after underperforming during the month.

And some energy and materials sector companies not significantly exposed to COVID-19 in Australia — including BHP, Rio Tinto and South32 — underperformed on Friday after surging over the past month.

Despite modest gains in S&P 500 futures as tech giants including Apple, Amazon, Alphabet and Facebook surged in after-hours trading following their results, Australian shares appeared to track the Japanese market, which fell 2.8 per cent on Friday.

After falling as much as 39 per cent from a record high of 7197 points in February to a seven-year low of 4402.5 in March, the ASX 200 bounced 41 per cent in the next seven weeks — marking its fastest ever bull market — amid unprecedented fiscal and monetary policy stimulus globally.

A 0.5 per cent rise in July made it the weakest month since a 21 per cent fall in March.

“This bounce in the market and the fall in earnings has made the market look expensive versus its historical levels,” King says.

“The PE (one-year forward) in the Australian market, is now approaching 20 times, and many commentators think the Australian market is very expensive.”

But the earnings yield of shares remains “very attractive” compared to other asset classes.

“Earnings yields have fallen, but they are nowhere near as low as the yields on bonds,” says King, who was inducted to the prestigious Australian Fund Manager Awards Hall of Fame last year.

Regal’s Australian Long Short Equity Fund was Mercer’s top-ranked domestic manager last quarter, with a 30.8 per cent annualised return before fees, and was also first over three years.

But the flagship Regal Atlantic Absolute Return Fund, which invests in companies listed in Australia and other Asian markets, has returned a stellar 24.8 per cent per annum since inception in 2004, but had a tough time coping with the extreme market volatility earlier this year.

Even after rising 30.5 per cent since March, the fund was down 61.24 per cent in the year to date.

“Real bond yields are negative in many countries and in our view this makes equities still very attractive on a relative basis,” King adds.

“Whether you think a 6 per cent future return on Australian equities is expensive or cheap, really depends on what you compare it too. Compared to historical levels, it’s certainly expensive, but compared to bond and many other asset classes, returns on equities over the next five years will remain very attractive.”

King adds that while he is still concerned about the economic and stockmarket impacts of the pandemic, he is “less concerned” about the chance of “another leg down” in the market than he was at the time of his last update in April.

“What’s changed is the fact that Australia has coped a lot better with the pandemic than initially anticipated, despite the recent outbreak in Victoria,” he says. “The amount of fiscal and monetary stimulus has also been a lot larger than we expected, and this has probably had a much more effective impact on the economy than most observers anticipated. Commodity prices have stayed a lot stronger than we expected.”

But he says it “took the Australian stockmarket almost 10 years to regain its high that we saw before the global financial crisis and I think it could be a considerable period again before the Australian market sets news highs”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout